Survey: Homeowners Look for These Three Things in Home Equity Financing

Homeowners have spoken: the traditional home equity financing system no longer matches the realities they’re living with. Across generations and financial scenarios, their unmet needs are consistent. Homeowners want more flexible ways to access the home equity they’ve earned, and they increasingly feel stressed, underserved, or boxed in by today’s conventional products.

These conclusions were uncovered in Hometap’s latest national survey of 1,000 homeowners and served as a follow-up to a survey we conducted in June of 2025, which explored the rising financial strain of homeownership. We wanted to dig deeper and discover what could alleviate that strain and. pinpoint homeowners sentiments, hesitations, and wishes regarding traditional home equity products (namely home equity loans, HELOCs, cash-out refinances and reverse mortgages). Together, the findings from the two surveys paint a picture of households working hard to stay afloat while navigating a financing landscape that hasn’t kept pace with their needs.

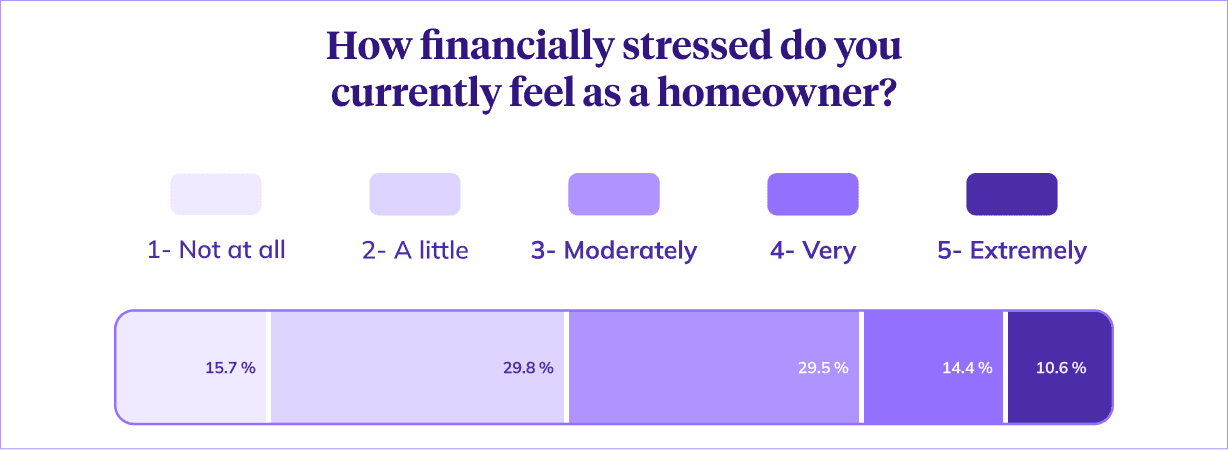

In summary, the survey we conducted in the Spring found that homeowners are already stretched thin. And when they look to financing options to relieve that pressure, many feel traditional products aren’t designed for the landscape they’re living in.

Finding No.1: Traditional home equity products fall short on flexibility

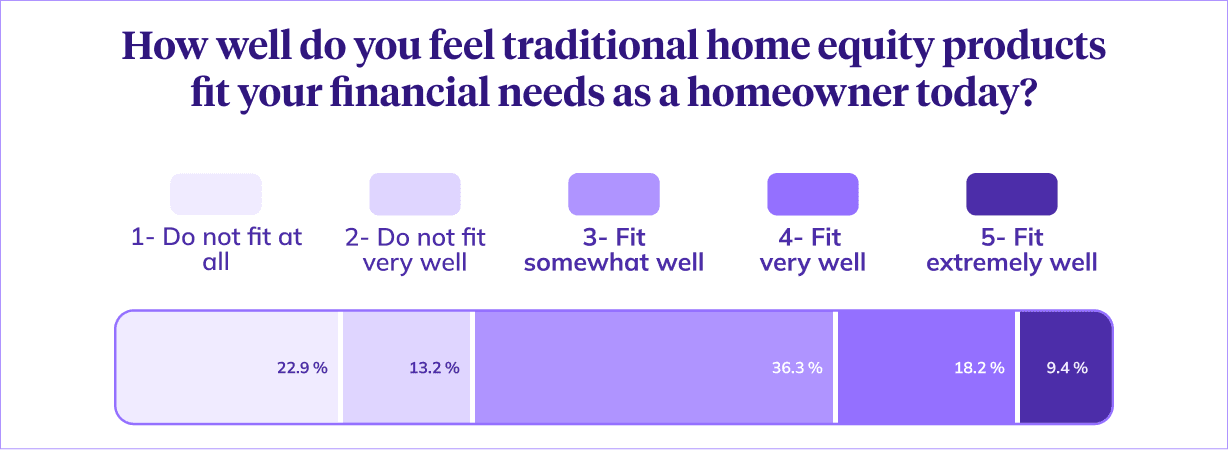

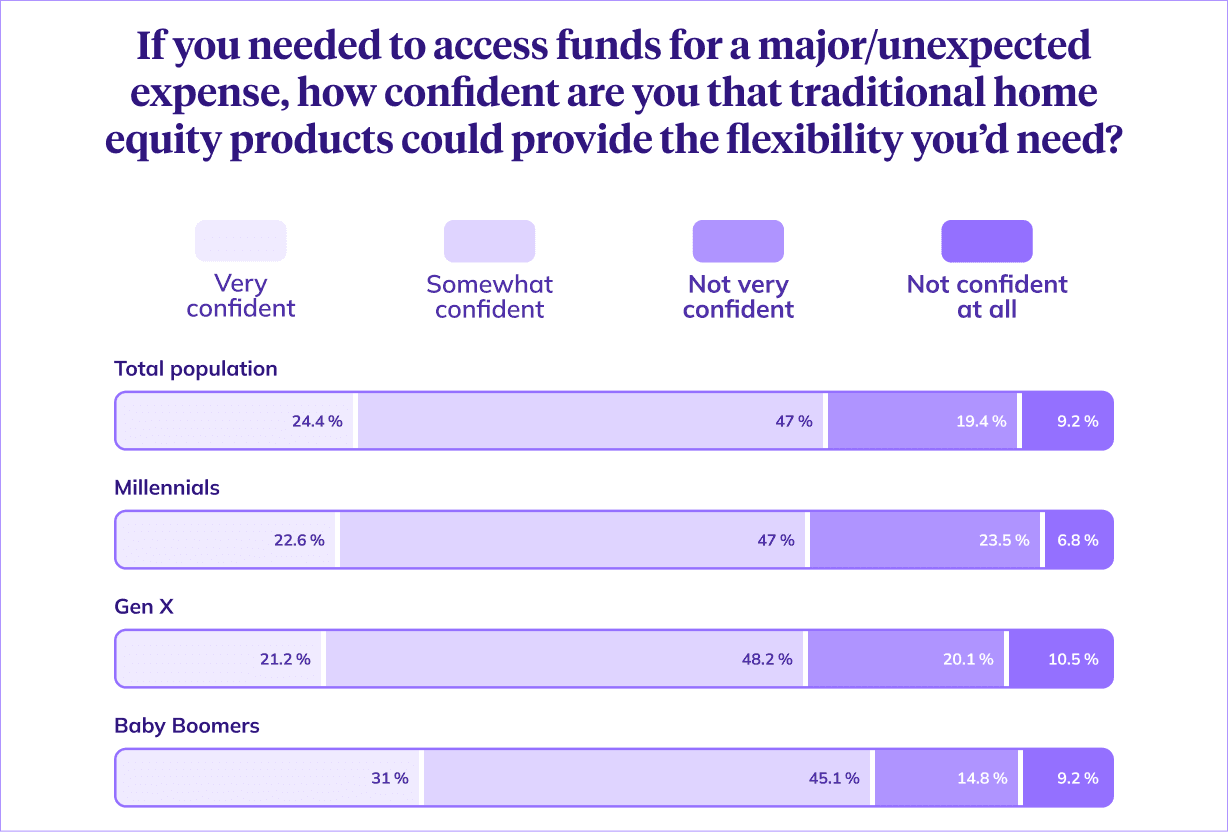

Analyzing the results of our latest survey (conducted in October of 2025), one theme rises above the rest: flexibility is the currency homeowners value most, and the traditional system doesn’t offer it.

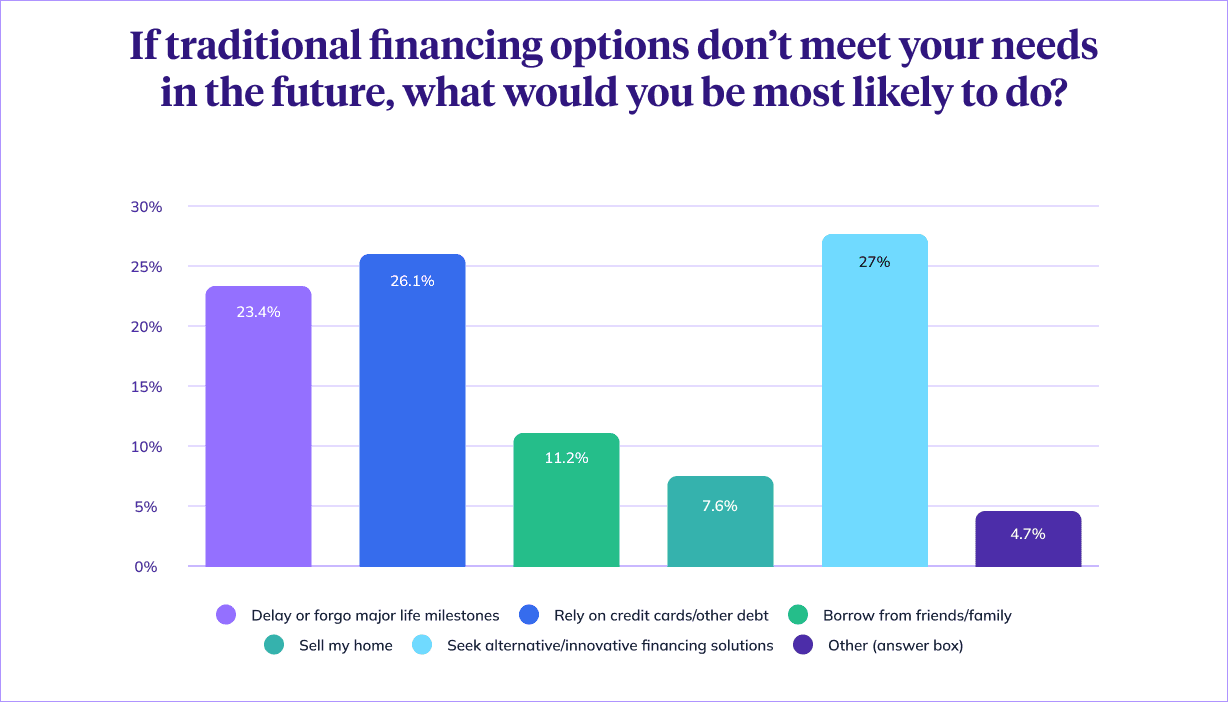

36% of respondents agreed that traditional financial products don’t fit the financial needs of homeowners today. And when asked what they would do if traditional products didn’t meet their needs in the future, seeking alternative financial solutions was the top response.

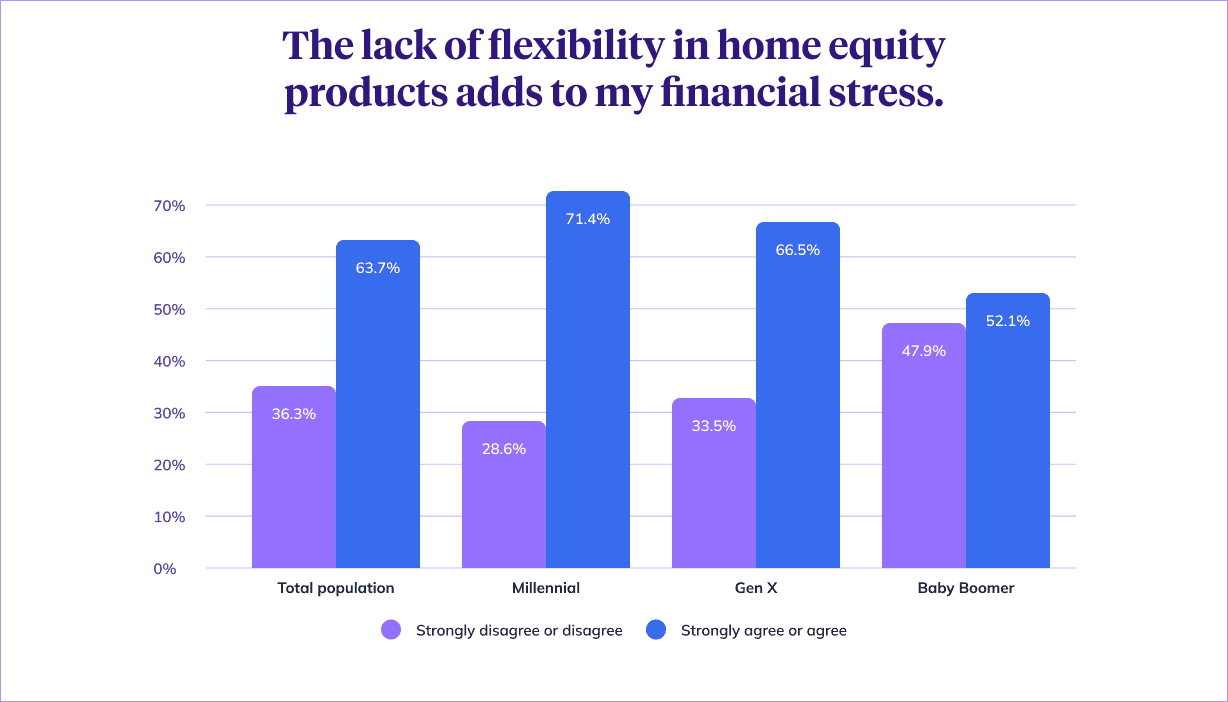

While concerns of misalignment in these products are widespread across generations, the uptick in younger homeowners is clear. When asked whether the lack of flexibility in home equity products adds to their financial stress:

- 71% of Millennials agree or strongly agree

- 66.5% of Generation X agree or strongly agree

- 52% of Baby Boomers agree or strongly agree

Even older homeowners, who are generally thought to be more financially stable, are signaling that rigid financing structures no longer fit the complexity of today’s budgets.

This group of homeowners isn’t merely expressing frustration. They’re pointing directly to a structural gap: today’s traditional products simply don’t align with how people need to use home equity.

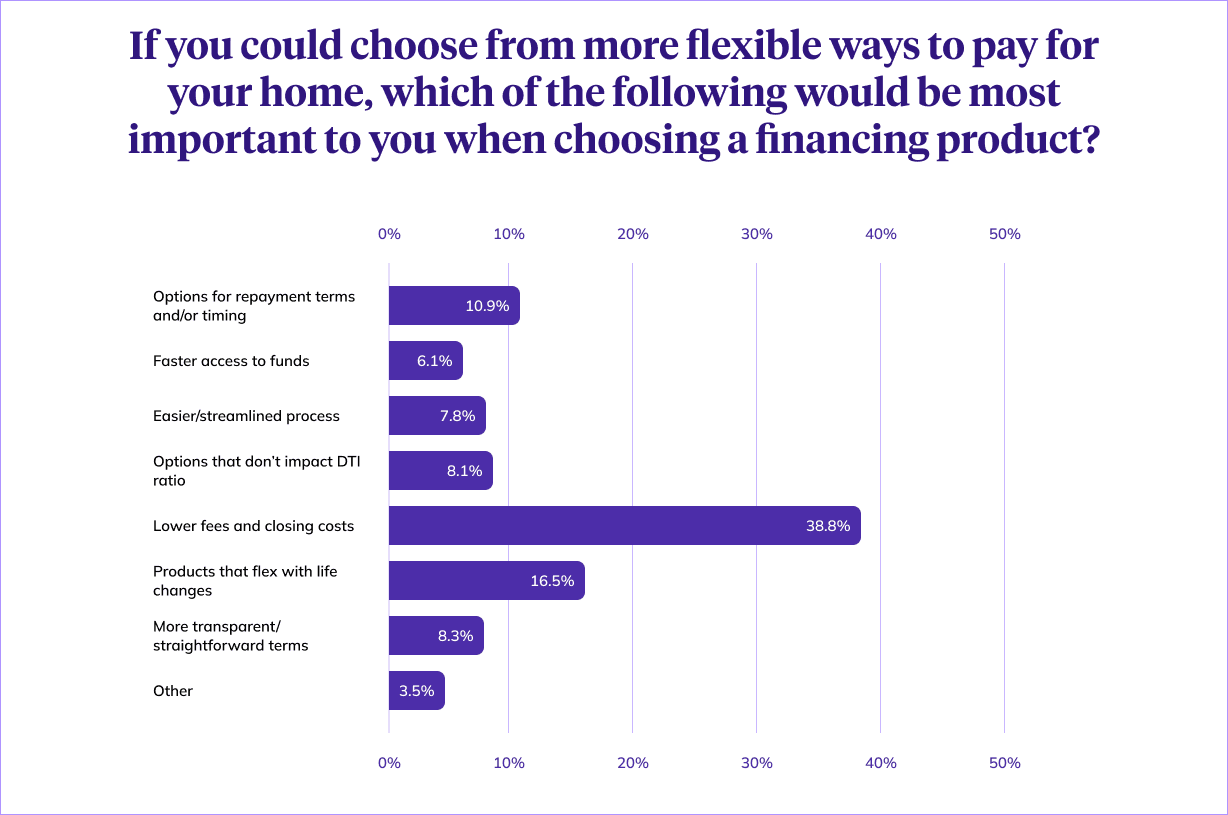

But what does flexibility actually mean in home financing? We asked respondents what characteristics mattered most in a financial product and the answers ran the gamut — with one clear standout:

- Options for repayment terms and/or timing - 10.9%

- Faster access to funds - 6.1%

- Easier/streamlined process - 7.8%

- Options that don’t impact debt-to-income ratio - 8.1%

- Lower fees and closing costs - 38.8%

- Products that flex with life changes (pause or change payments, adjust terms, etc.) - 16.5%

- More transparent/straightforward terms - 8.3%

- Other (answer box) - 3.5%

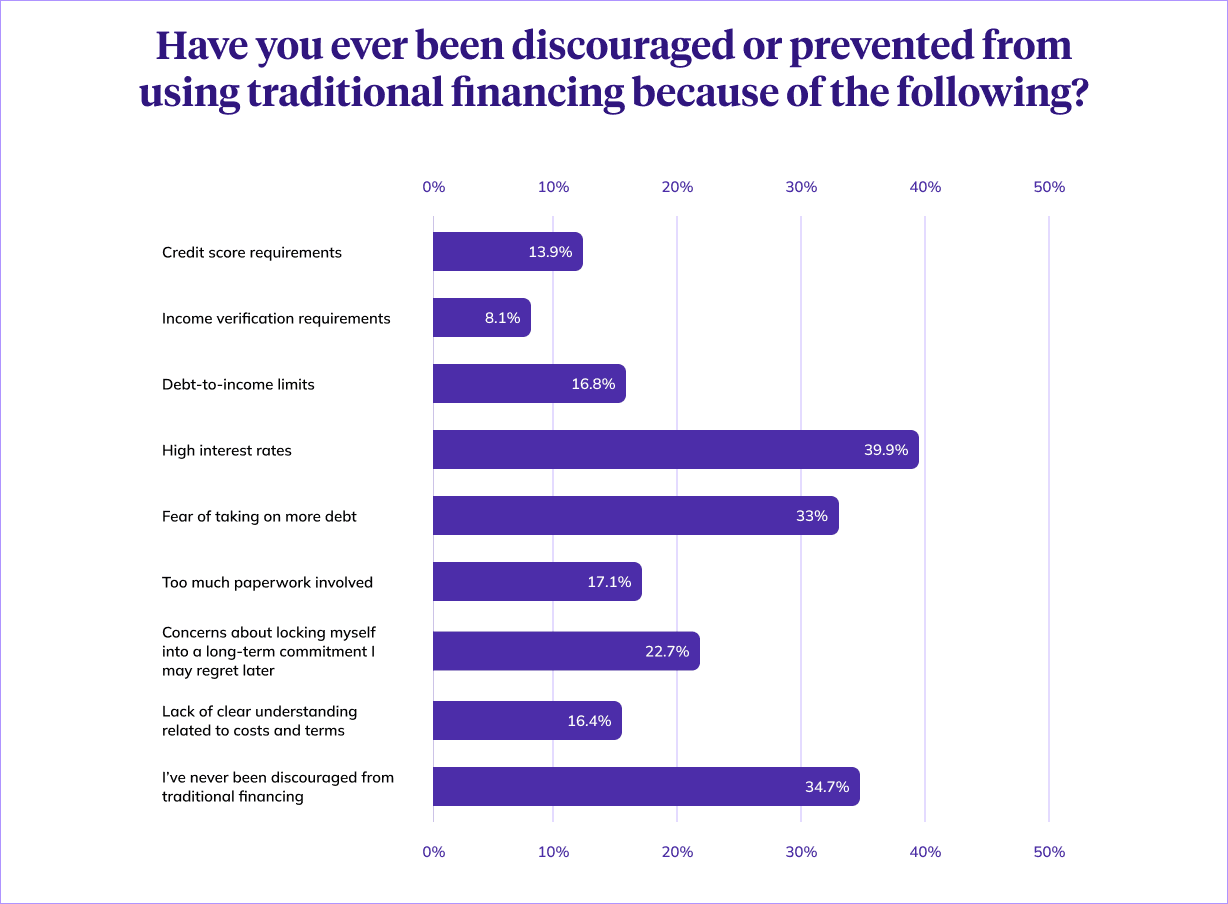

Diving further, respondents selected all of the characteristics that make traditional home equity products unattractive, and again found the answers were dispersed.

- Credit score requirements - 13.9%

- Income verification requirements - 8.1%

- Debt-to-income limits - 16.8%

- High interest rates - 39.9%

- Fear of taking on more debt - 33%

- Too much paperwork involved - 17.1%

- Concerns about locking myself into a long-term commitment I may regret later - 22.7%

- Lack of clear understanding related to costs and terms - 16.4%

- I’ve never been discouraged from traditional financing - 34.7%

Finding No. 2: Homeowners feel disconnected from traditional lenders

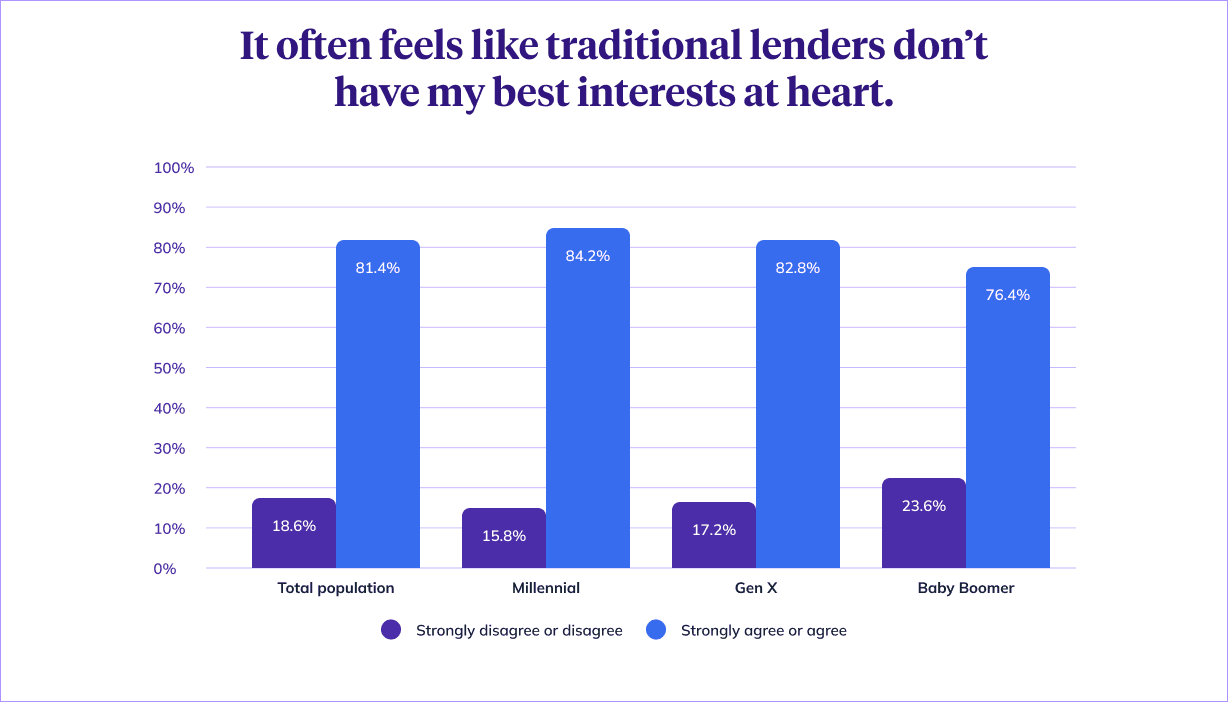

Trust emerges as another breaking point in the homeowner-lender relationship. Across all respondents: 84% of Millennials, 83% of Generation X, and 76% of Baby Boomers say it often feels like traditional lenders don’t have their best interests at heart.

Our June survey found that 37.6% of homeowners said housing costs were preventing them from achieving other financial goals, and many are sacrificing home repairs, retirement saving, or even healthcare to stay afloat.

All things considered, it’s no wonder why homeowners feel like they’re shouldering the financial burden alone, without support, without clarity, and without trustworthy partners.

Finding No. 3: The process of accessing home equity feels outdated, difficult, and slow

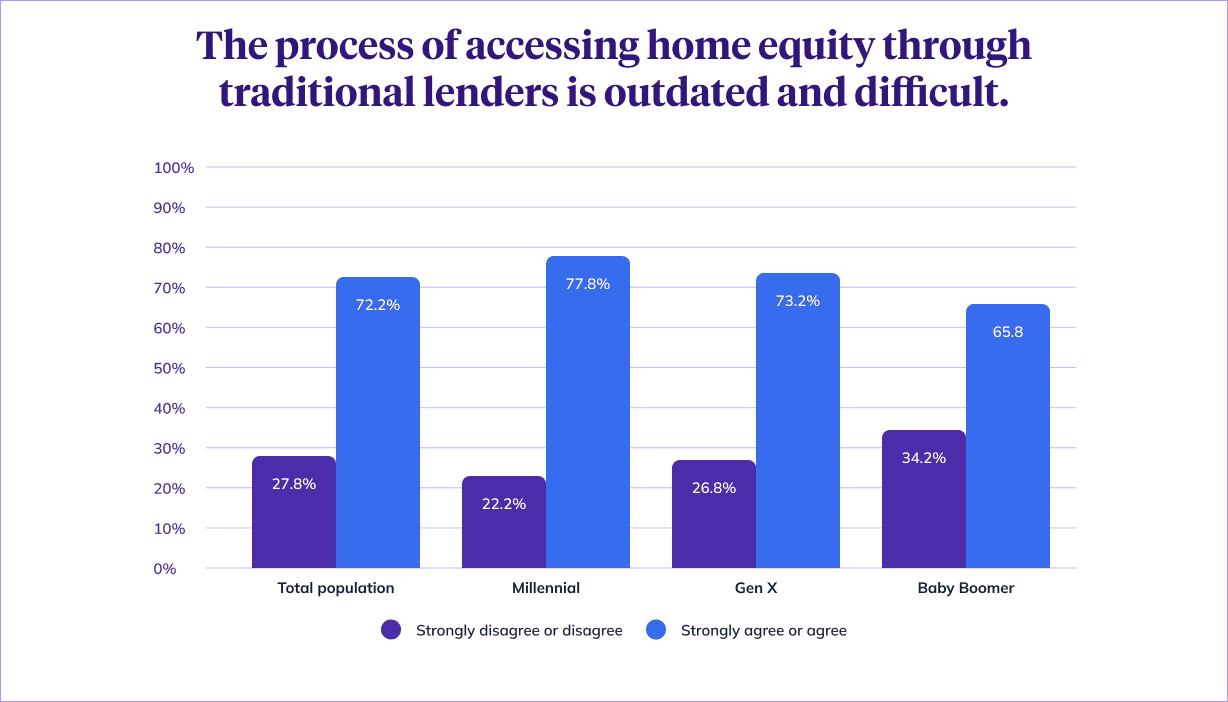

This concern appears across demographics. When asked if they agreed or disagreed with the statement that the process of accessing equity through traditional lenders is outdated and difficult:

- 79% of Millennials agreed or strongly agreed

- 73% of Generation X agreed or strongly agreed

- 66% of Baby Boomers agreed or strongly agreed

These sentiments are echoed by some of the characteristics homeowners called out as making traditional products unattractive: too much paperwork (17%) and a lack of understanding of costs and terms (16%).

“The home equity industry has been slow to evolve, but homeowners are thinking differently now,” said Pat Patterson, a South Carolina homeowner. “We want financing options that meet us where we are and move with us as life changes.”

For many, this isn’t just an inconvenience — it’s a barrier. In the June survey, only 6.2% of homeowners that indicated they were financially stressed said they had explored home equity financing in the past year. High friction is contributing to lack of adoption. This slow, paperwork-heavy process stands in stark contrast to the streamlined, consumer-centric experiences homeowners expect from financial services today.

Finding No. 4: Homeowners want to avoid another monthly payment

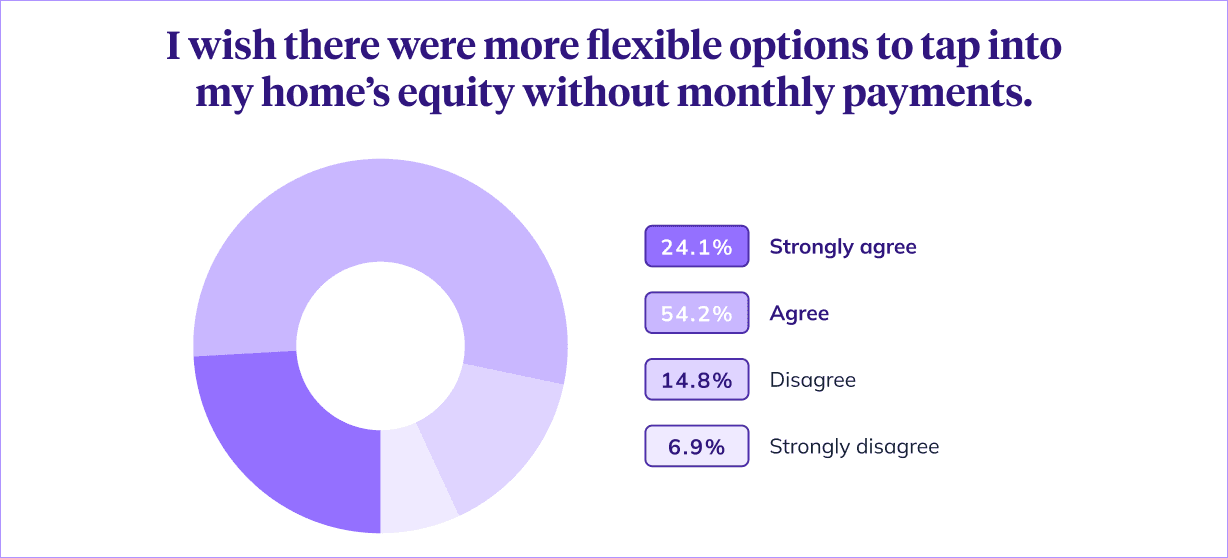

Perhaps the strongest signal of where homeowners want the industry to evolve: a desire for financing options that don’t require new monthly payments.

Across all respondents, 80% of Millennials, 82% of Generation X, and 70% of Baby Boomers wish there were more flexible ways to tap equity without taking on monthly payments.

What’s more, 3 in 4 respondents (74.5%) believe that homeowners today need new types of financing options beyond the traditional mortgage, HELOC, or home equity loan.

This is particularly important in a world where, as the June survey data shows:

- 43.2% say they’re spending a higher percentage of income on housing than ever before

- 49.4% have already cut nonessential spending

- 38.7% have delayed repairs or maintenance

Adding a new monthly payment feels incompatible with already-tight budgets.

Finding No. 5: Younger generations feel the mismatch the most

Younger homeowners, despite having the most time ahead in their financial journeys, are the least satisfied with traditional home equity products.

When looking at process frustration, flexibility gaps, and desire for alternatives, Millennials and Generation X are the most dissatisfied, with Baby Boomers closely trailing.

The cross-current is telling: Older homeowners feel underserved because traditional products don’t fit their stage of life. Younger homeowners feel underserved because traditional products don’t fit their financial realities.

Both groups of homeowners arrive at the same conclusion: the current system works for fewer and fewer people.

The home equity landscape is overdue for reinvention

Homeowners aren’t asking for small tweaks. They’re signaling the need for a fundamental shift toward financing that’s transparent, consumer-centric, and flexible enough to meet the realities of modern budgets.

For industry leaders, policymakers, and innovators, this moment represents both a challenge and an opportunity. The message from homeowners is clear: the old model no longer works for the majority. The next generation of home equity solutions must be built around flexibility, trust, and financial resilience.

The industry has a chance to evolve — and homeowners are ready for it.

Methodology: The survey was conducted by AYTM on behalf of Hometap from October 23–24, 2025, among 1,000 U.S. homeowners representing a mix of ages, demographics, and regions. Respondents were recruited through AYTM’s online panel and screened to confirm current homeownership. The 12-question survey, designed to measure perceptions and sentiments around home equity products, was administered online with randomized multiple-choice options and “Not applicable” or “Other” responses available for all questions. The results reflect a 95% confidence level with a ±3% margin of error.

Generations were grouped by the following age ranges: Millennials age 25-44, Generation X age 45-64, and Baby Boomers age 64-79.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Market insights”

Survey Highlights Real Costs & Stresses of Owning a Home

The Hidden Cost of the American Dream: Why Homeownership in 2025 Feels Broken