What Is the Difference Between Disposable and Discretionary Income?

Disposable income is defined as the amount of money an individual or household has to spend or save after income taxes have been deducted. It’s often used interchangeably with the term “discretionary income,” but the two are quite different. Disposable income is net income, whereas discretionary income is the money that remains after all necessities (food, housing, etc.) have been addressed.

So, if you’re talking about the money you spend on vacations, electronics, or concert tickets, you’re referring to discretionary income, but the two generally go hand in hand: typically, the more disposable income you have, the more discretionary income you have as a result. From June to July of 2021, disposable personal income in the U.S. increased from $17,850 billion to $18,048 billion.

Payments and Priorities

While it’s certainly nice to have, there are many day-to-day expenses that can take precedence over discretionary income, like mortgage payments, car loans, and credit card debt, and these necessities can eat away at a huge chunk of one’s disposable income.

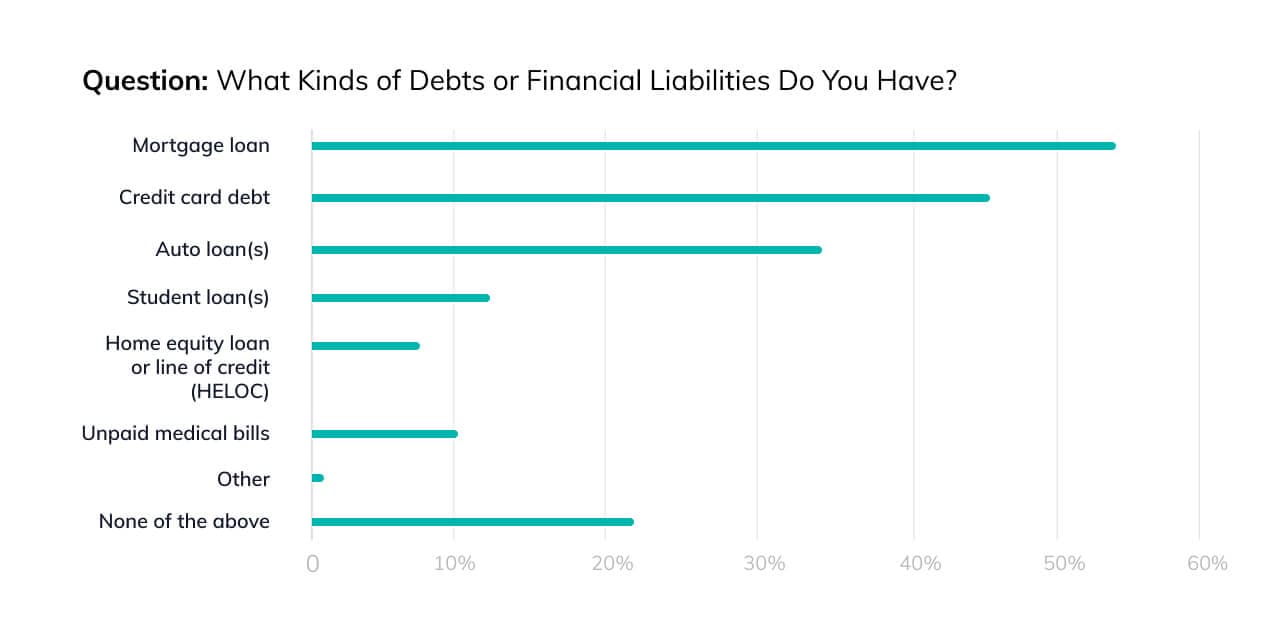

Hometap’s 2021 Homeowner Survey found that 53.9% of homeowners surveyed have mortgage debt, 45.4% have credit card debt, 33.9% have auto loan debt, and 13.7% have student loan debt.

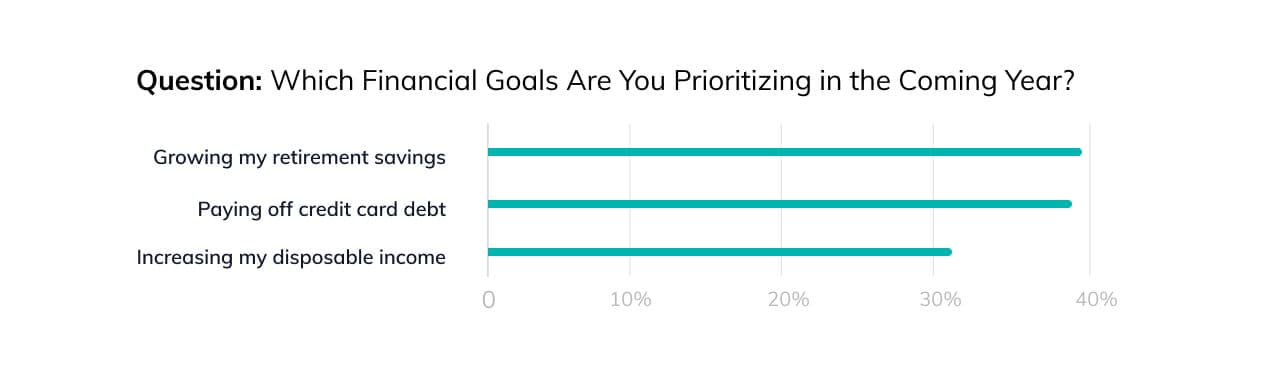

More than 32% of these homeowners have named increasing their disposable income as a financial priority in 2021, behind growing their retirement savings (39.6%) and paying off credit card debt (39%).

More Spending, Less Saving

Recent trends in spending look a bit different than those in previous years due to shutdowns and shifting priorities spurred by the COVID-19 pandemic. For example, a MassMutual survey of 1,000 U.S. adults in July of 2021 found that their spending increased an average of $765 per month compared to the summer of 2020, largely on discretionary expenses like dining out and taking trips. Along with this increase in spending came a predictable decrease in savings, with 48% of respondents saying that they saved less than $500 in the past three months.

And according to a recent Wallethub study, consumers spent less of their discretionary income in 2020 in favor of paying down credit card debt. However, in the second quarter of 2021, with spending increasing once again, consumers added $47.5 billion in credit card debt — a quarterly record that highlights the ongoing challenge to stay on top of life expenses.

How to Increase Disposable and Discretionary Income

If you’re hoping to increase your disposable income, there are a handful of options. The most obvious ones include working more hours if you have a wage-based position, seeking a job with higher pay, or even adding new streams of revenue through another part-time job or side hustle. If you can get a raise in your current job, this will help you make more money and avoid the stress and strain that comes with working multiple jobs and/or long hours, but be aware that if you enter a higher income bracket, you’ll also be subject to higher income taxes.

Investing is another avenue that can help you earn passive disposable income; this includes stocks, bonds, and real estate. However, if you’re looking to quickly increase your disposable income, this is probably not your best bet. Investing is a long game that may or may not see big returns, so you’ll need to be patient if you go this route.

Cutting costs where possible is also a great strategy to increase discretionary income: if you already have a budget where you keep track of expenses, it should be fairly simple to see where you can reduce spending. Of course, eliminating any outstanding sources of debt, like credit card debt or student loans is often a smart first step in making strides toward more financial freedom and discretionary income as well. If you want to get a better idea of how long it might take you to become debt free at your current rate, our Debt Calculator is a great place to start — just plug in your current balance, interest rate, and monthly payment amount, and we’ll do the rest.

If paying off debts sounds like it’s the best fit for your financial plan, your home equity could help you get there.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.