I think Hometap is a great resource for homeowners that are looking to pay off some debt, build their credit up, build their business, or build a real estate portfolio like myself.

How Real Estate Investor Nana Used One Rental Property to Bankroll the Next

Nana knew early on that owning real estate was something that interested him. His parents had moved from Ghana to Massachusetts, and made a home for their family in an apartment in Worcester. As a kid, he would watch in admiration as the landlord of their apartment came and went in his Mercedes-Benz.

So years later, when a real estate agent handed him a book about being a landlord and pointed him in the direction of a multi-family building for rent, Nana jumped at the opportunity, and followed the same route that so many first-time investors do. He lived in one of the units while fixing up and renting out the others until he had the funds he needed to purchase a second property for himself.

By his mid-twenties, Nana owned multiple properties around Worcester, and had the skills to make many home repairs and renovations himself.

When opportunity knocked to split the next rental property with his brother, Nana was all in — but so was his cash flow.

“We paid [for] the property [in] cash, so we were a little bit out of funds,” said Nana, who knew the rental unit needed renovations before they could find tenants. “[My brother] was able to come up with his half, so I said to myself, how do I come up with my half?”

Some of his other rental properties had equity, so he began searching for financing solutions and lines of credit to access it. Each of his options included funding timelines that would delay his renovation plans, and required a cumbersome amount of paperwork.

So when he found Hometap and read that he could receive his equity in cash in about three weeks after applying online, he was interested, but also skeptical.

“No way is this real,” he recalled thinking. “No one’s going to give you funding without looking for your paycheck; without asking for all these documents.”

Nana went ahead and requested an Estimate anyway, deciding he had nothing to lose. Within minutes, an Investment Manager at Hometap called and walked him through the Investment and funding processes.

A Hometap Investment was checking boxes that the other financing options he looked at hadn’t. No interest, no monthly payments, and funding that would allow him to start on his renovations almost immediately.

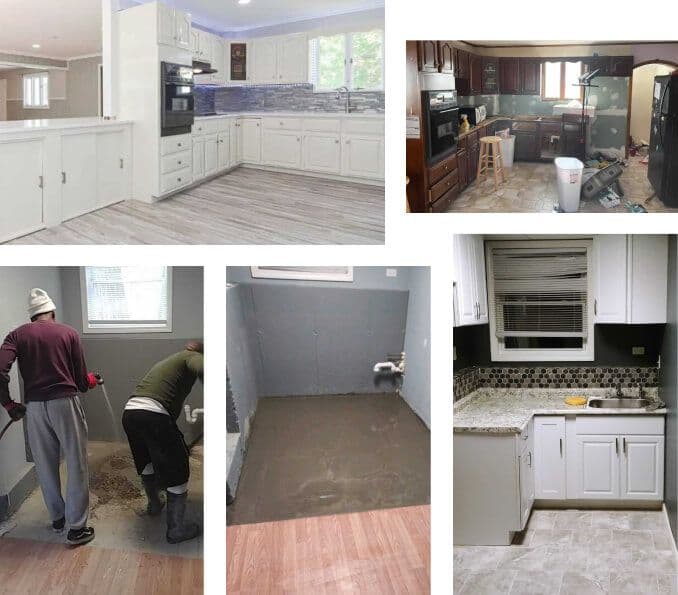

“It was a great experience working with Hometap, from the first call all the way through to me receiving the funds,” said Nana, who had his cash in-hand about three weeks after accepting an offer. He and his brother got right to work with the renovations, and tenants moved in soon after.

“I think Hometap is a great resource for homeowners that are looking to pay off some debt, build their credit up, build their business, or build a real estate portfolio like myself.”

Nana was so impressed with his experience, that when the opportunity arose to join the team of Investment Managers at Hometap, he took it. Surprised by how many of his peers had, like him, never heard of home equity investing, he looked at the role as an opportunity to educate other investors — and homeowners — about the unique solution Hometap provides. Now, as an Investment Manager, he’s able to speak to the ease of use and seamless funding process from the unique perspective of a homeowner that’s experienced every step of an investment firsthand.

Find out if Hometap can help you fund your next investment property. Get an estimate in less than two minutes.

Learn about our Ambassador Program

Find out about the benefits of being a Hometap ambassador — from the positive impact on other homeowners and industry leaders to the financial rewards.

Learn more