The Hidden Cost of the American Dream: Why Homeownership in 2025 Feels Broken

Ask just about anyone what the “American Dream” looks like, and homeownership still sits at the heart of it. But the dream of buying a home — the excitement of closing, getting the keys, and walking through the door for the first time as a homeowner — eventually gives way to the reality of owning a home; a reality that for many can be an expensive and exhausting wake up call.

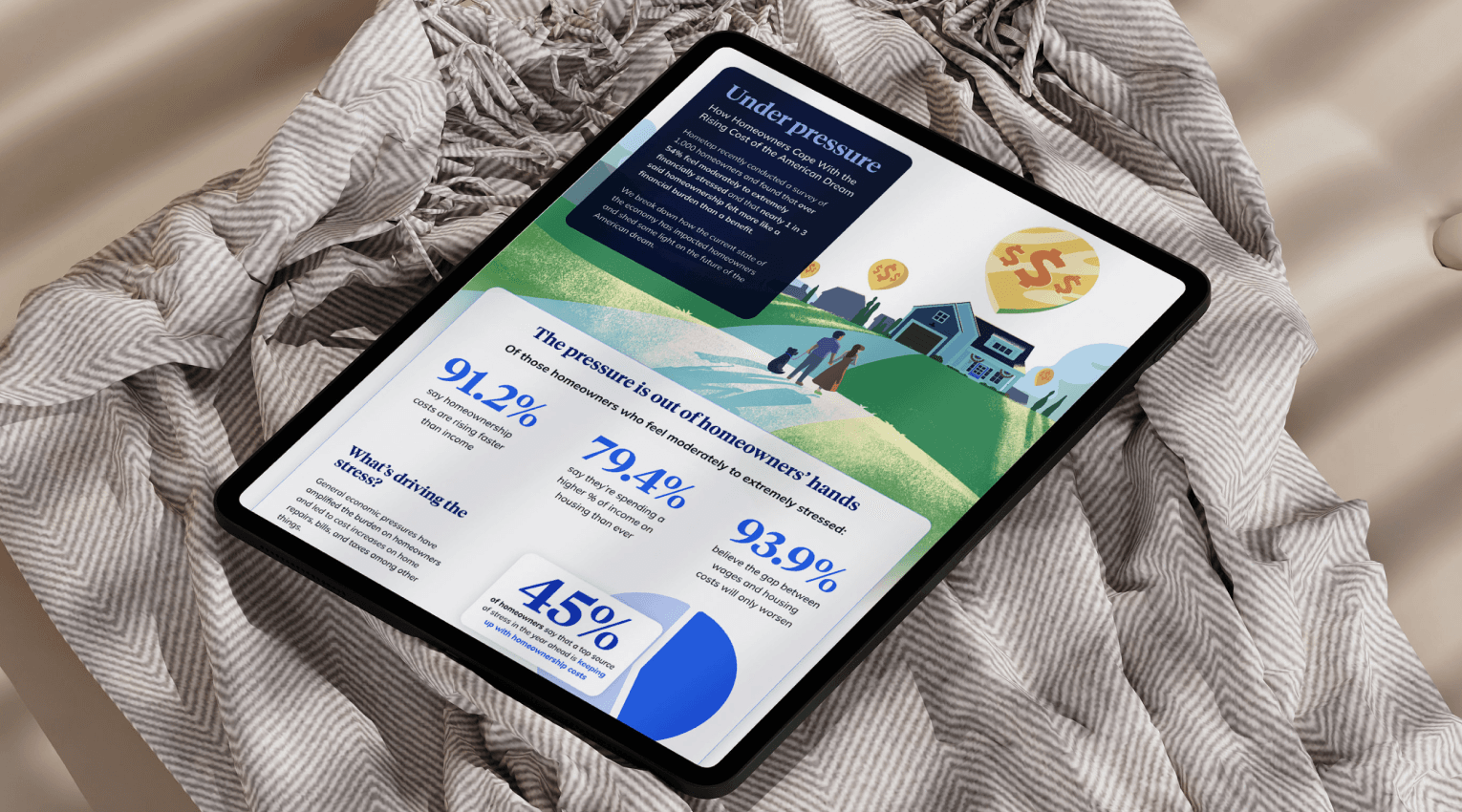

Our recent survey of 1,000 homeowners confirms this tension. Three in four respondents (75.6%) still believe homeownership is part of the American Dream. And yet, more than half (54.5%) also say they’re moderately to extremely financially stressed. More than 60% say they’re spending more of their income on housing than ever before, and nearly 80% believe their costs are rising faster than their income.

They're right.

Across the board, the cost of owning a home has risen far beyond what most people expected — or were prepared for. And it’s not just about monthly mortgage payments. Insurance, property taxes, utilities, maintenance, and renovation costs have all surged. Even with record homeowner equity in the market, most households aren't positioned to use that equity strategically. And far too many are stuck in a cycle of “just trying to keep up.”

The problem isn’t homeowners. It’s the system.

A Dream Without a Manual

The reality is, most homeowners don’t know exactly what they’re signing up for. And why would they?

For many first-time buyers, homeownership is not only unfamiliar — it’s generationally unprecedented. They may be the first in their family to make the leap from renting to owning, often without the benefit of advice from parents or peers who’ve done it themselves. There’s no owner’s manual telling you what comes after closing. What’s the difference between insurance and a warranty? Who do you call when your furnace breaks down? How do you budget for repairs or contest a property tax hike?

Suddenly, there’s no landlord or superintendent. And it’s not as intuitive as you might think.

Homeownership isn't just a financial decision — it’s an ongoing financial responsibility. And most Americans are operating in a system that leaves them to figure it out by trial and error, which only deepens the stress and anxiety that we see reflected in our survey results.

What’s Driving the Pressure?

It would be easy to chalk this all up to inflation (and yes, higher interest rates as the Fed attempts to tamp down inflation are certainly part of the story) but there are a lot of other things at play. The affordability gap — between what homes cost and what people can afford — is growing. And several underlying forces are making that worse:

- Stagnant wage growth: While housing costs have surged, real wages haven’t kept pace. In 1970, the typical single-family home cost about 3.9 times the median household income. Today, that figure has nearly doubled to 7.3.

- Chronic undersupply: The U.S. has a well-documented housing shortage that’s reached 4.7 million units. Millennials are aging into peak homebuying years while boomers stay put, keeping inventory tight.

- Rising “hidden” costs: Home insurance premiums rose by an average of 21% in 2023 alone, and another 11% in 2024. In some high-risk areas, insurers are pulling out entirely. Fourteen insurers ran out of funds between 2020 and 2023 in South Carolina, driving up premiums. Meanwhile, property taxes rose 6.9% in 2023 — double the rate of inflation.

- A tax system slow to adapt: The new SALT deduction cap increase passed in 2025 offers limited relief for middle-income homeowners, but it doesn’t address the root causes of rising ownership costs or help homeowners in lower-cost regions.

The truth is, unless there’s a significant shift in supply or a dramatic economic event, home prices aren’t likely to come down meaningfully. Holding tight may be the default plan, but for many, it’s only a stopgap — not a strategy.

Homeowners Need More Than Funding — They Need Support

There’s no doubt homeownership can still be a good investment. But what’s missing for many is the right kind of support.

Financial tools alone won’t cut it. Even with access to equity, homeowners need guidance: How to budget for the unbudgetable. How to make smart renovations. How to challenge a property tax increase or shop for insurance in a changing market. We need to build systems that support people not just at the point of sale, but across the entire arc of their ownership journey.

That’s what we’re working toward at Hometap.

We believe there’s a better future where homeowners feel empowered, not overwhelmed. Where equity isn’t just a number, but something people understand and know how to use wisely. We’re building a platform that supports not just one transaction, but an ongoing relationship — from the moment the sold sign goes up, to the day you decide what’s next.

Because owning a home shouldn’t feel like surviving a system. It should feel like living the dream — and knowing how to manage it.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Market insights”