Finance a Renovation

Tap into your home’s equity to fund your home renovations, big and small.

Whether it’s an emergency repair or a full home remodel, a Hometap Home Equity Investment can help you access your home equity to fund home improvement projects in just a few weeks, without interest or monthly payments.

Find out if a Hometap Investment is a fitting way to handle your home renovation costs. Take our quiz to see if we’re a good fit.

A home equity investment from Hometap can help you fund all kinds of renovations:

Why homeowners like you choose home equity investments finance renovations

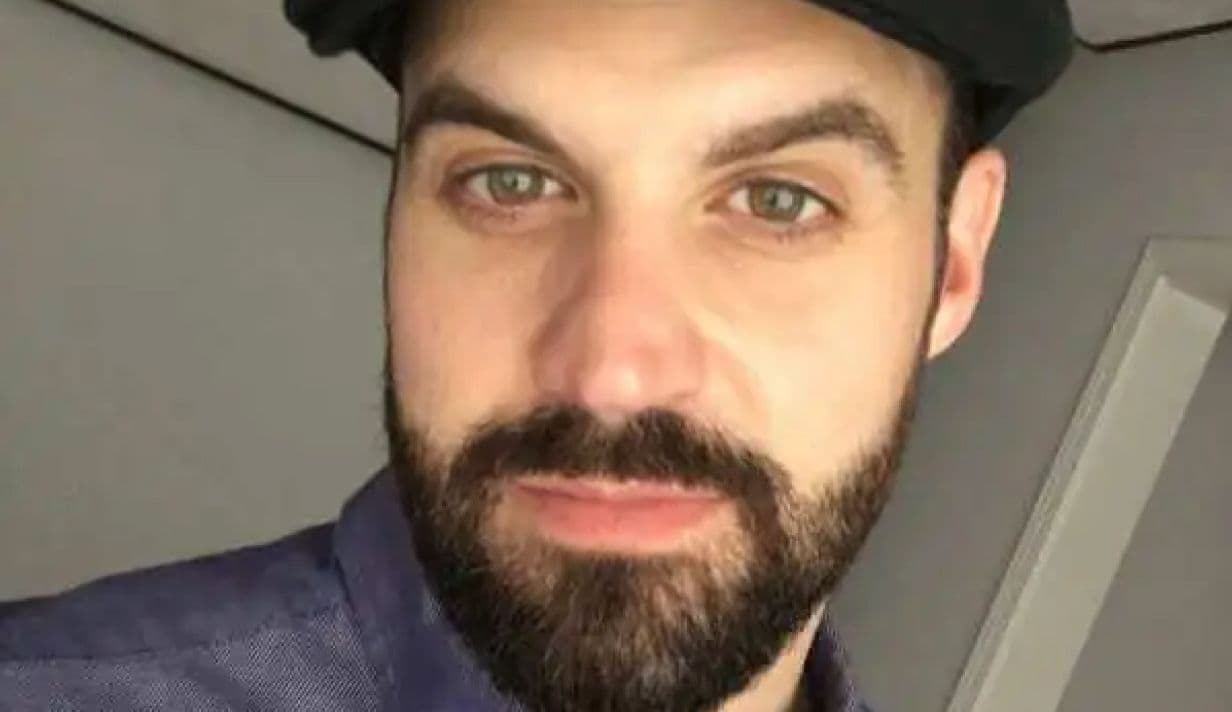

I was able to eliminate all my debt, increase my credit score by lowering DTI, and am using the additional money to create a rental space on my property.

Matthew C.

Los Angeles, CA

Read Matthew’s StoryCompare your renovation financing options

Home Equity Investment | FHA 203(k) Rehab Loan | |

|---|---|---|

| No monthly payments | ||

| No payments for up to 10 years | ||

| No debt-to-income requirements | ||

| No specification on use of funds |

Helpful renovation resources

Financial Goals

Good Estimate vs. Bad Deal: How To Evaluate Your Home Renovation Estimate

Article

4 min read

Financial Goals

5 Ways to Build Your Cash Flow for a Home Renovation

Article

5 min read

Financial Goals

Financing a Home Renovation: What Construction Loan Is Best?

Article

11 min read