The Complete Homeowners' Guide to Utility Costs

You’re likely here for one of two reasons. One: you’re planning for homeownership, and factoring in utilities on top of all the other costs. Or two: you’re already a homeowner who’s curious about how your costs compare to other homeowners, and how you can lower them. Either way, you’re in the right place.

When you're budgeting for homeownership, understanding your monthly utility cost is essential for financial planning and avoiding surprise expenses. The average utility bill can vary dramatically by your location, your home’s size and type, and your energy consumption habits.

In this comprehensive guide, we'll break down utility costs across all 50 states, explain what drives these expenses, and show you practical ways to reduce high bills while staying comfortable in your home. Here’s what you’ll find below:

- What Are Utilities and Why Do They Matter?

- Common Utility Types

- Key Factors That Affect Your Utility Costs

- Average Utility Costs Across the United States

- How Much Are Utilities Per Month? Breaking Down the Numbers by State

- How to Estimate Your Monthly Utility Costs

- Comparing Your Utility Bills to Local Averages

- What to Do When Your Utility Costs Are Higher Than Average

- Understanding the True Cost of Homeownership

- Frequently Asked Questions About Utility Costs

Understanding Utilities and What Drives Costs

Utilities are the essential services that keep your home functional and comfortable. These recurring expenses make up a significant portion of your monthly homeownership costs, so understanding them is crucial for effective budgeting. According to recent data, the average American household pays $489 per month for utilities, a total of $5,868 annually.

Utility costs can vary dramatically due to numerous factors, so it’s essential to understand what’s behind them — and how your bills compare to others in your area.

Common Utility Types

When we talk about utilities, we're typically referring to six primary services:

- Electricity (typically the largest utility expense for most households)

- Natural gas (commonly used for heating, water heaters, stoves, and dryers). Many homes rely on gas as a more economical alternative to electric heating.

- Water and sewer — many municipalities bill these together

- Trash and recycling

- Internet

- Cable/streaming services

The average price of utilities varies significantly and depends on which services your home requires and how much you consume.

Key Factors That Can Affect Your Utility Costs

Home size and type: Your home's square footage directly impacts your utility consumption. A 1,000-square-foot apartment requires far less energy to heat and cool than a 3,000-square-foot single-family home. According to energy consumption data, larger homes typically use 50-75% more electricity and gas than smaller residences.

Home type also matters. Single-family homes generally have higher utility costs than townhomes or condominiums, which benefit from shared walls that provide natural insulation. Apartments often have the lowest utility costs due to their compact size and shared building infrastructure.

Geographic location and climate: Regional specifics play a massive role in determining your average utility bill. Homeowners in Phoenix, Arizona face dramatically higher cooling costs than those in Portland, Maine, who contend with significant heating expenses. In general, states with extreme temperatures on either end of the spectrum typically see higher energy consumption.

Beyond climate variations, regional utility rate differences can also impact costs. For example, electricity rates in Hawaii are more than three times higher than those in Louisiana, even if consumption is comparable.

Seasonal fluctuations: Your utility bills change throughout the year. Summer months often bring higher electricity bills due to air conditioning usage, while winter can spike natural gas or heating oil costs. Understanding these seasonal patterns can help you budget more effectively throughout the year.

Many utility companies offer budget billing programs that average your annual costs into equal monthly payments and smooth out these seasonal spikes.

Energy efficiency and home age: Older homes often have higher utility costs due to outdated insulation, single-pane windows, and inefficient HVAC systems. A home built in the 1970s might use 30-50% more energy than a newly constructed home with modern efficiency standards, for example.

Energy-efficient upgrades, such as LED lighting, programmable thermostats, Energy Star appliances, and improved insulation, can significantly reduce your monthly utility expenses.

Average Utility Costs Across the United States

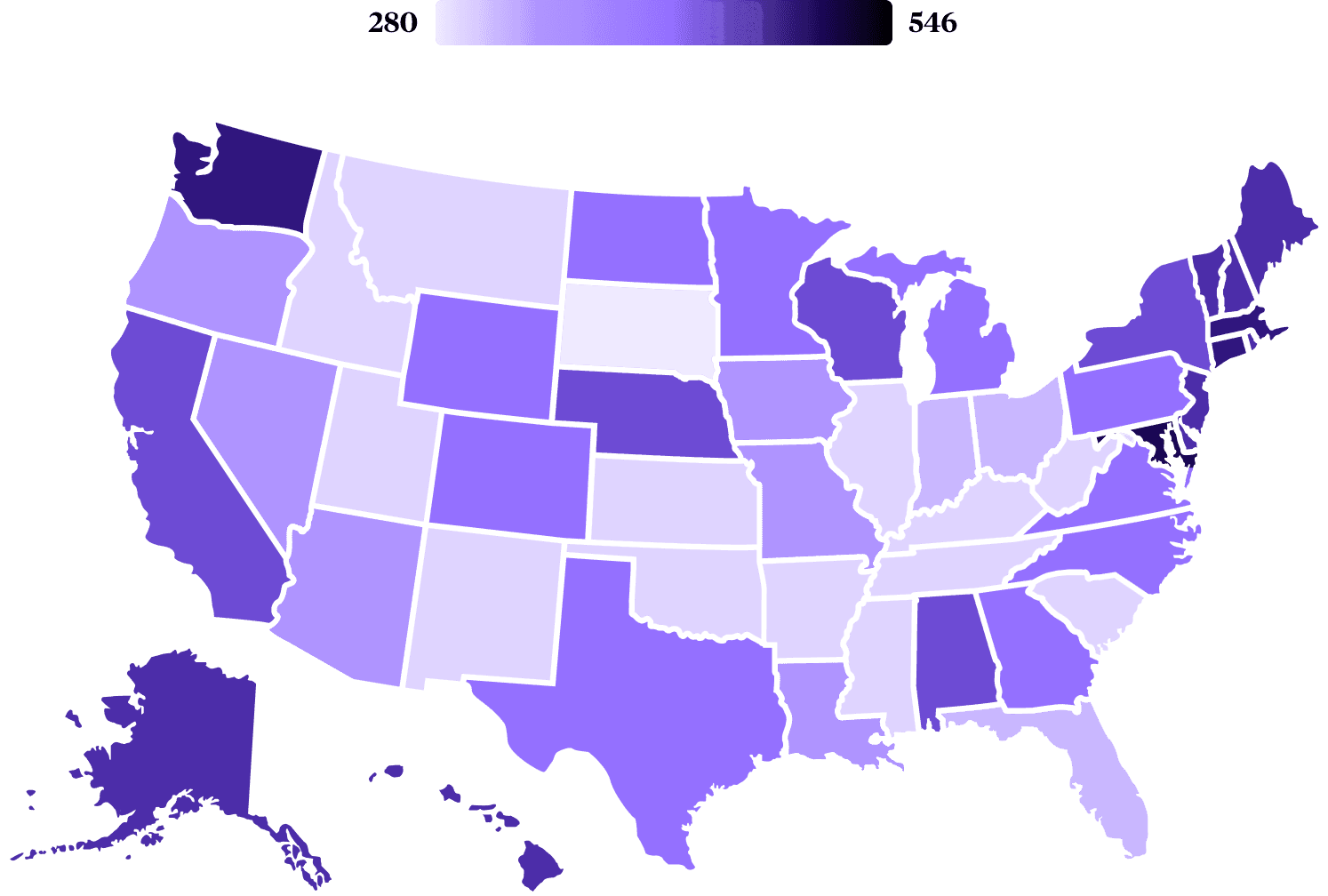

Understanding monthly utility costs requires looking at both national averages and regional variations. Doxo's 2025 report cited the national average monthly utility cost as $489, but this number masks significant regional differences.

The average utility bill varies from as low as $370 per month in some states to over $650 in others. These differences reflect changes in climate, population density, infrastructure age, and state-level energy policies.

How Much Are Utilities Per Month? Breaking Down the Numbers by State

Average Monthly and Annual Utility Costs by State

Monthly Average | |

|---|---|

| Alabama | $494 |

| Alaska | $445 |

| Arizona | $453 |

| Arkansas | $469 |

| California | $449 |

| Colorado | $447 |

| Connecticut | $538 |

| Delaware | $498 |

| Florida | $465 |

| Georgia | $507 |

| Hawaii | $614 |

| Idaho | $431 |

| Illinois | $489 |

| Indiana | $468 |

| Iowa | $463 |

| Kansas | $479 |

| Kentucky | $482 |

| Louisiana | $509 |

| Maine | $463 |

| Maryland | $523 |

| Massachusetts | $553 |

| Michigan | $489 |

| Minnesota | $491 |

| Mississippi | $487 |

| Missouri | $471 |

| Montana | $431 |

| Nebraska | $462 |

| Nevada | $424 |

| New Hampshire | $513 |

| New Jersey | $544 |

| New Mexico | $420 |

| New York | $525 |

| North Carolina | $480 |

| North Dakota | $468 |

| Ohio | $484 |

| Oklahoma | $462 |

| Oregon | $437 |

| Pennsylvania | $507 |

| Rhode Island | $524 |

| South Carolina | $493 |

| South Dakota | $456 |

| Tennessee | $485 |

| Texas | $502 |

| Utah | $434 |

| Vermont | $473 |

| Virginia | $501 |

| Washington | $449 |

| West Virginia | $483 |

| Wisconsin | $481 |

| Wyoming | $427 |

Data source: Doxo 2025 Utilities Insights Report

How to Estimate Your Monthly Utility Costs

Whether you're moving to a new home or just trying to budget more accurately, estimating your utility costs shouldn’t be guesswork. Here's how to get a realistic picture:

- Request historical utility data from the current homeowner or landlord. Most sellers are required to disclose this information, and it provides the most accurate baseline for your future costs.

- Contact local utility providers directly. Many companies can provide average costs for homes of similar size and type in your area based on their customer data.

- Use online utility calculators. Several websites offer tools that estimate costs based on your home's square footage, number of occupants, and location.

- Review your current bills if you're staying local. If you're moving within the same area, your current utility usage provides a helpful reference point — though you'll need to adjust for differences in home size and efficiency.

- Consider your lifestyle. Do you work from home, which requires more daytime energy use? Do you prefer warmer or cooler indoor temperatures? These personal preferences can significantly impact your actual costs.

- Remember that your state’s average utility price provides a helpful benchmark, but your individual circumstances will create your unique cost profile.

Comparing Your Utility Bills to Local Averages

Once you understand your own utility costs, comparing them to local averages can help you identify potential problems or opportunities for savings. Here are some tips and tricks:

- Gather 12 months of utility bills to account for seasonal variations, since a single month's bill doesn't tell the whole story.

- Calculate your monthly and annual totals for each utility type, as well as the combined figure. This gives you clear numbers to compare against benchmarks.

- Research local averages through your utility provider's website, which often publishes neighborhood comparison data. You can also reference the state averages in this article as a starting point.

- Adjust for home size by calculating your cost per square foot. Divide your total utility costs by your home's square footage to create a more apples-to-apples comparison with differently sized homes.

- Consider your home type and age. If you're in an older single-family home, you should expect higher costs than someone in a new townhome, even if you’re in the same neighborhood.

- Factor in household size. More occupants typically mean higher water usage and more energy consumption for appliances and electronics.

If your utility costs are 20% or more above local averages after accounting for these factors, it's worth finding out why — and taking action.

What to Do When Your Utility Costs Are Higher Than Average

If you discover that your average utility bill is higher than local norms, don’t panic. This can be an opportunity to take control and reduce your expenses. Here are some proven strategies to lower utility costs:

- Schedule a home energy audit. Many utility companies offer free or low-cost audits that identify specific areas where your home is wasting energy. Professional auditors use specialized equipment to detect air leaks, insufficient insulation, and inefficient appliances.

- Prioritize improvements that make the biggest impact. Sealing air leaks, adding insulation, and upgrading to a programmable or smart thermostat often provide the fastest return on investment.

- Replace inefficient appliances strategically. When buying new appliances, choose Energy Star certified models. While the upfront cost is higher, the long-term savings on your utility bills often justify the investment.

- Adjust your usage habits. Simple changes like washing clothes in cold water, adjusting your thermostat by a few degrees, taking shorter showers, and unplugging devices not in use can reduce costs by 10-15% without any investment.

- Explore alternative rate structures. Some utility companies offer time-of-use rates that charge less for electricity used during off-peak hours. If you can adjust some consumption to these periods, you could save money.

- Consider renewable energy options. Solar panels require significant upfront investment, but can dramatically reduce or eliminate electricity costs over time. Many states offer incentives, tax credits, and financing options that make them a feasible choice.

- Look into utility assistance programs. Many states and utility companies offer programs to help homeowners — especially seniors and those on fixed incomes — reduce their utility burden.

- Investigate water-saving fixtures. Low-flow showerheads, faucet aerators, and high-efficiency toilets can significantly reduce water and sewer costs with minimal impact on your daily comfort.

Reducing your utility costs isn't just about saving money; it’s also about decreasing your environmental footprint and increasing your home's value when it comes time to sell.

Understanding the True Cost of Homeownership

Utilities only represent one piece of the homeownership expense puzzle. Between your mortgage payments, property taxes, insurance, maintenance, utilities, and unexpected repairs, the true cost of homeownership often exceeds what many people budget for.

That's why having a comprehensive understanding of your all-in homeownership costs is essential for long-term financial stability. Hometap's Cost of Homeownership Assessment is a valuable tool that helps you see the complete picture of how much you're actually spending on home maintenance.

Frequently Asked Questions About Utility Costs

How much are utilities per month for a typical American household?

The average American household pays $489 per month for utilities, or $5,868 annually. However, this varies significantly by state, home size, and individual usage.

What is the average price of utilities for different home sizes?

Smaller homes (under 1,500 square feet) typically pay $350-450 per month, medium homes (1,500-2,500 square feet) average $450-550 per month, and larger homes (over 2,500 square feet) often pay $550-750 per month or more, depending on location and efficiency.

Which state has the highest average utility bill?

Hawaii has the highest average utility costs at $614 per month, followed by Massachusetts at $553 and New Jersey at $544.

Which state has the lowest average utility bill?

New Mexico has the lowest average utility costs at $420 per month, followed closely by Nevada at $424 and Wyoming at $427.

Do houses have higher utility costs than apartments?

Single-family homes typically have significantly higher utility costs than apartments due to larger square footage, more exterior walls, and independent HVAC systems. Apartments benefit from shared walls and centralized systems.

How can I reduce my utility bills?

The most effective strategies for lowering your utility costs include conducting a home energy audit, improving insulation and air sealing, upgrading to energy-efficient appliances, adjusting usage habits, and installing a programmable thermostat.

Are utilities included in my mortgage payment?

No, utilities are separate monthly expenses you pay directly to service providers. Typically, your mortgage payment only includes principal, interest, property taxes, and homeowners insurance (PITI).

How much do utilities increase in summer and winter?

Seasonal increases vary by climate and home efficiency, but during peak cooling (summer) or heating (winter) months, many homeowners see utility bill increases as high as 30-50% from the milder spring or fall months.

Should I choose a fixed-rate or variable-rate utility plan?

Fixed-rate plans provide budget certainty, but may cost more during periods of low market rates. Variable-rate plans fluctuate with market conditions, but can save you money when rates are low. When making this decision, consider your risk tolerance and budgeting preferences.

How often should I shop around for better utility rates?

In deregulated energy markets, it's smart to compare rates annually (or whenever your contract term ends). For regulated utilities with fixed providers, it can make more sense to focus on improving efficiency and optimizing usage instead.

Understanding how much utilities are per month is a fundamental part of successful homeownership budgeting. While the average utility bill can provide a helpful benchmark, your actual costs depend on a unique combination of your home characteristics, location, and lifestyle. By comparing your expenses to local averages, identifying opportunities for improvement, and understanding the full picture of homeownership costs, you can take control and build a more secure financial future.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

Related Tags:

Efficiency upgradesMore in “Home financing 101”

Home Affordability Made Simple: The 28/36 Rule Explained

How Much Is Your House Worth? Picking a Home Value Estimator