I Missed a Mortgage Payment — What Now?

Last updated September 12, 2025

Life happens. Jobs come and go. Unexpected bills show up in our mailbox. And suddenly, despite our best intentions, we find ourselves falling behind on our mortgage payments.

In most situations, there is a light at the end of the tunnel. Below, we'll cover the steps you can take today to get back in the good graces of your lender.

- Check Your Lender’s Grace Period

- See If You Can Apply for a Deferral

- Have a Heart-to-Heart with Your Lender

- Access Your Home Equity

- Frequently-Asked Questions

1. Check Your Lender’s Grace Period

Most lenders offer their borrowers a grace period to pay your mortgage. This is a buffer between when the billing cycle ends and when the payment is due. These terms vary by lender, but the typical grace period for mortgages is 15 days. If your mortgage is due on the first, you actually have until the 16th to pay your bill.

As long as you submit your payment before the end of the grace period, you normally don’t have to worry about late fees or a negative mark on your credit score.

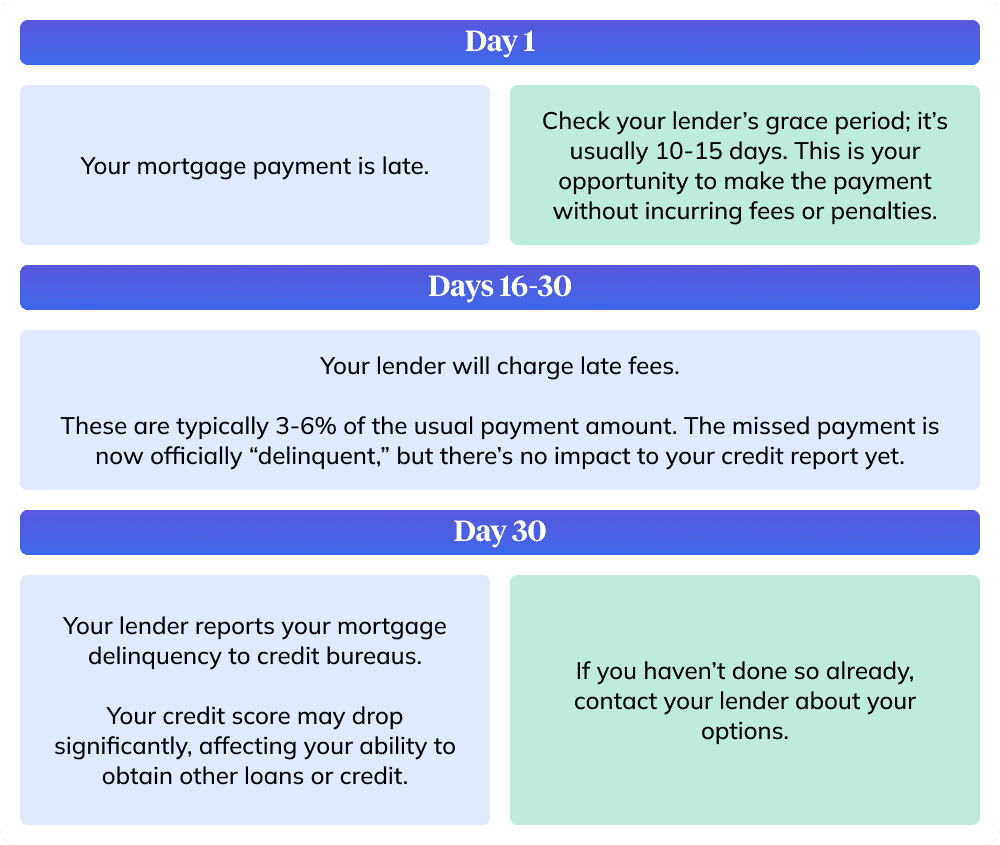

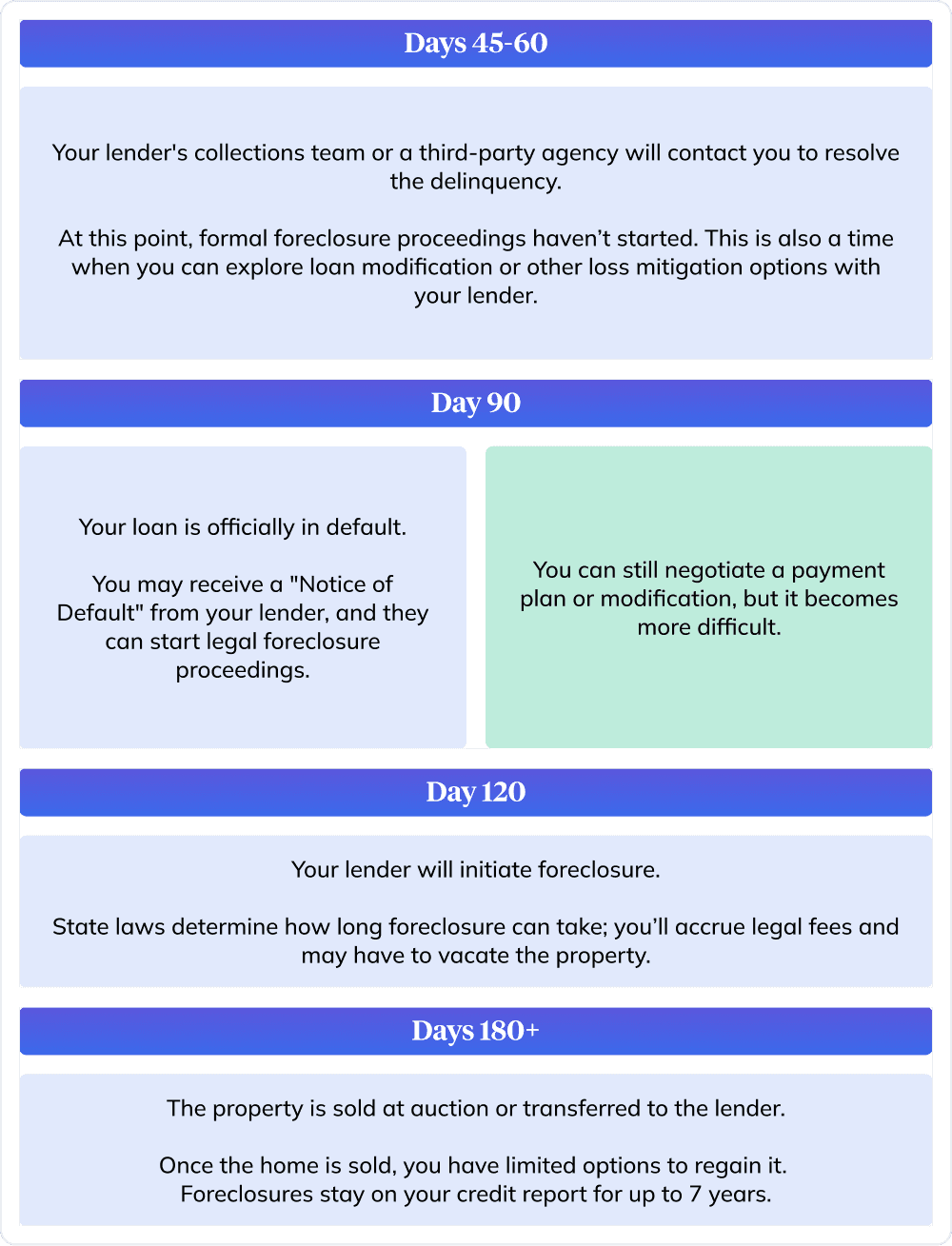

Below is a typical timeline of proceedings after a mortgage payment is missed:

2. See If You Can Apply for a Deferral

If you can prove to your mortgage lender that you’re experiencing a temporary financial hardship, you may be able to apply for a deferral. A deferral allows you to take a month (maybe two) off from paying your bills. You are still responsible for the money that’s due, but you get a little breathing room between payments.

This is best for homeowners who are experiencing a temporary setback. For example, you got hit with some unexpected medical bills or you’ve just started a new job after a period of unemployment.

But heads up: You can only defer mortgage payments on your primary residence. This program is not available for investment properties or vacation homes.

3. Have a Heart-to-Heart With Your Lender

Many banks and lending organizations offer borrowers the option to change the original terms of the mortgage via a process called loan modification.

This option is typically only available to homeowners who are experiencing significant financial hardships. Rather than defaulting or foreclosing on your home, the lender will work with you to reduce your monthly payments.

There are a number of loan modification options you can talk with your lender about, including:

- Principal reduction: Decreases the outstanding balance owed on your home. From the lender’s point of view, this is often less of a loss than going through the process of a foreclosure.

- Refinance: Replaces your current mortgage with one offering a lower interest rate. This is also a good option for homeowners who want to switch from a variable interest rate loan to one with a fixed rate — if you have good credit.

- Extend the term of your current mortgage: Gives you an extra 10 years to pay off your mortgage, increasing the overall amount of interest you pay, but it will also lower your monthly payments.

- Forbearance agreement: Like a deferral but on overdrive. You may be able to postpone your mortgage payments by up to a year. This option is generally only available to people experiencing a significant — but temporary — hardship. Say your home was damaged by a natural disaster or you can’t work for several months because of an injury or illness.

When it’s time for the conversation with your lender, come prepared. Depending on the loan modification program, you will likely have to demonstrate proof of your current financial hardship. This can include pay stubs, medical bills, and other documents. You may also have to fill out tax forms and agree to a trial period to prove you can afford the new, modified payment. Below is a sample letter you can use as inspiration when directly contacting your lender to let them know about your situation.

Dear [Lender’s Name],

I’m writing to inform you that I’m currently experiencing financial difficulties, which is impacting my ability to make timely mortgage payments.

As I want to ensure that I’m proactive about resolving this situation, I’m reaching out to inquire about the options available to me. Could you please provide information about payment deferral or forbearance programs, loan modification options, repayment plans, or any other assistance programs you may offer?

I am committed to working together to find a solution and would appreciate your guidance on the next steps. Please let me know if any additional documentation or information is required from me to explore my options.

Thank you for your understanding and assistance.

[Your Full Name][Your Address][Your Loan Account Number][Your Phone Number]

4. Access Your Home Equity

If you don’t want to change the terms of your current loan or your financial future is murky and you worry you may not be able to keep up with your payments (on top of other expenses), you still have options to gain control of your debt — and your life.

Unlike a traditional loan, a home equity investment from Hometap comes with no monthly payments, allowing you to pay down your debt without the extra stress. Instead, Hometap allows homeowners to tap into the cash they need today in exchange for a share of the future value of their homes.

In fact, more than 50% of all Hometap Investments go to homeowners looking to consolidate or pay down financial burdens.

Frequently-Asked Questions

Can you skip a mortgage payment?

If you can avoid it, you shouldn’t skip a mortgage payment. While it may be fairly easy to get back on track after one missed payment, it can also be just as easy to fall even further behind. As we mentioned above, there’s typically a grace period for a late payment that varies by lender — so if at all possible, you should try to make your payment by the end of that window if you missed the original deadline.

What should I do if I’m three payments behind on my mortgage?

Whether you’re one or three mortgage payments behind, you should work to find a way to repay the outstanding balance as soon as you can. If this isn’t feasible or you foresee continued financial hardship, consider approaching your lender to discuss potential options, such as mortgage deferment.

What is a deferred mortgage payment?

A deferred mortgage payment is an arrangement with your lender that allows you to move your past-due payments to the end of your mortgage loan term. This allows you to navigate a period of financial hardship and catch up on overdue payments, and differs from mortgage forbearance in that it’s not a temporary pause or reduction in your payments.

Can I get a HELOC with deferred mortgage payments?

No, it’s unlikely you’d be able to secure a HELOC if you’ve deferred your mortgage payments. This is due to multiple factors, but most lenders will be hesitant to take a risk by providing you with funding if you’re already struggling financially. If you have deferred mortgage payments, it might make sense to stabilize your financial situation and catch up on your payments before revisiting options like a HELOC.

What if I can’t afford my mortgage payment?

If you can’t afford your mortgage payment, you have several options. In cases of temporary financial hardship, you might be eligible for mortgage deferment (which we’ve discussed) or forbearance, which pauses your mortgage payments for up to a year.

In cases where you foresee a longer-term issue, you might consider refinancing in order to secure a new mortgage with a lower monthly payment. You can also discuss the possibility of a mortgage modification with your lender — with this solution, your lender permanently adjusts your loan terms to make your payments more affordable, but note that it usually involves extending your term and increased interest as a result. However, it can help you avoid foreclosure in the interim.

Finally, selling your home might make the most financial sense if you owe less than it’s worth. Alternatively, if you can find temporary accommodations with family or friends, you could consider renting your home out for a period of time in order to retain ownership while bringing in more money.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.