How Much Can You Save with an Improved Credit Score?

How much could you save on your mortgage with an improved credit score? A lot, it turns out.

According to BankRate, your credit score is one of the top factors that lenders consider when setting your interest rate. A solid score indicates to lenders that you present less of a financial risk and they reward that track record with generous loan terms. Credit.com reveals that loan officers also compare credit score and the loan-to-value ratio to determine interest rate adjustments.

It’s no secret that the closer your score is to 850, the odds of home loan approval go up and interest rates go down. But just how much of a score increase do you really need to see a significant difference?

Small Changes, Big Difference

On the vast scale of 850, a handful of points here or there may not seem like much. As such, most of us are focused on those big, hundred-point jumps that get us out of the garden-level apartment (500) and into the higher-rent districts (600, 700) or even the penthouse (850).

But it’s crucial to remember that the lending industry measures in 20-point increments and adjusts rates accordingly. This means a drop from 780 to 760 will likely result in higher costs that grow even higher for every level you go down. This system, as NerdWallet explains, is known as loan-level pricing. As 20, 40, 60 points start to rack up, you’ll find yourself talking about real money very quickly.

If your score drops by 100 points or more, the landscape can change completely. This is particularly true over the long view of 30 years when you may end up owing tens of thousands more in loan payments.

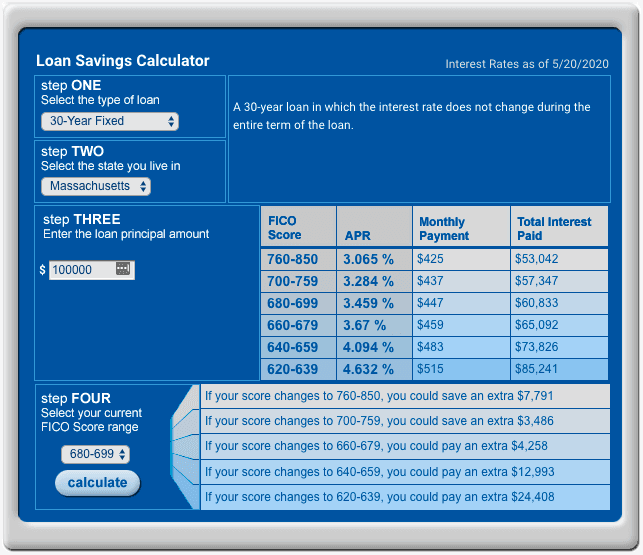

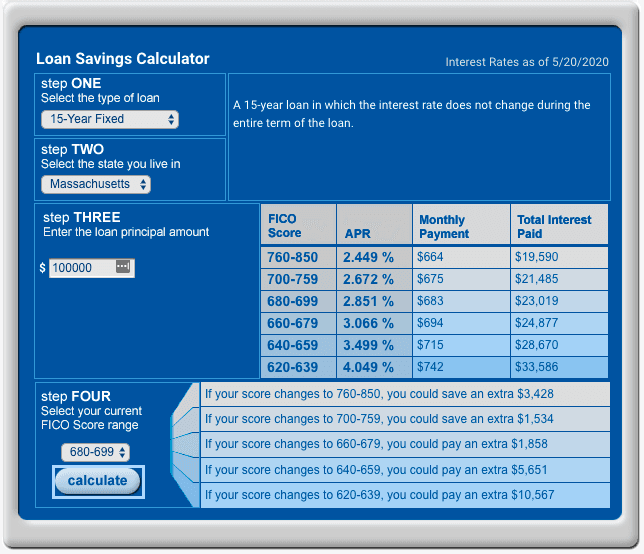

The following MyFico Calculator Results demonstrate how stark these differences can be:

In short, your credit score is money. The better it is, the more you’ll have. It, therefore, pays off in the long run to be vigilant—handle debt responsibly, don’t spend beyond your means, and do your best to pay all bills on time and in full.

Whether you need a loan to consolidate debt or pay down bills, Hometap can be a smart option for homeowners looking to cash in on their equity without monthly payments.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.