Home Equity Investments: A Smart Reverse Mortgage Alternative

One of the questions we receive most often at Hometap is whether a home equity investment is like a reverse mortgage. In short, the answer is no. While they may appear similar on the surface, the two are actually different in just about every way. Below, we’ll compare Reverse Mortgages vs. Home Equity Investments so you understand exactly how they differ.

How Do Reverse Mortgages Work?

A reverse mortgage can be a good option for older homeowners looking to get some extra cash to supplement their retirement funds. According to the National Reverse Mortgage Lenders Association, senior housing wealth reached a record $7.54 trillion in Q4 of 2019, representing a major opportunity for retirees to tap into the cash that’s tied up in their homes.

With this type of loan, the lender actually pays you every month, the homeowner, based on a percentage of your home’s value, rather than the other way around. You can also get cash fairly quickly, which can be a huge help to retirees who find themselves without a large amount of retirement savings. While this may seem very appealing on the surface, it’s important to understand the ins and outs, because reverse mortgages are more complicated than they appear.

This might be one reason why, according to Reverse Mortgage Daily, they’re used far less than other means of accessing equity.

“Whether it’s a reverse mortgage or a home equity loan, or cash-out refinance, they just are not showing any meaningful desire to liquefy the equity in their home,” says researcher Karan Kaul. “And, that may be because they don’t want to take on debt in their 60s, 70s and 80s. They may want to leave a bequest, or they may just be trying to stay financially conservative.”

Read more about your options with Reverse Mortgages in Retirement: When to Sign On and When to Steer Clear >>

There are three different types of reverse mortgages: single-purpose, proprietary, and Home Equity Conversion Mortgages (HECMs). Each is slightly different, and it’s wise to consider the nuances of each one to find the best fit.

Single-purpose mortgages, like the name suggests, are limited in their use as dictated by the lender — like, for example, home repairs or property taxes. They don’t cost as much and have fairly flexible qualification criteria, but aren’t as widely available as other choices, mostly provided by state and local governments and some nonprofits.

Proprietary mortgages are private mortgages that aren’t federally-insured and therefore, aren’t typically subject to as much regulation as single-purpose or Home Equity Conversion Mortgages. So if you’re seeking more equity from your home or simply have a home that’s of high worth, you might have more luck with a proprietary mortgage.

Finally, Home Equity Conversion Mortgages are backed by the U.S. Department of Housing and Urban Development. Once you’re approved, you can use the funds for anything you’d like, and there isn’t a firm income requirement to qualify. However, your loan amount will be capped at about half your equity, and they can be more expensive than traditional home equity loans. It’s for this reason that those looking to access equity from a high-value home might find proprietary mortgages to be more attractive.

Pros and Cons of Reverse Mortgages

The biggest advantage of a reverse mortgage is that unlike a regular (forward) mortgage, you don’t need to make monthly payments and the loan balance won’t come due until the loan matures. This can be a huge plus for homeowners on fixed incomes who want to stay in their homes. It can also help delay the need to pull money out of Social Security earlier, potentially helping you get bigger and better benefits later on.

However, you’re still responsible for taxes and insurance on the home, and those costs can add up. You’re also required to use the property as your primary residence for the life of the loan, and an unexpected 12-month stint in a nursing home would be considered a permanent move, making you responsible for paying back the loan. Overall, despite the lack of monthly payments, the fees associated with reverse mortgages are often higher than those of traditional mortgages.

You must be 62 years old to qualify for a reverse mortgage, which immediately rules it out as an option for many homeowners. Finally, a reverse mortgage decreases your home equity and increases your debt, since the interest becomes part of the loan balance over time rather than being due upfront.

Read more about the pros and cons of a reverse mortgage >>

Frequently Asked Questions About Reverse Mortgages and HECMs

What is the difference between a HECM mortgage and a reverse mortgage?

Home equity conversion mortgages (HECMs) are a type of government-backed reverse mortgage that give you up to approximately half of your home’s equity to use as you wish. There are two other types of reverse mortgages — single-purpose, which are limited in their approved use, and proprietary, which aren’t federally insured and aren’t as highly regulated — so it all depends on what works best for you.

Why do people dislike reverse mortgages?

While reverse mortgages can be a good fit for some homeowners, the criteria can be restrictive in terms of who qualifies — they’re only available to homeowners aged 62 or older. You’re also required to use the property as your primary residence for the life of the loan, so it might not be the best for everyone.

What is the H4P program?

The H4P program is a reverse mortgage program that allows seniors aged 62 or older to buy a new primary residence using the proceeds from their HECM loan at the same time — when they take out the mortgage, they purchase the home as well.

What credit score is needed for reverse mortgage?

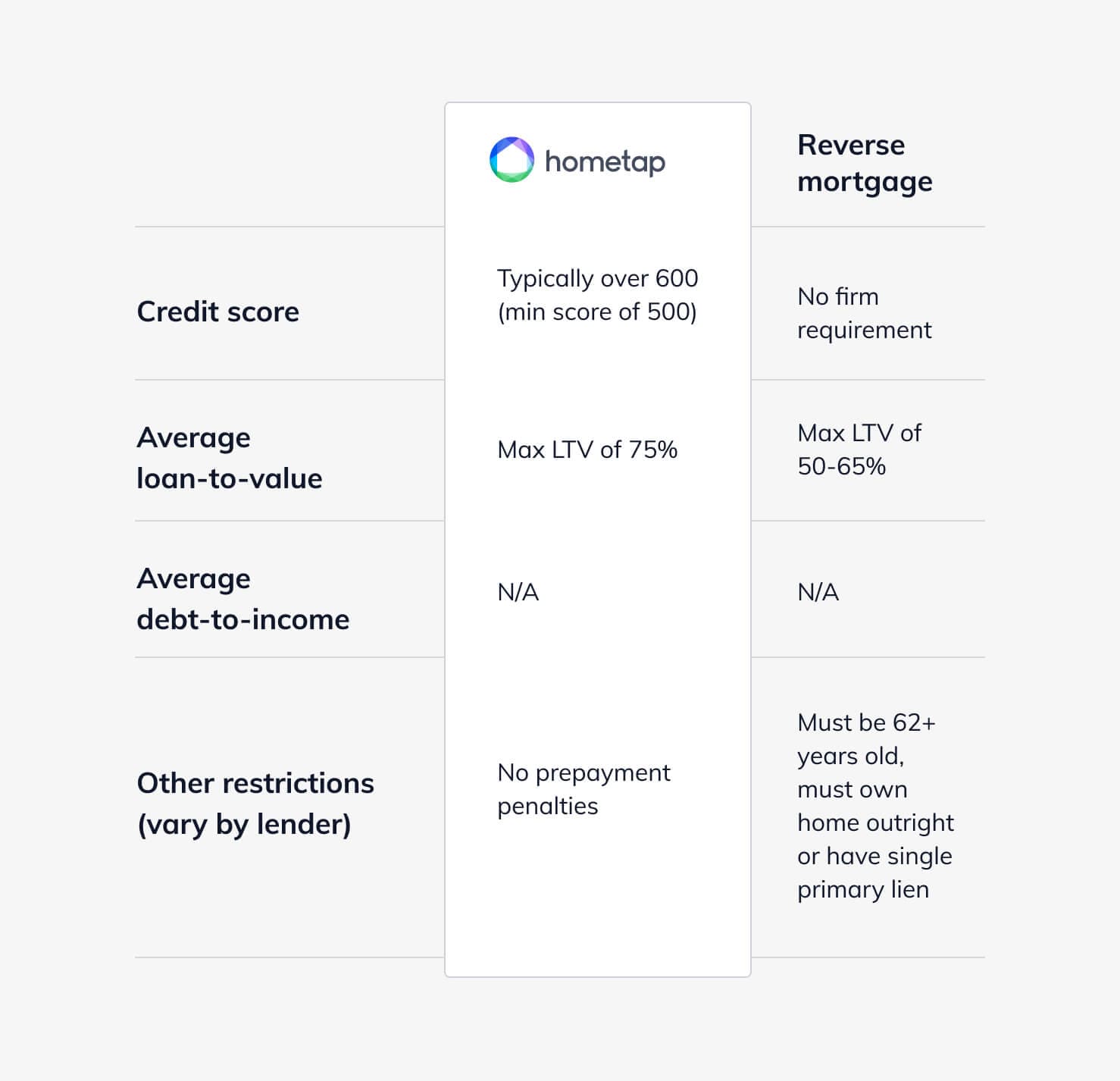

There are typically no firm credit score requirements for a reverse mortgage, though criteria might vary by lender.

Home Equity Investments: A Reverse Mortgage Alternative

If you’re worried about these disadvantages, consider the alternatives to reverse mortgages. There are the more traditional avenues, but they may not be the best choice if you want to avoid taking on more debt or monthly payments.

For example, a home equity loan gives you a lump sum of cash and tends to have a fixed rate and predictable monthly payment. However, the loan installments come on top of your existing mortgage payments, so older homeowners may not want or be able to handle both.

A cash-out refinance is another option that involves taking out a new mortgage on your home and potentially locking in a lower interest rate — but there are closing and origination fees, and they’ll likely extend your mortgage payoff timeline.

Finally, home equity lines of credit (HELOCs) give you flexibility in terms of the amount of cash and frequency with which you can take it out. However, the application and approval process can be challenging, and the variable interest rate means that monthly payments will be unpredictable, so it may not be a great fit for older homeowners looking to keep spending down.

Fortunately, there’s also a fairly new option, a home equity investment. It gives you near-immediate access to cash without monthly payments — just like a reverse mortgage — but without any interest or additional debt. Since Hometap is an investor, not a lender, it can provide you with up to 30% of your hard-earned equity in exchange for a share of your home’s future value.

With a home equity investment, you can use the money for whatever is most important to you, whether it’s getting rid of debt, completing a home renovation, paying off medical bills, or anything else you want; it’s up to you. Quickly compare reverse mortgages and home equity investments with the chart below.

You should fully understand your options before making a decision, as Hometap Investments do have an effective period of 10 years, by which point you’ll need to settle. While you don’t have to sell your home to do this — a buyout with savings or a home refinance works, too — it’s something to take into consideration if you don’t think you’ll be able to refinance or buy out the Investment.

Tap into your equity with no monthly payments. See if you prequalify for a Hometap investment in less than 30 seconds.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.