How to Accurately Predict the Appraisal Value of Your Home

Last updated November 20, 2024

There are many reasons you may be looking to find an accurate appraisal estimate for your home. If you’re refinancing your home, or looking at home equity loans, home equity lines of credit (HELOC), or home equity investments, your lender will likely require a home appraisal. Knowing your home value is an important part of homeownership for other reasons , too, such as determining a fair asking price when selling, or deciding if you need to make certain repairs or upgrades. Understanding the appraisal value of your home can also help you better understand your property taxes, or prove you have enough equity in your home to eliminate private mortgage insurance. But can you find your home value on your own?

Before you rush to schedule a home appraisal, also called a home value appraisal, consider the cost: upwards of $350 for single-family homes, according to Angi. That’s why many homeowners turn to realty sites—such as Zillow or Redfin, among others that offer automated valuation models (AVMs)—to predict their current home appraisal estimate. But in doing so, you may notice you’ll find a wide range of values.

Why Do Home Valuation Websites Differ So Much?

While AVMs may give you a rough idea of your home’s value, they’re not always the most accurate tools, as these websites often rely on public and user-inputted data. This is one reason the home value estimate you receive can differ from one website to another.

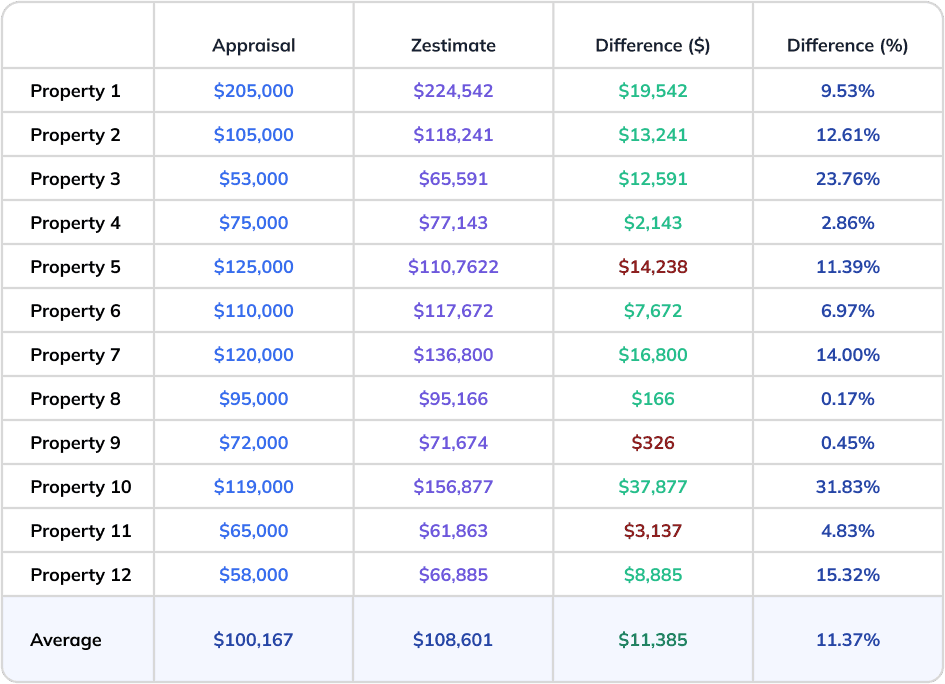

In fact, a recent experiment from BiggerPockets illustrates just how unreliable Zillow’s “Zestimates” can be compared to physical property appraisals:

As you can see, the margin for error can be as high as 30%!

While you can compare multiple sites to get a better sense of an average, or use a lender-grade AVM, you can also crunch the numbers yourself to calculate your house’s appraisal value. Follow these three steps to find your estimated appraisal value.

How to Find Your Home Value in 3 Steps

1. Find Nearby Comps

Comps, short for comparables, are homes that are similar to yours in location, size, acreage, floor plan, bed and bathroom counts, and more, that have recently sold. Definitions of “recent” vary, particularly in areas without much market activity, but try to find homes sold no more than 60 days ago. It’s also recommended to compare homes that are within about 25% of your home’s square footage.

In terms of location, NerdWallet recommends the closer, the better. It’s not about the same zip code, but rather the same school district, neighborhood, and even street. If possible, visit the homes in person. Photos online may not tell the whole story, such as if the property is on a noisy street, if it’s in need of repairs, or if it has features like an in-ground pool.

Use sites like Realtor.com to find homes similar to yours. Look for “just sold” properties, as homes still on the market will show asking prices; the home may sell for more or less. Selling prices of comps have a major impact on your home’s value. You can also ask a real estate agent for a comparative market analysis to see nearby selling prices of homes. These reports are often low cost or free, but the agent may anticipate working with you if you decide to sell.

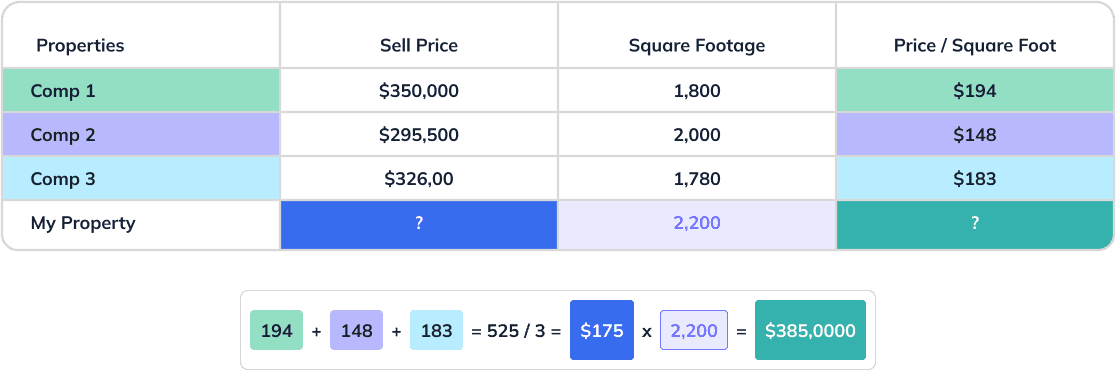

2. Find the Cost-per-square-foot

While some listings may have the price by square footage, some may not. You’ll want to take the selling price and divide by the square footage to find the price-per-square-foot. For example, a 2,500-square-foot house that sold for $400,000 is $160 per square foot.

Look at several properties, at least three if possible, and get the cost per square foot of all homes.

3. Determine Your Range

Add up the cost per square foot of all the homes you looked at and divide by the number of homes to get the average cost per square foot. Take this number and multiply it by your home’s square footage.

You’re not quite done yet. With this information, give yourself a range of 10 percent in either direction, as home values can quickly change based on nearby comps and the supply and demand of the housing market.

10% = .10 x $385,000 = $38,500

$385,000 + $38,500 = $423,500

$385,000 – $38,500 = $346,500

Your estimated home value appraisal range = $346,500 – $423,500.

Now that you know how to find your home value range and why you should take realty AVM values with a grain of salt, let’s talk about one more home value estimation tool we think you’ll like: the home value forecast in your Home Equity Dashboard.

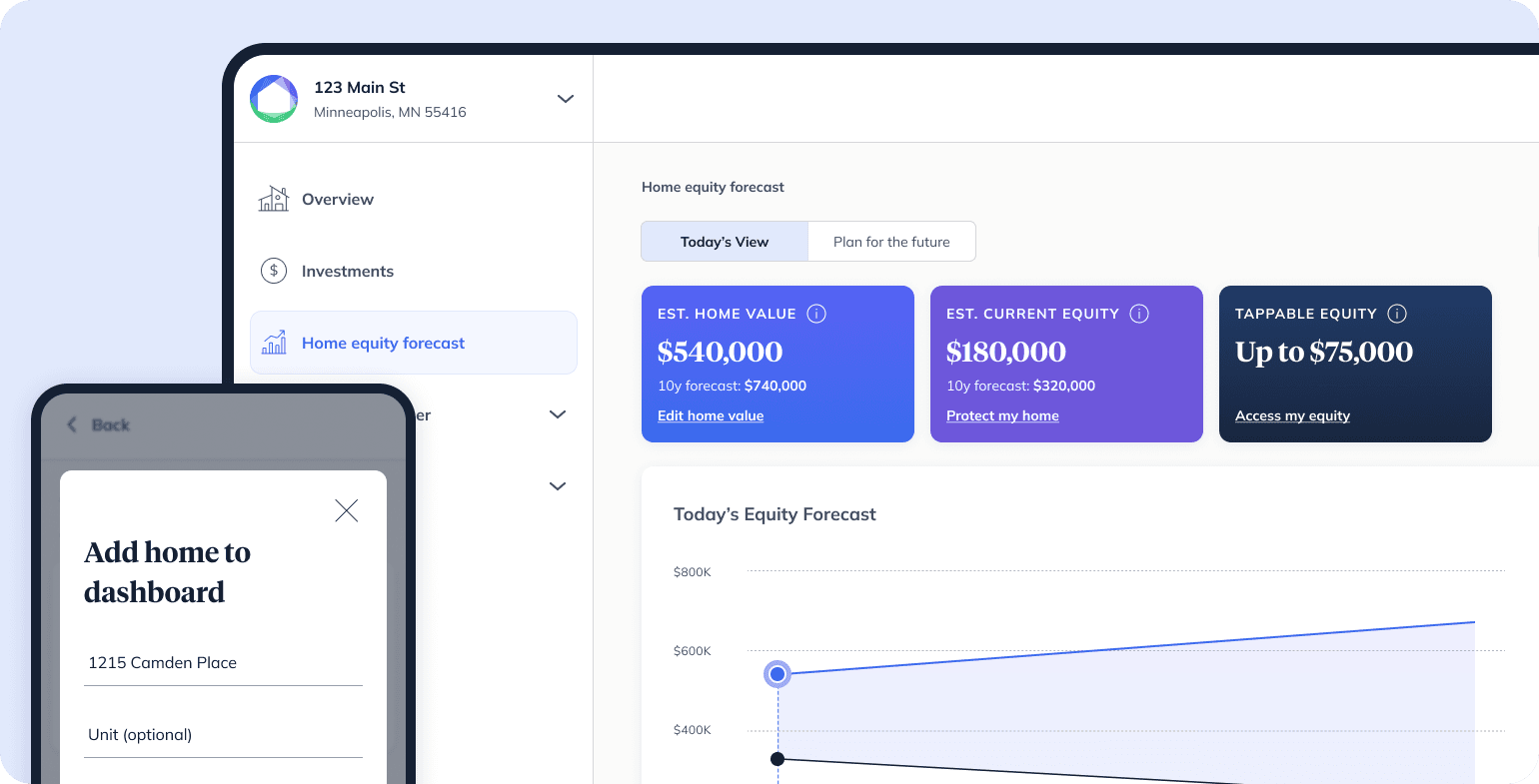

How Hometap’s AVM Works

Hometap’s Home Equity Dashboard is a tool that’s available to all homeowners, even if you don’t have a Hometap Investment. Not only can you use the Dashboard to get a free home value estimate, it also provides you with a simple way to monitor the growth of both your home value and equity over time.

Using the Dashboard’s Home Value Estimate, you can see your home’s current value, as well as future projected values up to 10 years down the road. The Home Value Estimate draws on industry-proven data sources to give you an accurate estimate of your home value that’s updated every 90 days. But if you’re unsatisfied with the estimate you receive, you can manually change the value displayed to input one that you believe is more accurate.

The Dashboard has plenty of other free tools that are worth exploring, like the interactive scenario planner. This allows you to input potential financial decisions you might make about your home, and see the projected change in your home value, so you can understand its potential impact and more confidently plan ahead.

How to Increase Your Home’s Value

If you’re not thrilled about your house’s appraised value, there are ways to increase it. Certain repairs have a greater return on investment than others, such as garage door replacement or a new roof. But your upgrades don’t have to break the bank; consider smaller renovations like a fresh coat of paint or increasing your home’s curb appeal with a power wash and updated landscaping.

Our free Equity Increaser Guide is designed to help homeowners not only maintain, but grow their home value over time.

Certain home renovations may require more funding than you have on hand. With a home equity investment from a company like Hometap, you can get the cash you need now to make home renovations in exchange for a share of the future value of your home.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Home financing 101”

Home Affordability Made Simple: The 28/36 Rule Explained

How to Get Equity Out of Your Home Without Refinancing