Whether you're looking to make over your home, manage your Investment, or meet financial goals, we have you covered.

What you need to make the most of homeownership, from real estate trends to renovations.

Get the latest news, tips, and resources to make the most of homeownership. Join 150,000+ newsletter subscribers to get ahead of the curve.

Whether you want to make a dent in your debt or kick-start your business, learn how your equity can help you do it.

Pay off debts

Pay down loans, bills, or other debts so you can get closer to financial freedom.

Renovate your home

Get funding for home repairs or renovations.

Buy a second home

Fund a down payment for an investment property or vacation home.

Fund a life event

Pay for a life event, the transition to a new home, or your growing family.

Fund an education

Invest in higher education and access money for tuition or student loan payments.

Live comfortably in retirement

Make your current or future retirement more financially comfortable.

Invest in your business

Get the cash you need to start or grow your business.

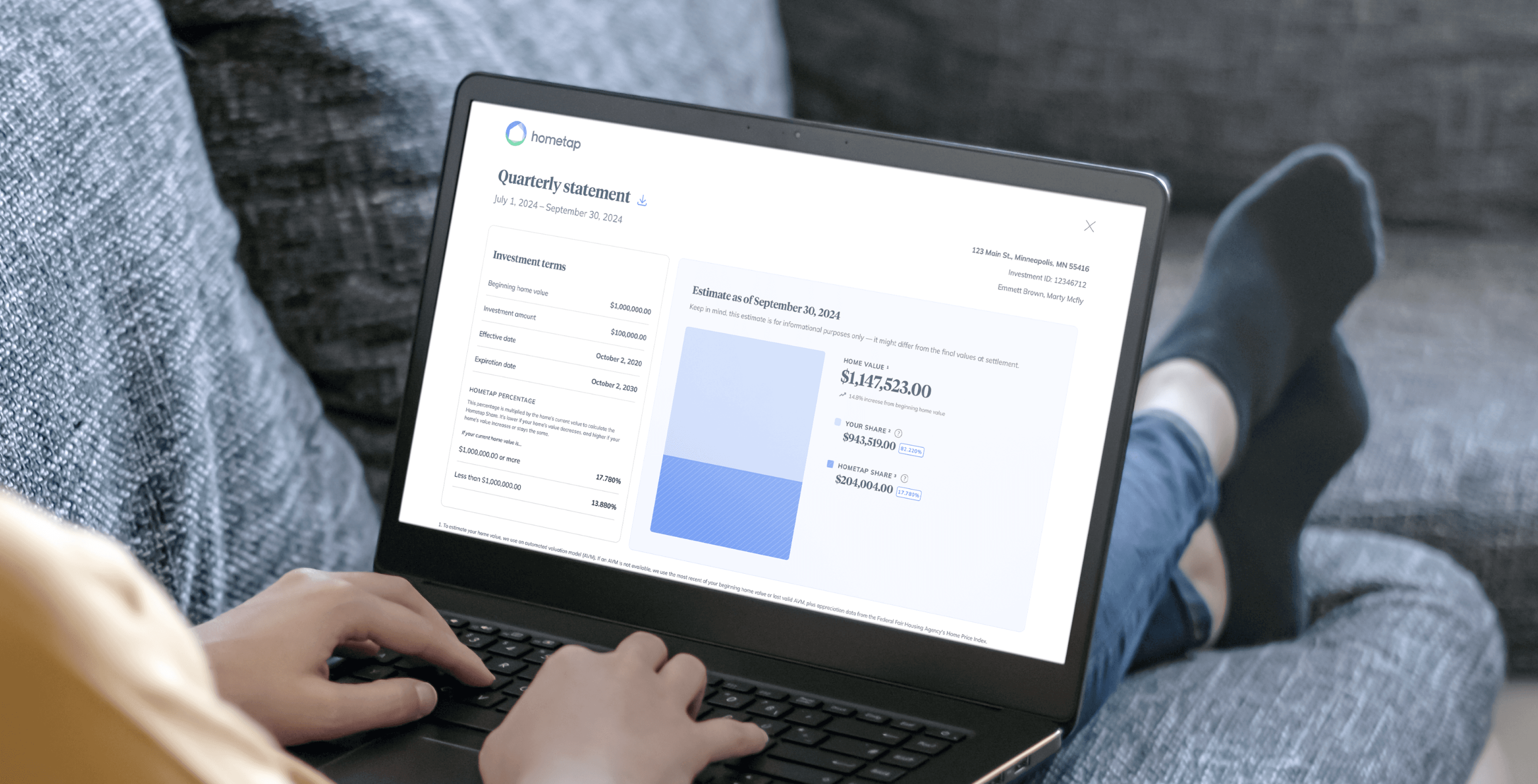

Have a Hometap Investment? Make the most of it and get answers to common questions here.

Tune in and watch the latest tips, tricks, and news.

Dive into resources across a wide variety of homeownership and financing topics.

Check out what's new in our world.