Infographic: Pandemic Creates a Surge in Home Renovations

With less time being spent traveling, shuffling kids from one activity to the next, and commuting to work, many homeowners are finding more time in their schedules to tackle much-needed home improvement projects around the house. Whether it’s painting, landscaping, or remodeling a kitchen, home projects both big and small are becoming top priorities. In fact, 32% of consumers have taken on home improvement projects since the start of the pandemic and another 15% plan to. As new home renovation trends emerge due to more people spending time at home, homeowners can look into financing options that can help make them possible.

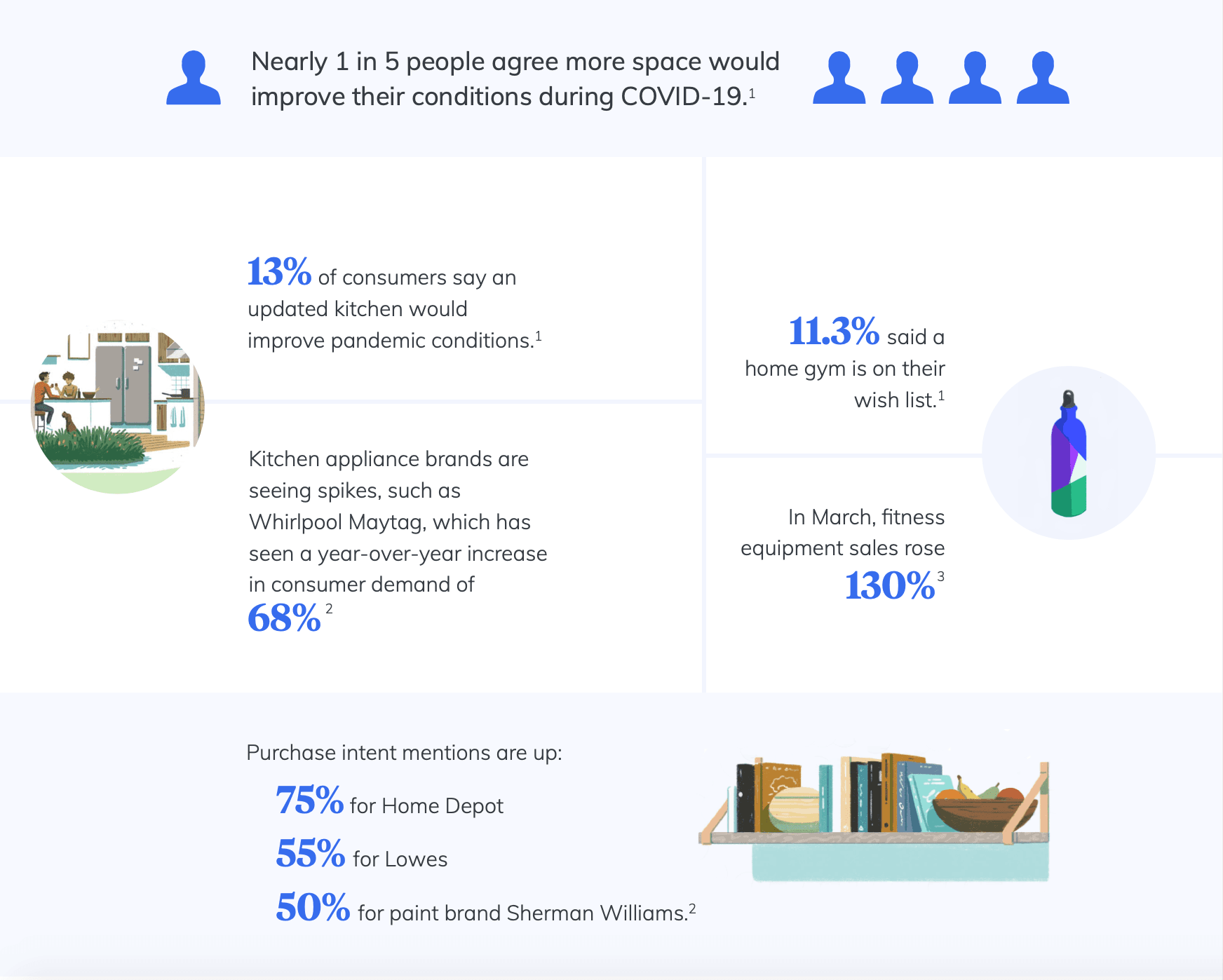

Since the start of the COVID-19 pandemic, many peoples’ homes have also doubled as their at-home office, gym, school, daycare, and more. Resulting in multiple family members being together all at once. When consumers were asked what would improve their conditions during the pandemic, nearly one-in-five people agreed that more space was at the top of their lists. Creating an at-home gym or redecorating the family room could make all the difference for a homeowner trying to navigate day-to-day life during the pandemic.

DIY Projects and Home Repair Trends

As featured in the Realtor.com survey, 18-34-year-olds said that their top home projects at the start of the pandemic were creating a home office, work out space, and redecorating rooms, while 35-54-year olds focused on cleaning out closets and gardening. Similarly, consumers 55 and older said that they were most likely to paint, clean out closets or garages, and take up gardening during the pandemic.

1. Painting

Painting is one of the easiest ways for homeowners to spruce up the inside of their homes while also increasing the resale value. While painting can be a whole family affair, when not done correctly, it can become very time-consuming and end up being more of a hassle than a fun project. If homeowners choose to paint themselves, they should account for the costs of any supplies including, paintbrushes, floor tarps, paint trays, and more. Painting projects can cost homeowners anywhere between $960 and $2,770 according to Home Advisor. If a homeowner is deciding between conquering a painting project on their own or hiring a professional, they can start by researching what would be the best fit for them. Find estimates for painting each room type in this guide from HappyDIYHome.

Read More: Should You Go DIY or Hire a Contractor? »

However, some homeowners might have additional concerns about hiring outside help during COVID-19. It’s recommended to start the process by having an open and honest conversation with the contractor about their protocols during the pandemic. Asking about safety policies they have set in place to keep both the employees and homeowners protected and how they are following CDC guidelines, could help alleviate some of the uncertainty. Realtor.com also recommends leaving the house if possible to avoid being present in the house at the same time as the contractor.

2. Gardening & Landscaping

Landscaping and gardening outside can also be an easy-to-do project for homeowners in the fall months. While outside projects can go a long way in improving the appearance of a home, investing in landscapers seasonally can be expensive. Homeowners are finding that minor landscaping tasks such as seeding a lawn can range between $300 – $700 and even $200- $500 for mulching. Bigger outdoor projects such as installing a sprinkler system can cost a homeowner anywhere between $2,150 – $4,000. Although these lawn improvements can make a difference in preventing dead grass, weeds, and overall increase the home’s curbside appeal, homeowners may not always realize a one to one return for the amount they invest with these projects.

3. Home Gym

With more people adapting to at-home workouts in the age of social distancing, more people might start opting-out of going to the gym in the future. In fact, a survey by TD Ameritrade found that 59% of Americans said that they are not planning to renew their gym membership even once the pandemic ends, as there are now “more affordable” ways to work out. While trends around at-home workouts are changing, at-home gyms are now top desire on consumers’ house wish- lists. Even fitness equipment stores have seen an upward trend with sales rising 130% in March compared to the previous year. While the at-home gym itself might not increase a home’s resale value, creating an additional room in the house for more square footage, or finishing a basement, certainly can.

4. Kitchen Remodeling

As more time is being spent in the kitchen cooking, homeowners are also looking into remodeling their kitchen area too. In fact, 13% of consumers said an updated kitchen would improve their pandemic conditions. With more homeowners eating breakfast, lunch, and dinner all in one place, home appliances are being used more as well. More wear and tear on-at-home appliances such as dishwashers and stovetops are causing homeowners to look into replacing them altogether. Even kitchen appliance brands like Whirlpool Maytag are seeing spikes, with a 68% year-over-year increase in consumer demand. Purchase intent mentions for home improvement stores are rising too, with 75% year-over-year for Home Depot, 55% for Lowes, and 50% for paint brand Sherwin Williams.

While a brand new kitchen with new countertops and appliances sounds like a dream, it could also require financing to help to make it possible. According to Home Advisors, most homeowners spend between $13,269 and $37,509 depending on the size of the layout for a kitchen renovation. For example, having the walls painted, refacing the cabinets, upgrading the sink, and installing a tile backsplash could cost a homeowner anywhere between $10,000 and $15,000. Larger renovations such as installing custom cabinets, hardwood floors, granite counters, and high-end appliances can range from $30,000 and above, which can be a steep price for the average homeowner.

If the cost of a home renovation or repair is holding you back from moving forward with improvement projects, look into home equity investment as an alternative financing solution. A Hometap Investment allows homeowners to access the equity out of their home for these much-needed home repairs without taking on monthly payments.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Market insights”

Survey: Homeowners Look for These Three Things in Home Equity Financing

How Should Homeowners React to a Fed Rate Cut?