What is a Reverse Mortgage?

Last updated December 26, 2023

A reverse mortgage allows homeowners who are at least 62 years old to use home equity to supplement their retirement income. Reverse mortgages, also called home equity conversion mortgages, aren’t like conventional forward mortgages in that you do not make monthly mortgage payments. So, how does a reverse mortgage work?

Instead, as ReverseMortgageAlert.org describes, “the borrower receives payments from the lender and does not need to make payments back to the lender as long as he or she lives in the home and continues to fulfill basic responsibilities, such as payment of taxes and insurance.” As time goes on, the loan balance and interest grows, while home equity decreases.

While this option was perhaps an afterthought for many retirees in the past, the coronavirus crisis has brought it to the forefront once again as a choice for those whose funds were decimated during the economic crash caused by the pandemic. Applications for home equity conversion mortgages (HECMs) increased 15% in March 2020 from the previous month, and up 50% in Q1 from 2019.

David Peskin, the president of Reverse Mortgage Funding, LLC, said he’s seen a 67% jump in application volume across the industry.

“Our customer is the older homeowner that is in their retirement, and their retirement just got pummeled by about 20% or 30%,” he explained. “Our customers are thinking, ‘I should be accessing the equity in my home versus trying to sell off my position or live off my retirement with the notion that over time, it’ll come back.”

Experts believe that the knowledge deficit that existed when reverse mortgages first hit the market has been addressed, leading to fewer cases of cold feet.

“Over the years, what I’ve noticed, especially with borrowers in that 62 to 72 range now, they’re coming in a lot more educated than they had previously been on the product,” Paul Fiore, chief retail sales and operations officer at AAG, told HousingWire. “They’ve done a lot of research, probably online, looked into different things and different aspects of the product. So, they’re coming in more educated, at least in the fundamentals of the loan.”

There are three types of reverse mortgages:

Single-purpose reverse mortgages

This option is typically the least costly, but it has restrictions and might not be the easiest to come by. As the name suggests, the lender dictates the purpose of the loan — for example, to pay property taxes or take care of home repairs. While the qualification criteria makes it fairly easy for most homeowners with low-to-moderate income to get approved, they aren’t very widely available, mainly offered by state and local governments and select nonprofits.

Proprietary reverse mortgages

These are private loans that are funded by the companies that create them. This may be a better choice if you own a high-value home, as you have the potential to receive a higher loan amount than you would with other types of reverse mortgages, especially if your mortgage balance is low.

Home Equity Conversion Mortgages (HECMs)

HECMs are backed by the U.S. Department of Housing and Urban Development (HUD) and are federally insured. There are a few advantages to HECMs: there isn’t a firm income requirement, and unlike single-purpose mortgages, they can be used for any reason. However, they tend to be pricier than old-fashioned home equity loans in terms of both total costs and upfront fees.

Reverse Mortgage Pros

No mortgage payments. A reverse mortgage allows retirees on fixed incomes to stay in their home — with no monthly mortgage payments. The entire loan comes due at the end of the term, generally when the homeowner dies or moves out.

Immediate cash. Many families have little to no retirement savings, according to the U.S. Government Accountability Office. If you’re in a similar boat but have equity in your home, a reverse mortgage can help eliminate or mitigate cash flow issues that can crop up once you’ve stopped working.

Bigger Social Security benefits. A reverse mortgage can allow you to delay drawing on your Social Security, helping you reap bigger benefits down the road. As the Internal Revenue Service lays out, you can get 100% of your benefits at age 66. But you can get 132% of your benefits if you wait to draw funds until age 70.

See how Reverse Mortgages compare to home equity loans, refinances, and other financial products in our Home Equity Investments 101 Guide.

Reverse Mortgage Cons

High fees. According to Reverse.org, reverse mortgage fees are typically higher than those of a traditional mortgage. For example, there’s an initial Federal Housing Administration (FHA) mortgage insurance premium of 2% of the home value, up to $13,593, plus ongoing FHA premiums of 0.5% of the outstanding mortgage balance.

Inability to move. You may not have plans to move. But, as Investopedia cautions, if you have to move into a nursing home or assisted living facility for more than 12 consecutive months, it’s considered a permanent move. Since lenders require you to live in the home you’re borrowing against, you’ll need to pay back the reverse mortgage. If you can’t, then the lender will foreclose on your home.

“When the money runs out, you can’t borrow any more. You can’t dip into that well,” warns Bruce McClary of the National Foundation for Credit Counseling. “And often times what happens is this leaves seniors with their back up against the wall with one less financial option and a home to maintain…it is a back pocket option, and I would say that people should probably save it as something that’s more like a last resort.”

Inheritance is tricky. If you’re hoping to keep your home in your family, your heirs will have to repay the loan balance. Reverse Mortgage Funding says that the loan is traditionally paid off by selling the home or refinancing through a traditional mortgage.

“There are provisions that allow family to take possession of the home in those situations, but they must pay off the loan with their own money or qualify for a mortgage that will cover what is owed,” McClary adds. And while a reverse mortgage refinance is possible, it’s quite uncommon and requires that very specific criteria be met first.

Alternatives to a Reverse Mortgage

Reverse mortgages aren’t your only financing option as a homeowner. Unlike reverse mortgages that require you to be 62 years or older, these financing options do not have age restrictions. Plus, you don’t have to fully own your home (or have a very small mortgage) to qualify as you do with a reverse mortgage.

Home equity instruments. A home equity loan and a home equity line of credit (HELOC) are not the same thing. Although both allow borrowing against the equity in your home, the terms differ. A home equity loan is a lump sum that generally has a fixed rate while HELOC rates are usually adjustable and the amounts are smaller. Both are better suited to filling short-term financial needs.

In addition to considering your long- and short-term financial needs, you’ll want to determine the cost of borrowing, taking into account interest and fees.

Selling your home. If you sell your home — particularly if your mortgage is paid off — and move to a rental property, you can gain a significant bump to your retirement fund. Downsides include monthly rent payments and the loss of property from your estate.

Home Equity Investments. For many homeowners, home equity investments or home equity agreements can offer the best of both worlds. Like a reverse mortgage, an HEI eliminates monthly payments. But it also doesn't impact your debt-to-income ratio, and doesn't have the same age requirements as a reverse mortgage.

Read more of Brenda’s story >>

Unlike some reverse mortgage options, there aren’t any restrictions on how you can use the money, so you can put it toward whatever is most important to you, from renovating your home, to paying down debt, or diversifying your portfolio. Finally, if you’re worried about qualifying for a reverse mortgage, it may help to know that the requirements for a Hometap Investment are unique from a reverse mortgage and traditional loan options.

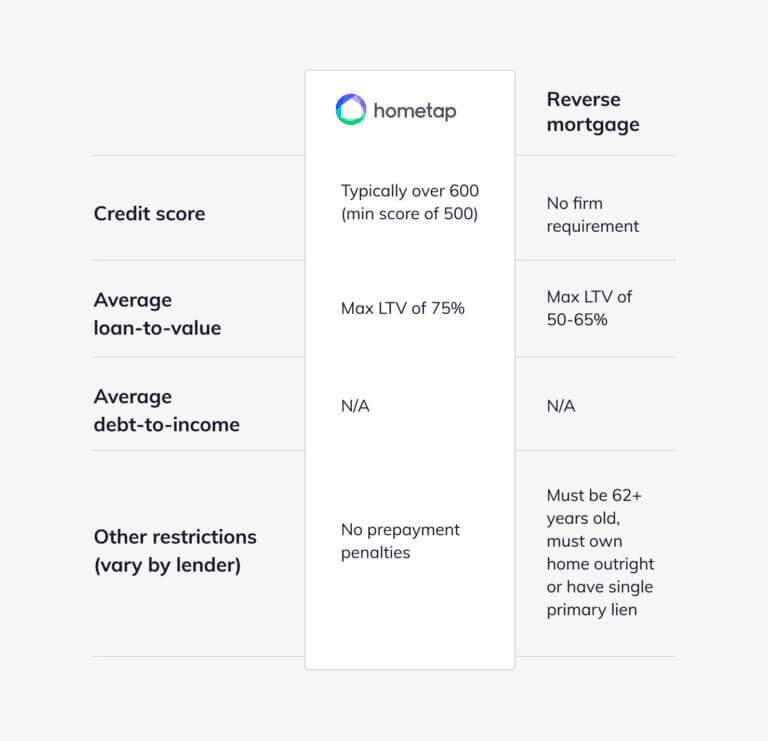

You can quickly compare a Hometap Investment and a reverse mortgage using the chart below.

Everyone hopes they’ve set aside enough money to enjoy retirement, but unexpected expenses or a longer lifespan may leave us needing additional sources of income. Carefully consider the pros and the cons of a reverse mortgage to decide where your home fits into your retirement plan based on your goals and your situation.

Tap into your equity with no monthly payments. See if you prequalify for a Hometap investment in less than 30 seconds.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

Related Tags:

Reverse mortgageMore in “Home financing 101”

How to Get Equity Out of Your Home Without Refinancing

5 Common Mistakes That Silently Erode Your Home Equity