Understanding Your Hometap Quarterly Statement

You may have noticed something called a Hometap Quarterly Statement in your inbox lately, and might be wondering what it’s all about.

Your Hometap Quarterly Statement is designed to help you feel empowered to make informed financial decisions by providing an estimated view of your home’s full financial picture, backed by multiple industry-proven data sources. These statements will help you to stay informed and on top of your home’s estimated value and updated Investment details.

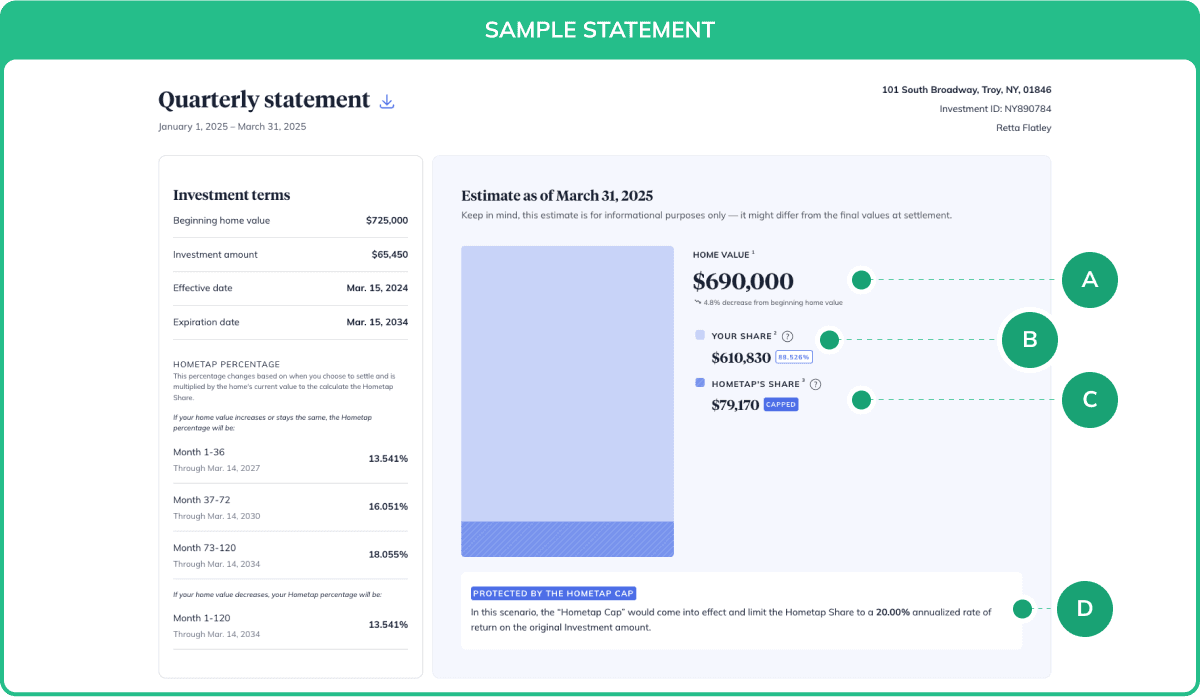

Sample Hometap Quarterly Statement

Let’s take a look at a sample Hometap Quarterly Statement and what each section means. Note that this is just an example and you’ll need to access your own statement for figures specific to your own Investment and home.

- Your estimated home value: Hometap’s Home Value Estimate combines multiple industry-proven AVMs (automated valuation models) to give you an accurate estimated home value that’s updated every 90 days.

- Your (homeowner’s) share: The percentage of your home's value you retain when you settle your Investment

- Hometap Share: The amount of money Hometap will receive when you settle your InvestmentYou’ll notice that this is labeled as capped in this example. We’ll explain more below.

- The Hometap Cap: In this example, the Hometap share is capped because of the rate at which the home appreciated. The Hometap Cap is a 20% annualized rate of return that limits the Hometap Share to this amount and protects your interest in your property. If you don’t see a capped figure, that means the Hometap Cap was not applied to the Hometap Share amount due to the appreciation rate of the home.

Whenever you decide to settle the Investment, we’ll calculate your share in two ways, as explained below. You’ll always pay the lesser of the two values.

- The Hometap Share = Final home value multiplied by the agreed-upon percentage of the home’s future value

- The Capped Share = Annualized 20% rate of return on the Investment Amount. This is calculated using the following formula:

The Capped Share = Initial Investment Amount x (1 + 20%) ^ Number of Years

- Effective Date: This is the date on which your 10-year Investment term begins.

- Expiration Date: This is the date on which your 10-year Investment term ends (and the date by which you’ll need to settle your Investment).

Frequently-asked Questions

How often will I receive these statements?

You’ll receive an updated statement via email once a quarter, but you can always access all of your statements through your Home Equity Dashboard account.

Note that these statements reflect estimates, and are subject to change for things like renovations that may increase the value of your property (and, in turn, the amount you’ll owe at settlement).

Where can I find my statement?

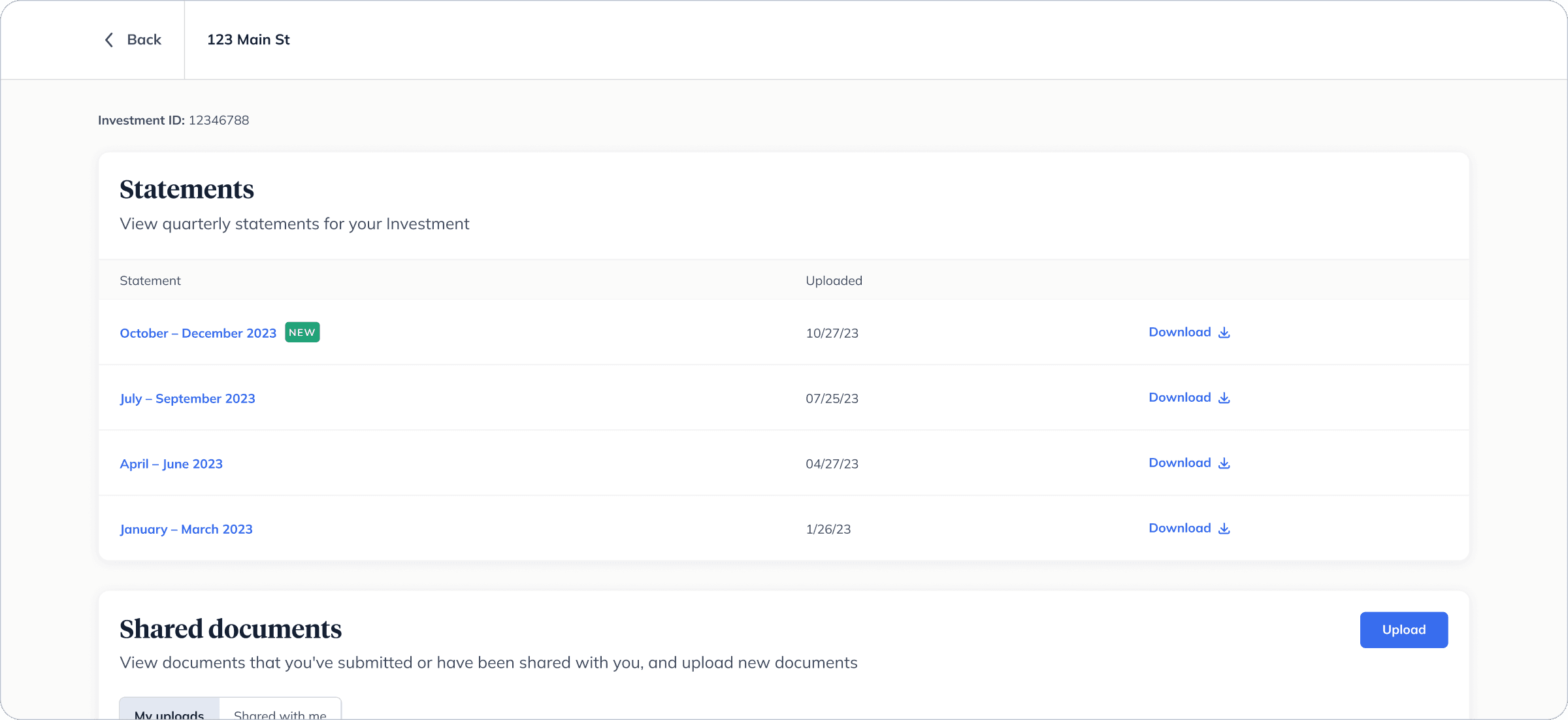

Once you’re logged into your Home Equity Dashboard account, look for the “Snapshot” section, and navigate to the “Documents” page.

Is there a way to save my Hometap Quarterly Statement?

Yes! You can download your statement as a PDF by navigating to “Statements & Documents,” in your Investments tab, and then selecting “Download” next to the appropriate statement.

How do I know if I’m looking at my most recent Hometap Quarterly Statement?

You can see the date the statement was issued on the top left of the document.

What do I do if I can’t see my Hometap Quarterly Statements?

Currently, if you’re the co-applicant on the account, you won’t have access to the Hometap Quarterly Statements. But we’re working on updating that soon!

I’m ready to settle my Investment. How do I get started?

We’re here to help! To start the settlement process, reach out to our Investment Support team at homeowners@hometap.com or call +1 (617) 604-6985. When you do, please provide the following information:

- A good-through date for your Settlement Statement — this should be at least 30 days out.

- Your preferred method of settlement

Where can I view the contract for my Investment?

You can view your contract any time by logging into your account. Your contract is also included in the signing package that is sent to you after you have accepted your offer. Additionally, if you have specific questions or need further assistance regarding their investment documents, you can contact the Investment Support team directly via email at homeowners@hometap.com or by calling (617) 604-6985.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

Related Tags:

Home equity investingMore in “Manage your Investment”

What Happens If You Don't Pay Property Taxes? A Guide for Homeowners

What You Need to Know About Refinancing with an HEI