Maryland Home Prices Soar Due to D.C.'s Desirability

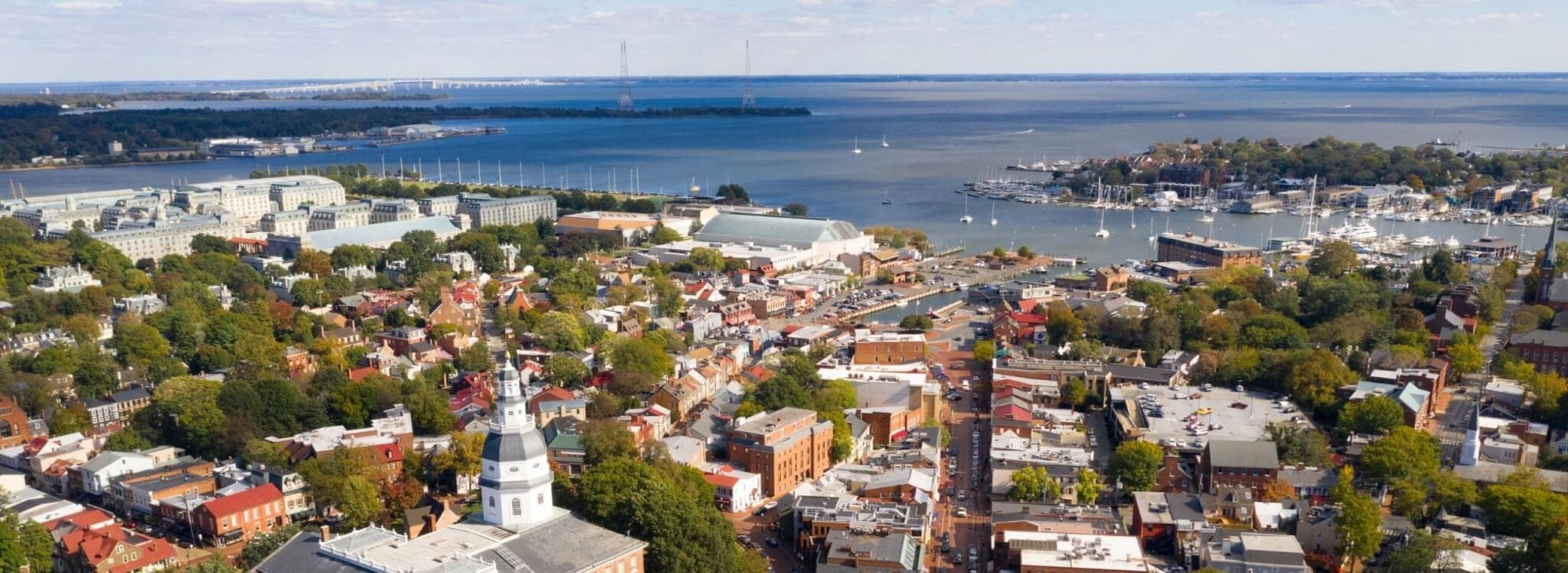

With its close proximity to Washington, D.C., Maryland is an especially popular place to live for many in the government and educational sectors. Situated along the Chesapeake Bay, the state is also home to healthy fishing and tourism industries and boasts beautiful waterfront properties that demand top dollar.

In fact, a study that looked at Maryland home prices from March to September of 2020 found that the 21056 zip code, the exclusive community of Gibson Island in Anne Arundel County, was one of the most expensive in the country, with a median home price of $1.95 million.

A recent Realtor.com study found that the state’s “hottest” zip codes were located between D.C. and Annapolis in the towns of Bowie, Columbia, and Crofton. While affordability was the primary driver of a high amount of home searches and quick sales, education and short distance to bigger cities also factored into the popularity of these suburbs.

Bustling Baltimore has plenty to offer, with the shopping and dining of the Inner Harbor, a world-class aquarium, and Fort McHenry, where the U.S. national anthem originated. In Baltimore, demand is strong: time on the market recently hit a historic low of just nine days. In contrast, that number was 27 days last year. The median home price here is currently $162,197, a 7% increase in the past year.

Still, it’s well below the statewide figure of $322,000 in November 2020, a decade high and a 32% increase year over year. However, the inventory was down 56% from the same month in 2019. In fact, at the height of the pandemic’s first wave in April 2020, home listings in the Baltimore metro area reached the lowest levels in 10 years at 3,628.

A City Surge

Closer into D.C., the prices are much higher. In the city of Potomac, the median closing price for a single-family home in September 2020 was $1.1 million. In Montgomery County, which includes Bethesda and Gaithersburg, the median price was $660,000, the highest it has been in 10 years. In Bethesda specifically, the median sold price for a detached/single-family home in June of 2020 was $1,110,000, a 5.7% jump year over year, and the city took the top spot in a December 2020 study from GOBankingRates that ranked the most overpriced cities in the country as based on the difference between home values and listing prices.

Homebuyers Seek More Space

Similar to the phenomenon seen in New York, the pandemic spurred an exodus from Washington D.C. to suburban and rural areas of Maryland, Virginia, and Delaware.

“If [you’re] going to telework, why pay high taxes in areas such as Montgomery County when you can do your job from Washington County, get a larger home in a less densely-populated area?” Leanne Kuehnle, a real estate agent in Hagerstown, told WDVM. “It’s very attractive to many new home purchasers.”

At the same time, there are fewer homes on the market than usual: while a typical January sees 900–950 listings in Frederick County, there were only 316 as of January 6, 2021. Compounding this is that many are homes yet to be built.

“It’s our understanding that even new construction, they’re having a hard time bringing houses to the market as quickly as they would like to because of COVID, because the factories are experiencing delays,” Realtor Cassandra Bailey told the Frederick News-Post.

Contrary to popular belief, you don’t need to sell your home — or even refinance it — to reap the benefits of its appreciation. Whether you’re looking to renovate, purchase a second property, or eliminate debt, a home equity investment gives you near-immediate access to the equity you’ve built without monthly payments. If you’re a Maryland homeowner who’s looking to make the most of your home’s value, it might be the perfect time to start taking steps to make it happen and get closer to your financial goals.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.