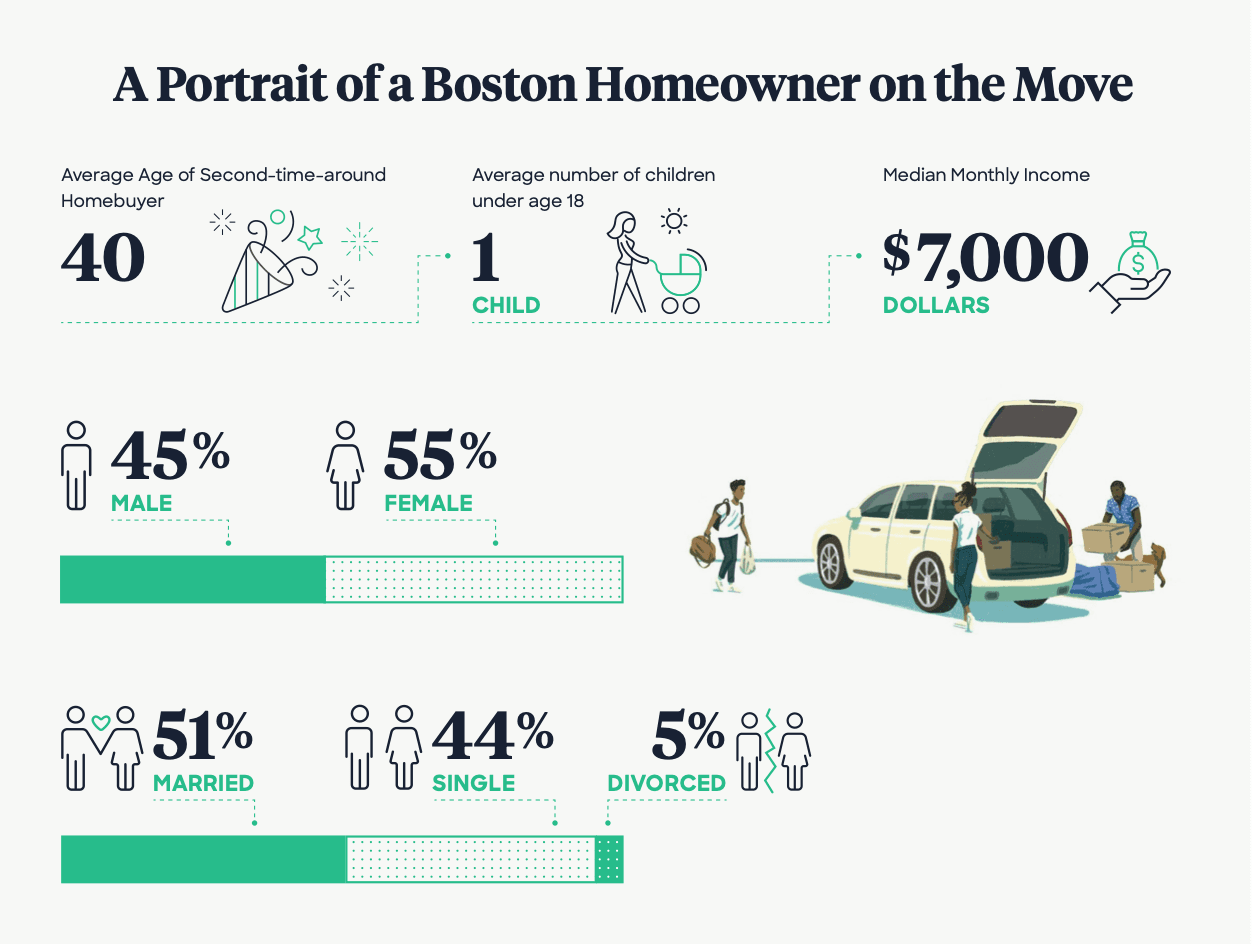

Infographic: A portrait of a Boston homeowner on the move

With attractive home values and appealing neighborhood benefits like walkability and access to entertainment, Boston residents have a lot to be thankful for.

However, Boston has also had notoriously high housing costs for years, and home values are skyrocketing even further. It’s making Greater Boston-area homeowners house rich and cash poor, with the majority of their wealth net worth tied up in their homes.

Read through our infographic to understand the portrait of a Boston-Area homeowner on the move, and the factors leading some Suffolk-county homeowners to seek properties outside of the state.

House Rich, Cash Poor: A Tale of Boston Homeowners

Boston has had notoriously high housing costs for years and home values are skyrocketing even further. It’s making Greater Boston-area homeowners house rich and cash poor. But what does that mean? Read more to find out.

Bigger Houses, More Property: Suffolk County Residents Look to Upgrade

With attractive home values and appealing neighborhood benefits like walkability and access to entertainment, Boston residents have a lot to be thankful for. It may sound out of the ordinary, then, for Suffolk County homeowners to leave a good thing behind. See why 40% of Suffolk County residents plan to move in the next five years.

Check out this infographic to understand who is buying properties in Boston.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Market insights”

Survey: Homeowners Look for These Three Things in Home Equity Financing

How Should Homeowners React to a Fed Rate Cut?