The Ultimate Guide to Your Home Equity Dashboard

Last updated January 14, 2025

If you’re new to the Home Equity Dashboard, this blog post will give you an introduction that covers what it is, how you can best leverage it, and what new tools you’ll want to know about. The Dashboard is a free online tool Hometap created to provide you with a simple way to monitor your home value and equity growth over time — and intel on how to actively grow and leverage that equity.

The Dashboard includes features we’re really proud to share with you, including an interactive scenario planner so you can see a clearer picture of how your home value might change with each financial decision you make. It also includes a renovation calculator, maintenance resources to preserve and grow your home’s value, and special offers from some of our trusted and vetted partners.

The Home Equity Dashboard is free for all homeowners to use, and it takes just two minutes to create an account. If you already have a Hometap account because you've received a home equity investment, it’s even easier! You can already access all of the features of the Dashboard right from your account.

Navigating This Guide

This guide is designed to make it easy for you to see the latest features, learn how to use them, and locate them. We'll also walk you through all of the not-so-new features for you to refer back to at any time. Let’s get into it!

New Features in Your Dashboard

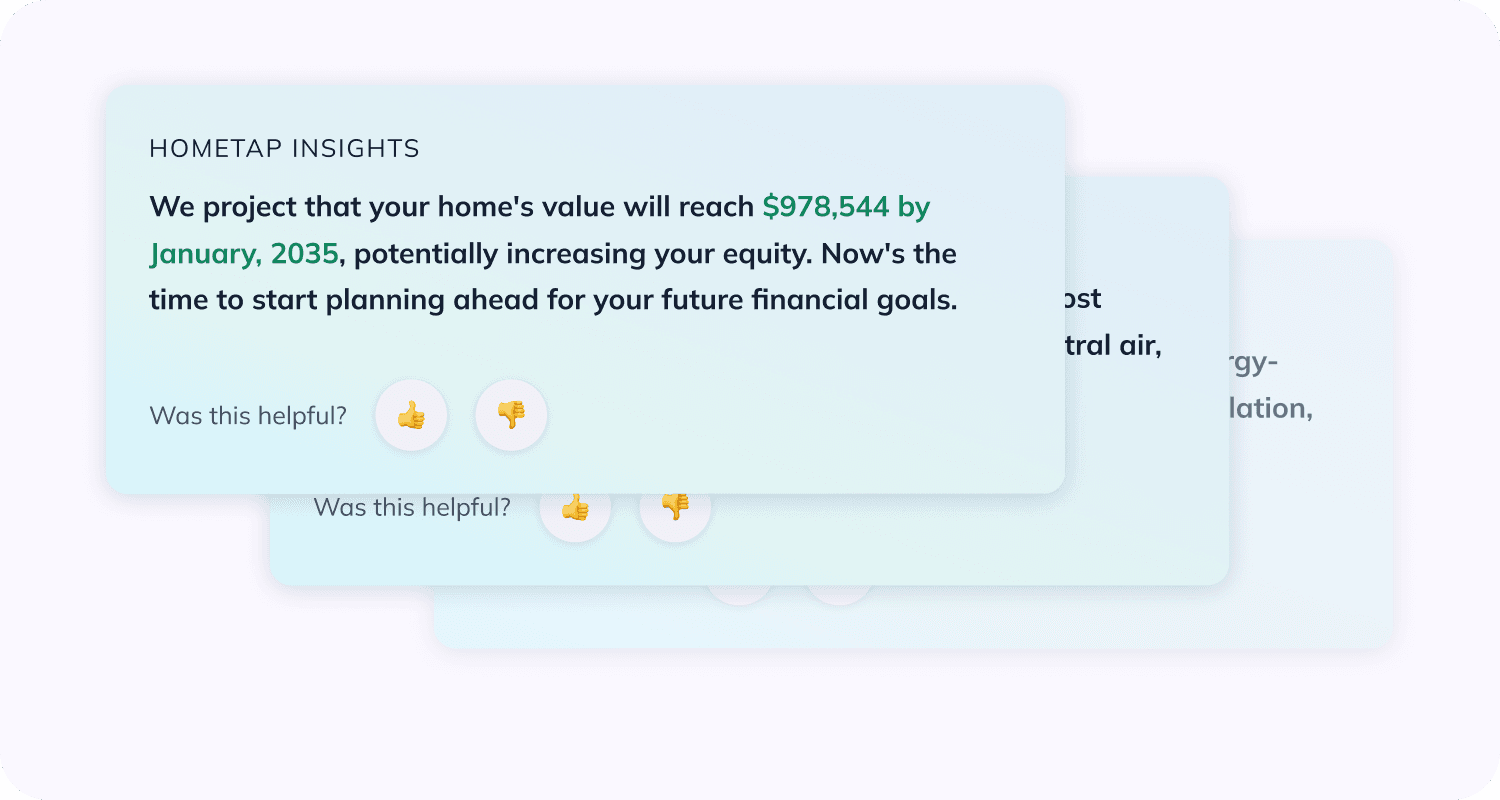

Improved Insights

Where you can find them: At the bottom of your Overview page

We first launched Insights because we knew homeowners like you would find value in receiving customized tips and facts about your home value and financial goals. Now, we’re thrilled to bring you even more tailored insights to help you make the most of homeownership. If you have an Investment with us, you’ll even find insights about your Investment and settlement timeline, account updates, funding goals, and much more.

Previously-released Features by Category

Already know what you’re looking for? Click to go there directly.

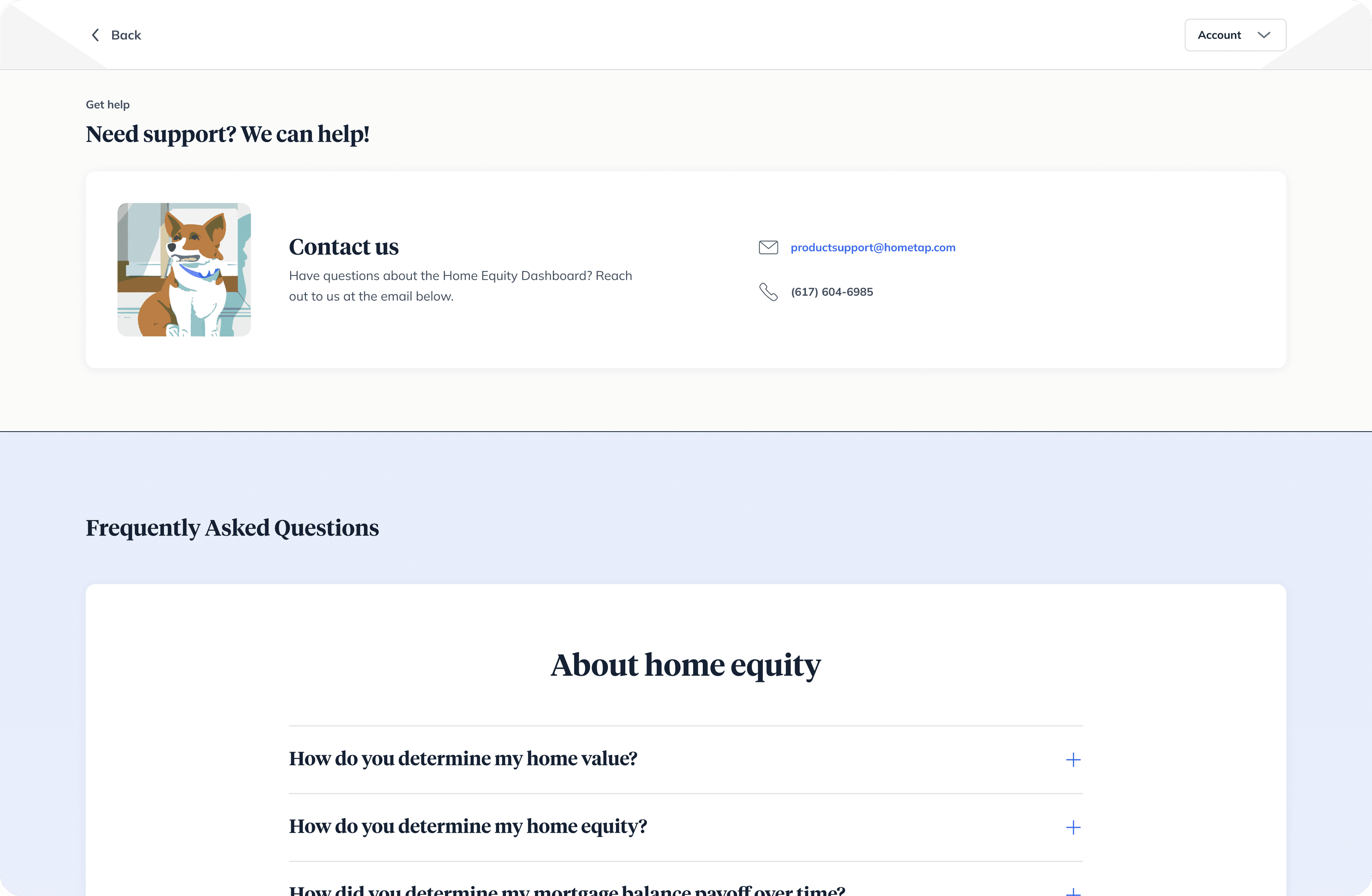

Account

Where you can find it on desktop: In the top right corner of your screen

Where you can find it on mobile: At the bottom of the navigation menu on the left side of your screen.

Your account has two areas: Account details is where you can manage your profile details, reset your password, and add new properties; Get help is where you can find answers to some of your most frequently asked questions, and find contact information to talk with a member of our team.

Overview

Consider the Overview your home base, with your most important details front and center. Like much of your Dashboard, it’s customized to you and your home, so what you see on your Overview page will depend on whether or not you have a home equity investment with Hometap. For example:

- If you don’t have a Hometap Investment, you’ll see clear visuals of your current home value, current home equity, current debts on your home, and helpful insights customized to your home and financial situation.

- If you’re in the process of applying for or receiving a Hometap Investment, you’ll see your home value and your Investment status.

- If you’re a homeowner with a Hometap Investment, you’ll see clear visuals of your current home value, current home equity, your debts, Hometap's current share, and helpful insights customized to your home and financial situation.

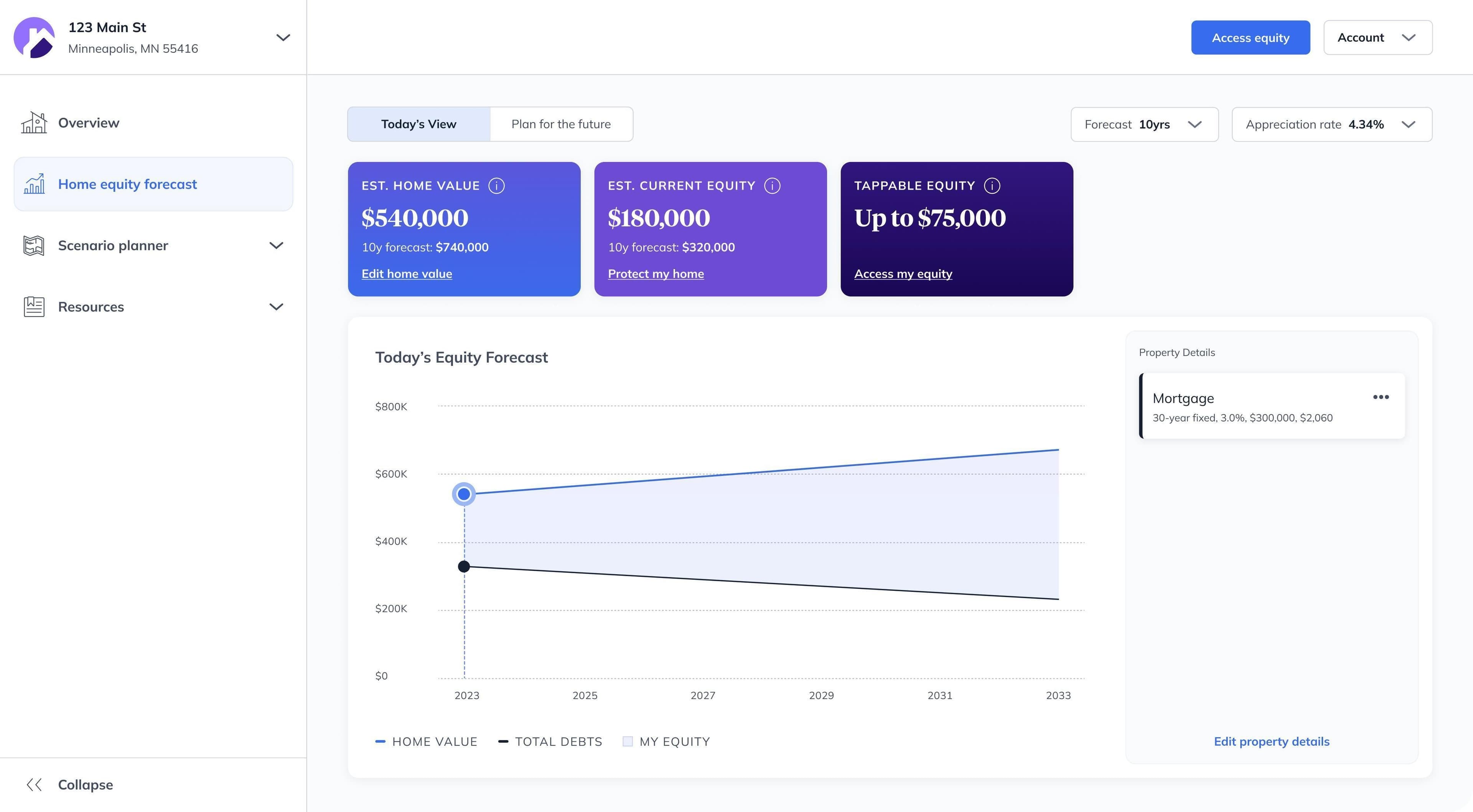

Home equity forecast

Where you can find it: Under the Overview in your navigation menu. (Note: If you have an Investment with us, your forecast will appear under Investments in the navigation menu).

Get the intel you need about your home to make the best decisions possible. The home equity forecast provides you with your estimated home value, current equity, accessible or ‘tappable’ equity, and projections that forecast these figures 10 years down the road. You can also add debts so that you can track things like your mortgage payments and lien payments and visualize when those will be paid off.

Your Home Value Estimate uses a unique blend of industry-proven data sources to give you an accurate and up-to-date number, whenever you need it.

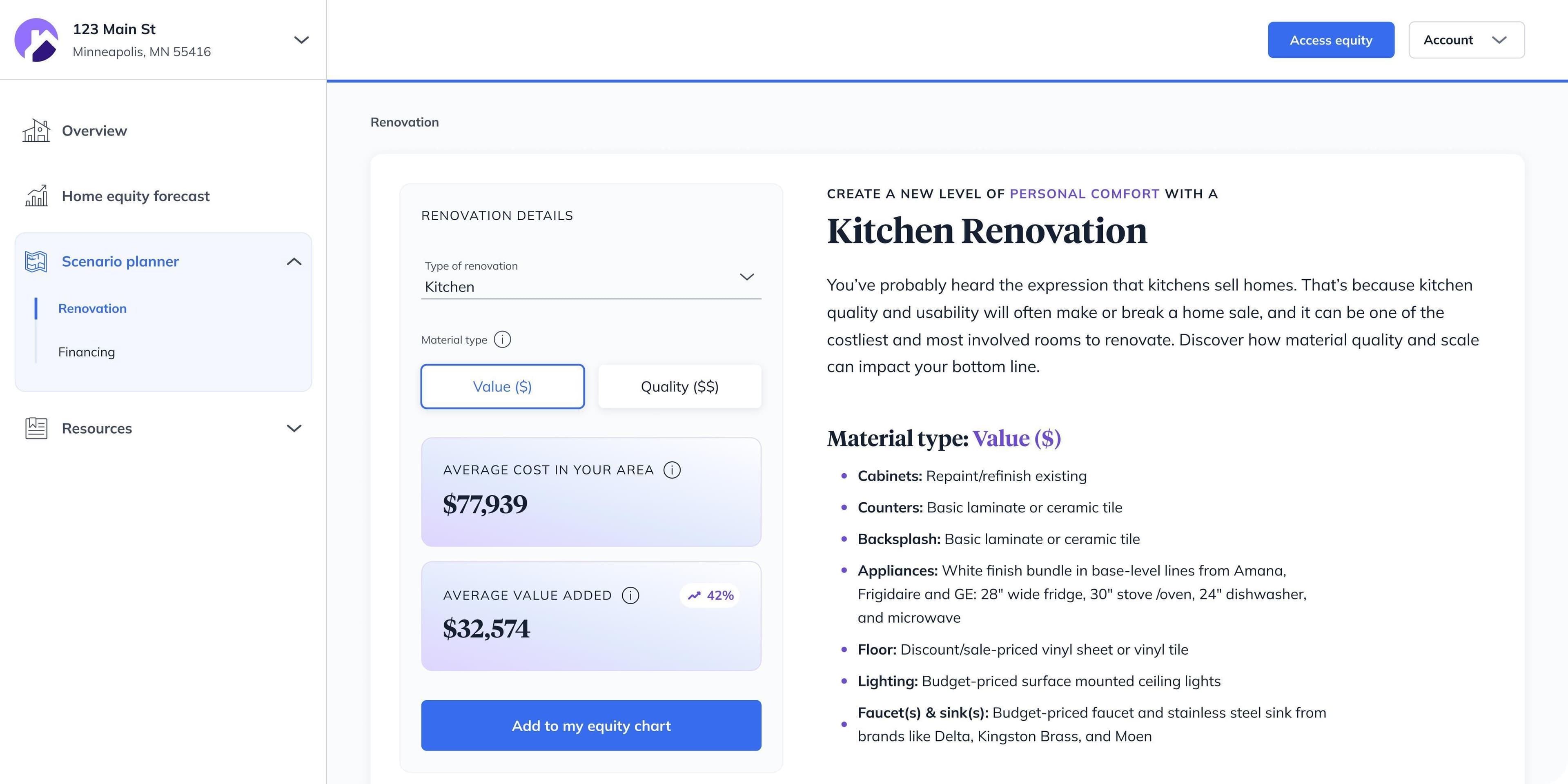

Scenario planner

Where you can find it: In your navigation menu

Your scenario planner is where you can find your Renovation Calculator and your Financing Calculator.

- The Renovation Calculator was designed to help you find the best renovation scenario to suit your needs and budget. Select your project and desired quality tier to learn the average cost for your area, the estimated average value it will add to your home, and other considerations to help you prepare for your renovations. You can even add a planned renovation to your current home value to see how it will impact that value over time in different cases of appreciation.

- With the Financing Calculator, you can weigh the options for tapping into your home's equity with confidence. View your equity, now and down the road, so you can plan ahead for a brighter future — and compare common financing solutions, side by side, to make the best decision for your goals and understand the cost of each over time.

Note: you'll only see financial products that are available in your area. For example, home equity investments (HEIs) will not be shown in states where HEIs aren't currently available.

Resources

Where you can find it: In your navigation menu

Our resources are an ever-evolving collection of maintenance guides, articles, and featured offers. Our articles are designed to help you achieve your financial goals and stay apprised of the latest events that have the potential to impact you and your property

- Your maintenance checklist helps you prioritize projects by season, giving you tips on what to handle yourself and what to outsource, the equipment you’ll need, how to successfully execute each task, and suggested frequency.

- Articles is where you can find in-depth resources about home financing, debt management, and guidance about reaching your financial goals.

- If you have an Investment with Hometap, you’ll also see the Financial Health Hub within your Resources. This is a robust suite of financial wellness tools and resources, including articles, webinars, videos, and access to personal finance counselors -- all free as part of your Hometap account! You’ll just need to create an account with Enrich to gain access.

- Featured Offers: We partner with home brands that align with our mission to help homeowners like you achieve their goals with less stress and more control. These partnerships allow us to offer exclusive rates and discounts to our loyal homeowners. We’re always vetting new potential partners, so check back in often to see what else is new!

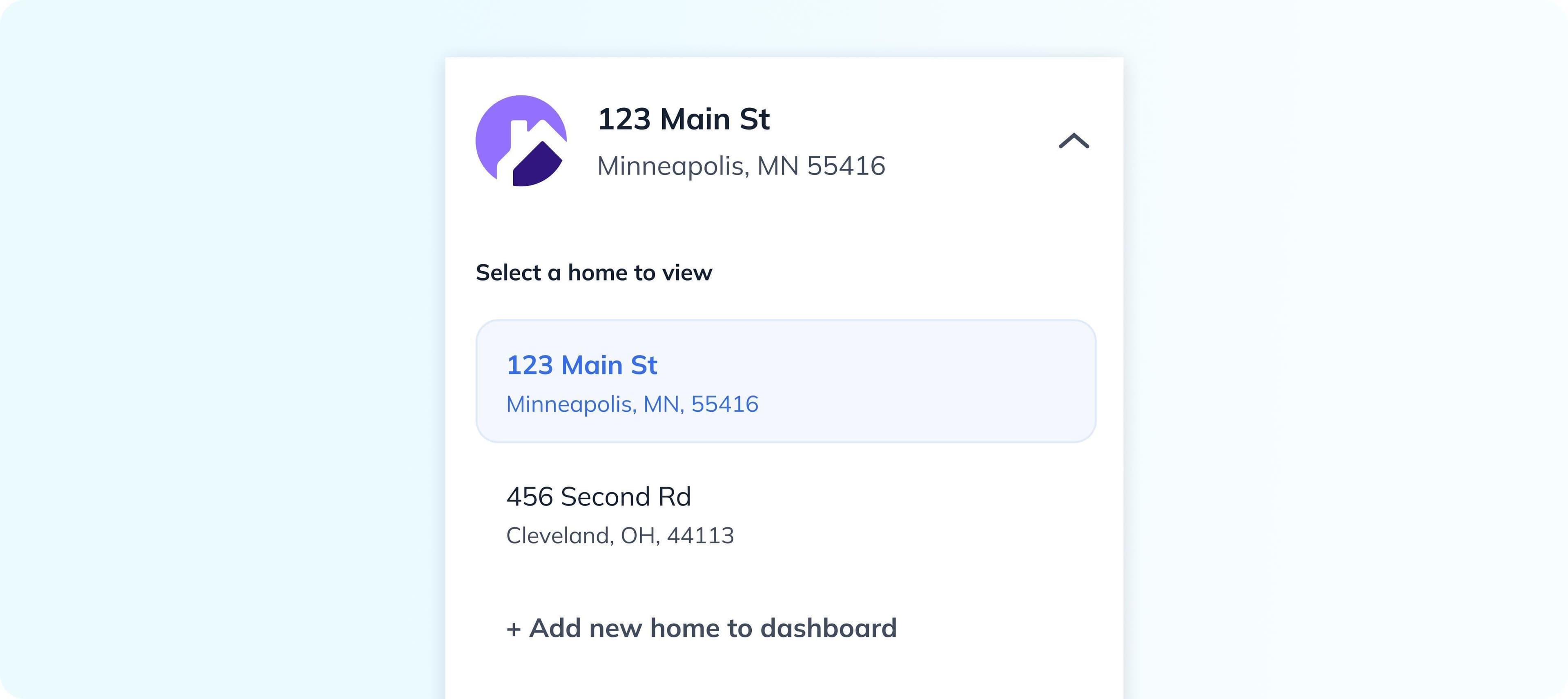

Property Selector

Where you can find it: The top of your navigation menu

If you have more than one residential property you’d like to track in your Dashboard, whether it’s an investment property or a vacation home, you can add (and seamlessly toggle between) them!

Investments

Where you can find it: Above your Home Equity Forecast in the navigation menu.

If you've received a home equity investment from Hometap, this is where you can see all in-progress, invested, and settled Home Equity Investments. You won't see this option in your menu if you've never applied for a home equity investment.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.