Why Homeowners Are Quietly Rewriting Their Financial Plans

Financial habits may look a little different from one house to the next. While one homeowner is cancelling a small vacation they had planned for later this year, another is holding off just a little longer on the roof repairs — until they’re really needed. Yet another is picking up more shifts than usual, or finding another way to add some supplemental income. But across neighborhoods, the pattern is clear: American homeowners are making subtle yet important adjustments to their financial habits — choices born less out of choice, and more out of necessity.

A recent Hometap survey of 1,000 American homeowners uncovered how rising homeownership costs are reshaping day-to-day spending, long-term goals, and life plans. These quieter adaptations don’t feel drastic — but together, they signal a broader concern about middle-class stability and the growing burden of affording homeownership.

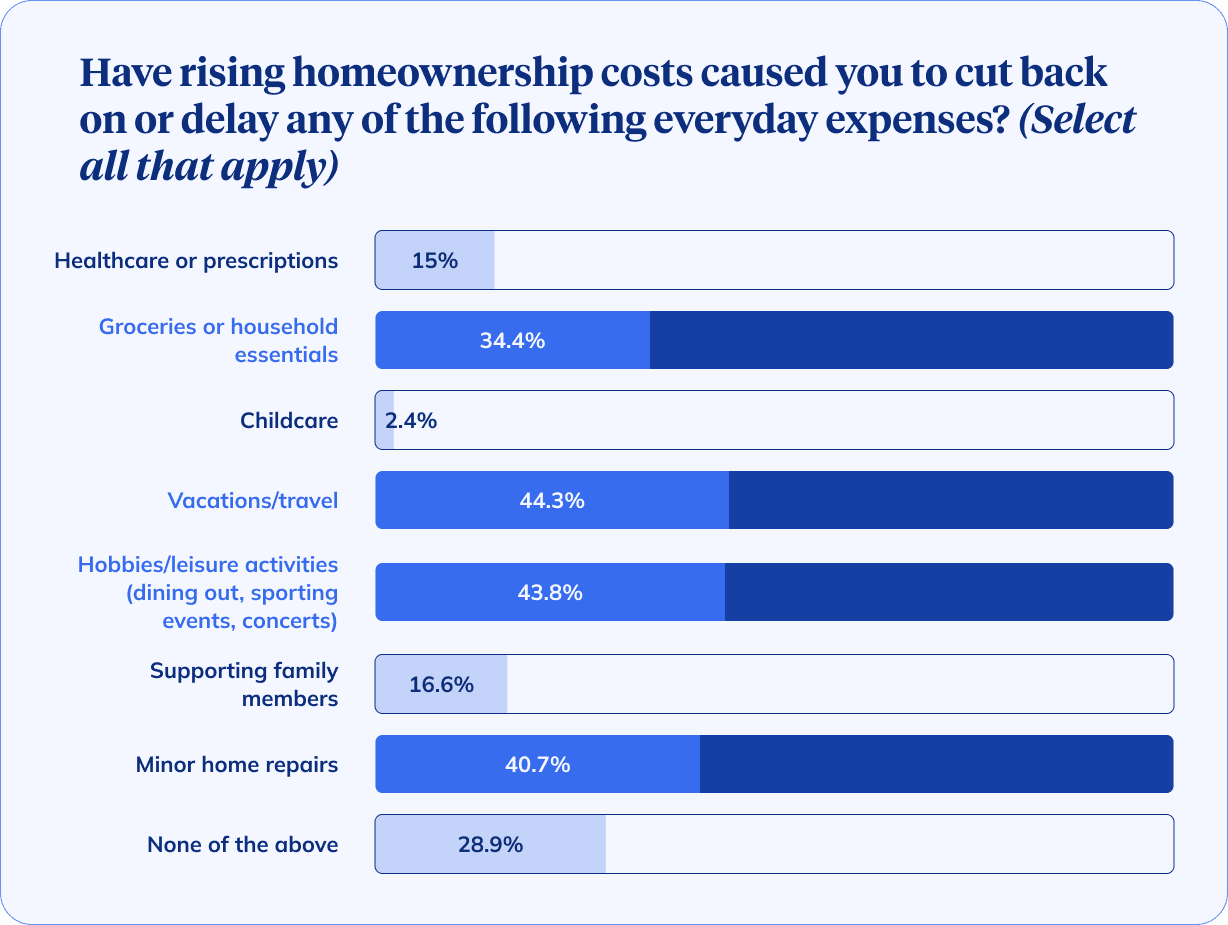

Everyday Trade-offs: Where Homeowners Are Cutting Back

Our survey found that homeowners are trimming a wide range of everyday expenses:

- About 44% have reduced spending on vacations or travel. This number jumps to over 56% when we look at those who indicated they were moderately to extremely financially stressed.

- Nearly 44% have cut back on leisure expenses like dining out or entertainment.

- 40% are postponing minor home repairs.

- Essentials aren’t safe either — 34% say their spending on groceries or household necessities is being tightened.

- Even medical costs, like prescriptions or healthcare, are being deferred by 15% of respondents.

These aren't decisions people make lightly. Skipping small repairs may preserve cash now, but as minor issues go unattended, they can grow into larger problems later. A separate study from Ace Hardware found that 57% of the 1,000 millennial homeowners they surveyed avoid using parts of their home for extended periods due to unresolved maintenance issues.

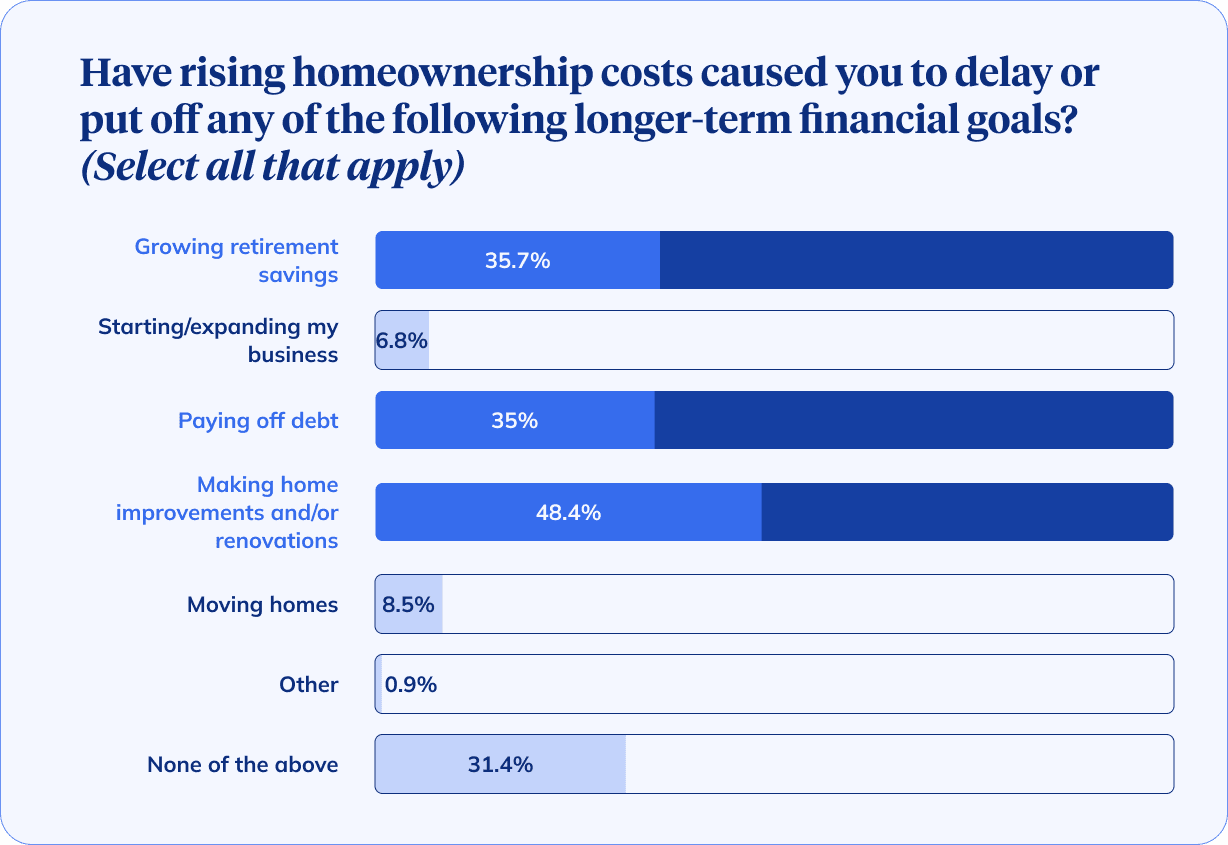

Putting Big Goals on Pause

The impact stretches beyond everyday costs. Many homeowners are deferring longer-term financial targets:

- Nearly half (48%) are delaying home improvements or renovations — a sentiment that’s clearly reflected by the renovation industry. It’s projected that year-over-year spending for home renovations will increase by just 1.2% in 2025, a significant decrease from previous growth rates that marks the first annual decline in more than a decade.

- 36% are holding off on growing their retirement savings, an alarming statistic when you consider how delayed contributions will impact potential for compound growth.

- 35% are delaying their plans to pay down debt, having incurred more interest than planned or expected.

- A smaller but meaningful portion, nearly 7%, put starting or expanding a business on the back burner.

Household budgets are effectively being tightened not just for the month ahead, but for the foreseeable future.

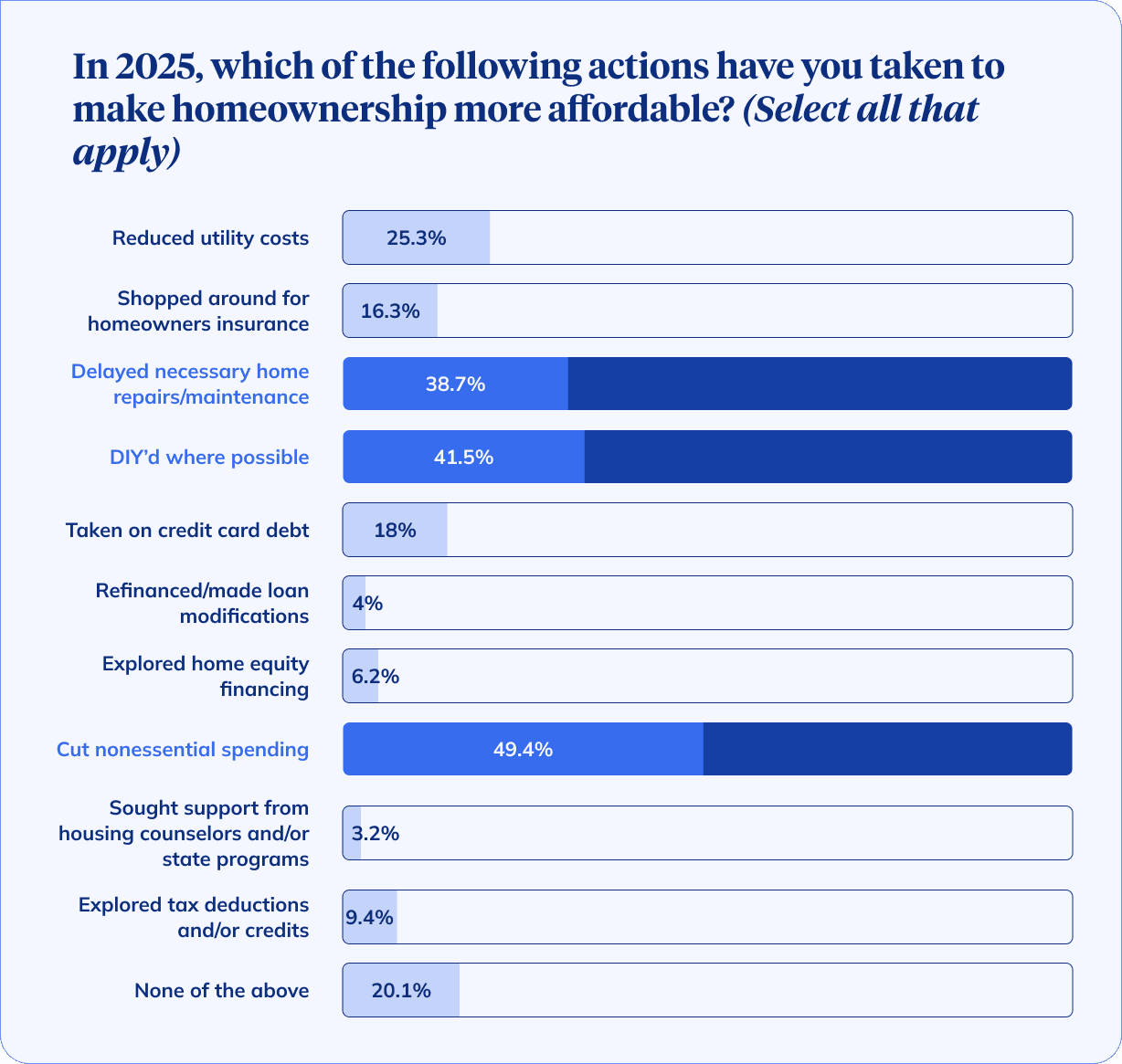

The Hidden Actions: How People Are Adapting

To make ends meet, people are adapting in other subtle and scrappy ways:

- Nearly 50% have cut nonessential spending.

- 42% are risking DIY fixes instead of hiring help. And while we love to see a savvy homeowner, we can’t ignore the fact that the aforementioned Ace Hardware study found that nearly 30% of homeowners had abandoned their DIY home improvement projects, with ongoing stress and incomplete work affecting daily life for 51% of millennial homeowners.

- 39% even postponed necessary maintenance.

- A quarter have looked for ways to reduce utility bills, and more than 16% shopped around for better homeowners insurance rates.

- 18% have leaned on credit cards to bridge the gap — which is worrying when you consider that credit cards carry some of the highest interest rates (22.5% on average for cards accruing interest in Q2 2025), and that Americans’ total credit card debt reached $1.2 trillion as of the second quarter of 2025, up from $1.1 trillion in Q1.

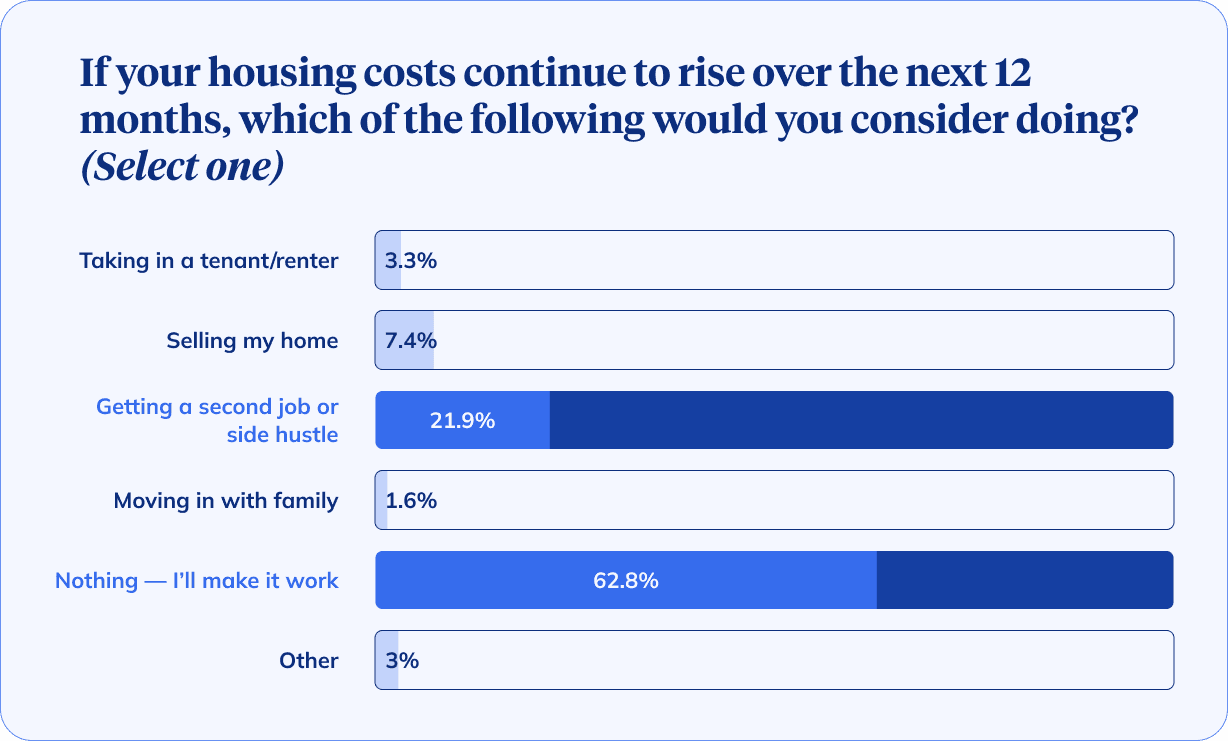

When asked about the year ahead, a majority of homeowners (63%) say they’ll “make it work,” but 22% are considering a side hustle, and 7% would contemplate selling their home. A few even considered taking in a renter for additional income.

The Bigger Economic Picture

These decisions come against a backdrop of economic factors that have made the costs of homeownership more strenuous. Real household incomes remain below pre-pandemic levels — 2023 median real income was just ~$80,600, slightly lower than 2019, reflecting stagnation. Personal saving rates have fallen sharply — from over 10% during the pandemic to just 4.5% in June 2025. And although inflation has eased, earnings have largely kept pace, haven’t exceeded price increases, and left little room for discretionary spending.

In other words, incomes aren’t growing meaningfully, spare cash is scarce, and savings are low. That combination leaves many homeowners vulnerable to rising home costs such as property taxes, higher insurance premiums, and repair bills.

What This Reveals About the Middle Class

These quiet sacrifices reflect a larger structural concern: even established homeowners, who are often seen as financially stable, are experiencing fragility. Postponing home maintenance or retirement savings may seem benign on a person-by-person basis, but cumulatively, this trend could risk widening wealth inequality and weakening financial resilience.

In effect, many are choosing the path of least disruption now, hoping to shore up stability — with a financial burden that may grow heavier tomorrow.

And while it's far less quantifiable, it begs the question how these sacrifices — limiting vacations, hobbies, leisure activities, and healthcare spending — are impacting homeowners’ mental health and happiness.

For homeowners, acknowledging these adaptations is the first step toward a realistic, sustainable plan. It's okay to make short-term choices — but it also matters how you rebuild from there:

- Reframe deferred savings as temporary, not permanent.

- Prioritize high-impact financial goals, such as building emergency buffers or tackling high-interest debt.

- Explore financial support options proactively, from maintenance grants to tax credits or counseling.

For policymakers and advocates, these trends should ring alarms. When a significant share of homeowners are making visible compromises, it signals broader middle-class erosion, and may warrant deeper support through housing affordability, tax policy, or savings incentives.

The Quiet Rewrite Isn’t Over

Homeowners aren’t abandoning homeownership or giving up. In fact, we found that more than three-quarters of those we surveyed said they still believe owning a home is a part of the American Dream, despite the financial burdens. Instead, they’re quietly rewriting their financial plans; scribbling minor edits to budgets and goals in the margins of daily life. The question now is how they — and we — respond. For now, that’s with support, understanding, and strategies that restore ease rather than extend compromise.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Market insights”

The Hidden Cost of the American Dream: Why Homeownership in 2025 Feels Broken

Survey Highlights Real Costs & Stresses of Owning a Home