Introducing Hometap: Offering a Smart Way to Access Your Equity

Your home is where life happens. Where family gathers, where you share daily triumphs and minor tragedies with the people you love the most. Your home keeps you safe in the present, and secure in the future, appreciating in value even as you enjoy it day in and day out.

If you’re like the majority of Americans, you’ve taken out a mortgage in order to fund the purchase of your home. A lender fronted you the money so you could buy the home from a seller. Since then, you’ve been paying that lender back (plus interest) as your home accrues equity. Equity that you can’t access.

Why is Accessing Your Home Equity So Complicated?

You can refinance, take out a second mortgage, or a home equity loan, but these options can be challenging:

- It can be very hard to qualify for these loans

- The process – and time to funding – can take months

- Your credit score (FICO) may be affected

- And, if you’ve made it this far, you may be living with even more debt

What if you could bring some of tomorrow’s financial security into your family’s life today, without giving up control of the home you love? Well, that’s why we started Hometap, the revolutionary new financial service for responsible homeowners, nationwide. Hometap is like a time machine for your home equity, bringing some of the value built up in your home down the road into your bank account right now with no monthly payments.

Find out if your property qualifies in minutes.

How Does a Hometap Investment Work?

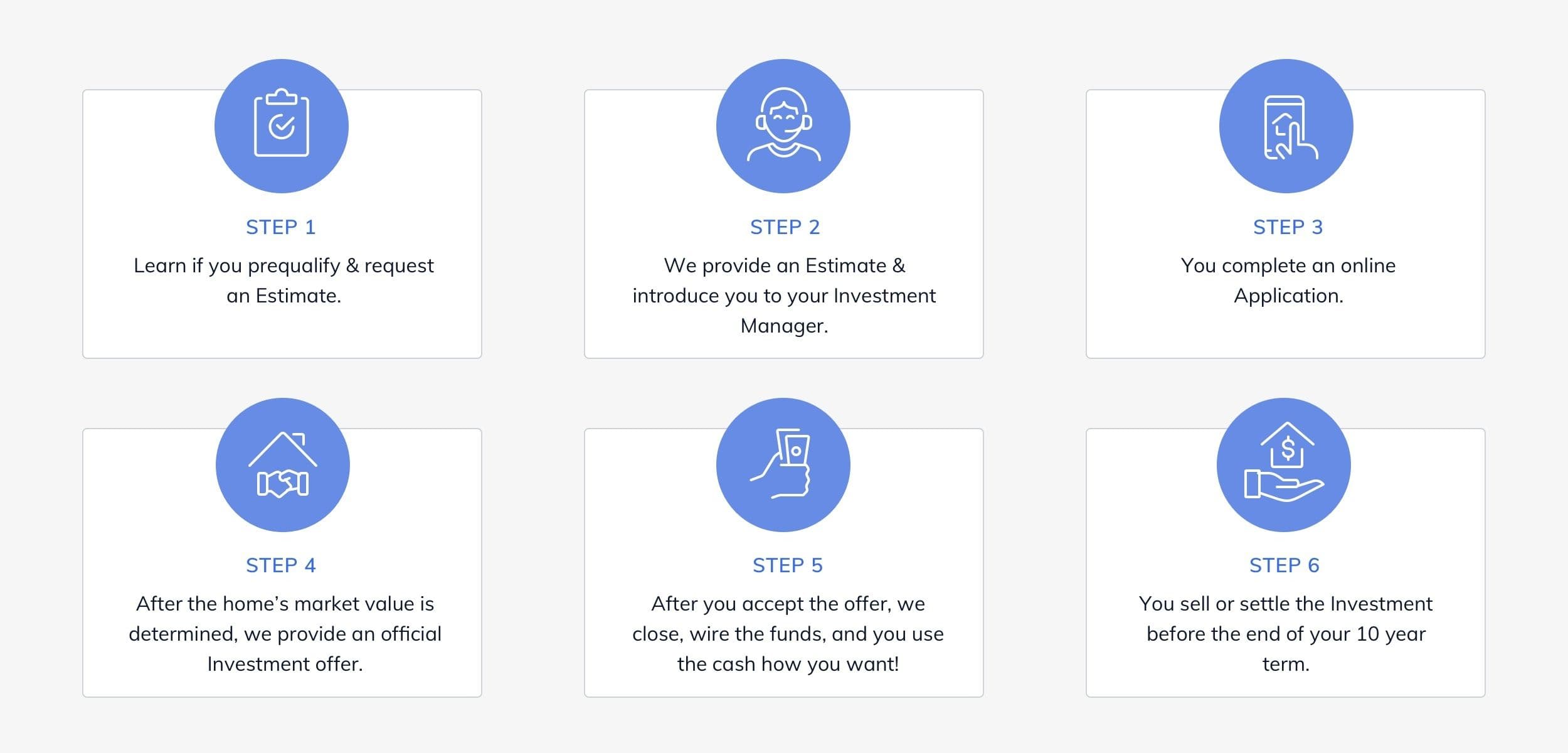

Depending on your home’s equity, its expected appreciation, and your own financial history, you can receive up to 25% of the value of your home in cash. Here’s how the process works:

It’s that simple. You could receive a percentage of your equity in cash to pay off debt, fund your business, renovate your home, cushion your retirement fund, or pay for an education.

Read about how homeowners like you have made their Hometap Investment work for them in our Homeowner Stories series.

At Hometap, we understand the value of home, too. We’re investing right alongside you in that value, as confident as you are that your home is a great investment.

Hear more about who we are and why we started Hometap:

Still have questions? Find answers to the most common questions we receive about eligibility, the investment process, and more here.

Ready to get started? Find out if your property qualifies in minutes, risk-free.

Related Tags:

Home equity investingMore in “Hometap happenings”

10 Questions with Hometap's VP of Data

10 Questions with Hometap's Director of Investment Support Operations