You’ve Inherited a House — Now What?

If you’ve inherited a house, you probably have a lot of questions. There’s a high likelihood it’s your first time dealing with this kind of situation and it can be tough to know exactly what to do. And if the home belonged to a parent or close relative who recently passed away, emotions can run especially high, so it’s typically a good idea to consult an objective, third–party financial advisor who can help you decide on a sensible course of action before you make a final decision.

So, what happens when a house is willed to you?

Ultimately, you have three options:

- Sell the home

- Rent the home out to tenants

- Move into it yourself

The best way to determine which of these options is for you is to weigh all the pros and cons of each, really thinking through what makes the most sense for you personally. Of course, if there are other family members involved (which we’ll discuss below), you’ll need to take their wishes into account as well, but the last thing you want is to be stuck paying for or managing a home you don’t want to live in. Or conversely, having sold a home you had emotional ties to and weren’t quite ready to part with. Here, we’ll cover the most common choices and how to navigate your path forward with the house you’ve inherited.

Handle Any Necessary Housekeeping and Paperwork

Regardless of whether you decide to sell the home, rent it out to tenants, or move into it yourself, there are a handful of items you should make sure you take care of first:

- Update the homeowners insurance policy on the inherited home — in many cases, it may need to be rewritten

- Cancel any unnecessary utilities for the home and take care of any outstanding bills

- Pay the property taxes and any delinquent mortgage payments

- Pay for upkeep of the property if necessary

You’ll also want to handle the disposal or distribution of any belongings that remain in the home. If there are sibling inheritors, experts advise that you all meet at the home and take turns choosing the items you want — once you do that, you can open up remaining items to grandchildren or other relatives, and if there are any items left, you can donate them to charity or hold an estate sale. While this step may seem frivolous, it’s important to take care of quickly, as it can be time consuming and hold up the process of selling or renting out the home if all of the belongings are still there. The faster you deal with this, the faster you can move forward.

Educate Yourself on the Tax Implications of Inheriting a House

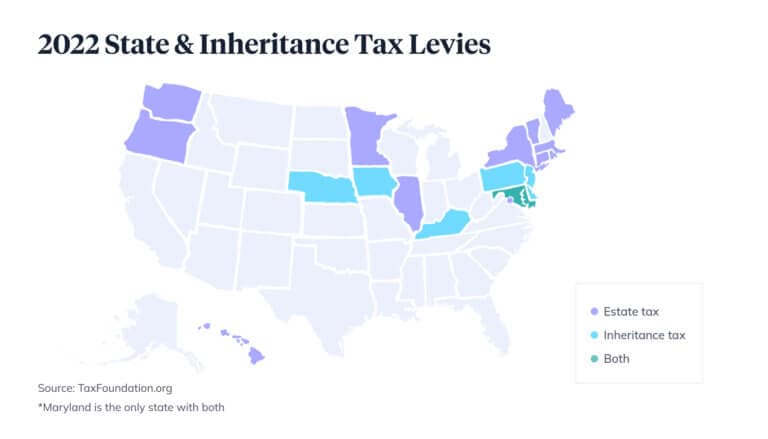

It’s important to note that typically, inheriting a home doesn’t automatically mean that you’ll have to deal with tax obligations, but, the specifics largely depend on the state you’re in. For example, there is no federal inheritance tax on a house one is willed, but Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania all have state inheritance taxes.

There are also potential estate taxes to be aware of. As of 2022, a federal estate tax applies if the estate’s combined gross assets and prior taxable gifts exceed $12.06 million for individuals, ($24.12 million for married couples) and 12 U.S. states are subject to these taxes as well: Connecticut, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington, as well as Washington, D.C. Tax obligations can make or break your decision to sell, rent out, or move into the home, so it’s critical that you determine what you might owe before figuring out your next move.

2022 Estate Tax by State

Connecticut: 10.8-12% on estates above $7.1 million

District of Columbia: 11.2-16% on estates above $4 million

Hawaii: 10-20% on estates above $5.5 million

Illinois: 0.8-16% on estates above $4 million

Maine: 8-12% on estates above $5.8 million

Maryland: 0.8-16% on estates above $5 million

Massachusetts: 0.8-16% percent on estates above $1 million

Minnesota: 13-16% percent on estates above $3 million

New York: 3.06-16% for estates above $5.9 million

Oregon: 10-16% on estates above $1 million

Rhode Island: 0.8-16% on estates above $1.6 million

Vermont: 16% on estates above $5 million

Washington: 10-20% on estates above $2.2 million

2022 Inheritance Tax by State

Iowa: Inheritance tax of up to 15%

Kentucky: Inheritance tax of up to 16%

Maryland: inheritance tax of up to 10%

Nebraska: Inheritance tax of up to 18%

New Jersey: Inheritance tax of up to 16%

Pennsylvania: Inheritance tax of up to 15%

Options for Handling the House You’ve Inherited

Option 1: Sell the Home

The biggest and most obvious advantage of selling an inherited house is that if you either can’t afford or don’t want to handle the upkeep and mortgage of the house, it’s an easy way to relinquish control. This option also provides you with fairly quick cash, so long as the home’s value exceeds the mortgage once you make any required repairs. Relatedly, before you put the home on the market, it will be to your benefit to get a home inspection to identify any major issues that need to be addressed, like a roof or water heater replacement, so you don’t run into unexpected problems and delays during the sale process.

If you find you’ll need to make renovations or repairs that are too costly to pay out of pocket, you’ll want to consider your financing options. Renovation loans, home equity loans, cash-out-refinances, or home equity lines of credit (HELOCs) can potentially get the funding you need to make renovations, but they could delay your timeline for getting the house on the market.

A home equity investment on the inherited home or your primary home could give you access to as much as 30% of the equity in the home in as little as three weeks.1

While you may face a tax for capital gains on the inherited house when you sell, the amount won’t be based on the house’s original price, as its fair market value resets when the owner dies. With inherited property, the IRS employs what’s known as a “step-up cost basis” that starts with the cost of the home when you inherit it, so you’ll only be on the hook if the home sells for more than the value of the home when you became the heir.

If you inherit a house with a mortgage that is underwater — which means that the balance is greater than the home’s value — and you want to avoid foreclosure, you may be able to arrange a short sale through a bank that allows you to accept less for the home than the outstanding loan amount.

Option 2: Rent the Home Out to Tenants

You can retain ownership of the home and use it as a rental property, which can be a good source of passive income and tax benefits. Not to mention, if you don’t want to immediately leave your current home but also aren’t quite ready to permanently part with the home you inherited by selling it, this may be a reasonable temporary compromise as you figure out what solution makes the most sense for you.

However, you should make sure that you’re prepared for the responsibilities that come along with being a landlord, including making repairs and handling tenants’ needs. Here are some tips to help you understand some of the ins and outs of being a landlord.

If you go this route, there is also the possibility that the home may need renovations before you’re able to rent it out — so, just like if you’re making improvements before selling, it can be helpful to research funding choices to find the best fit for your financial situation.

Option 3: Move into the Home

Lastly, you have the option to move into the house yourself. If the house is in your family and you have fond memories associated with it, or you’re currently renting and ready to become a homeowner, it might be a no-brainer to go this route.

And if you’re inheriting a house that is paid off, you won’t have to worry about making any additional monthly payments, which can be a relief — especially if you came into the inheritance unexpectedly.

Keeping the house might mean you’re eligible for a capital gains exclusion of up to $250,000 from your income as a single filer or up to $500,000 if you file a joint return with your spouse, provided that you meet two conditions:

- The home is used as your primary residence for at least two out of five years.

- In the two years preceding the sale of the home, you haven’t used the capital gains exclusion on another property.

However, if there is still an outstanding mortgage balance on the home, you’ll want to run some numbers to determine whether it makes sense to take on that financial burden. In many cases, as mentioned above, the balance on the mortgage may exceed the home’s value, the costs of maintenance and taxes may be unaffordable for you, or principal and interest (P&I) might simply be too much to handle. While it may seem like the easiest decision, you want to make sure you’re not getting in over your head before taking ownership of the property.

Let’s recap; If you’ve recently inherited a home, here are the first things you’ll want to check off of your list:

If You’re Not the Only Heir….

There are some situations in which you may not be the sole heir to inherit the home, and it is actually pretty common for families with multiple children to have the siblings jointly inherit the property. In certain cases, it might be fairly easy to come to a mutual agreement on whether to sell or rent out the home, but different personalities and different priorities can clash when it comes to determining the best path to take.

You might have the option to buy out the other heirs by paying them cash for their share and having them sign the deed over to you, but it’s important to note that this may mean a larger mortgage payment for you to deal with as a result. You also may need to pay closing costs on the home as well as an appraisal to determine the home’s value.

If you’ve recently inherited a home or expect to in the future, consider using the equity you’ve built up in your primary property to get cash for repairs or renovations, or even to help handle outstanding debts on the home.

Tap into your equity with no monthly payments. See if you prequalify for a Hometap investment in less than 30 seconds.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.