4 Steps to Personal Financial Planning (without an Advisor)

If some of your goals include being more self-sufficient and cutting out unnecessary costs, we’ve got good news for you: You don’t need to hire a financial advisor to create your own financial plan.

If you’ve been thinking about buying a second home, saving for retirement (before you turn 50), paying for college, or any other goal that involves a major investment, you’ll need a financial plan. While the concept of a financial plan may seem daunting at first, it doesn’t need to be complicated: Simply put, financial planning is the process of making a specific plan for your money that will help you reach your unique goals.

See how your financial goals compare with other homeowners around the U.S. Our 2021 Homeowner Report is out!

While you could reach out to a financial advisor, here’s a little secret: You may not necessarily need one. In fact, with a little research and a can-do attitude, you can create a financial plan without an advisor.

Here’s how to get started.

Financial Plan Step 1: Determine Your Financial Goals

First thing’s first: With any financial plan, you’ll want to determine your goals, prioritize them, and come up with a timeline for when you want to reach them. Think along the lines of:

“I want to buy a lake house in two years.”

“I’d like to retire at 65.”

“I want to pay for college when my kids are 18, so they don’t have to take out too many student loans.”

“I want to take a trip to Tanzania next summer.”

Your goals will be personal, specific to you, your situation, and your schedule. Your friends and family may have very different goals and plans, and that’s OK! Eliminate the idea of “shoulds” or “supposed to”— that’s not what a financial plan is about. You always want to remember that your financial plan is designed to build the life you want.

Once you have your key goals and potential timeline in mind, the next step is putting together a budget.

Financial Plan Step 2: Crunch the Numbers

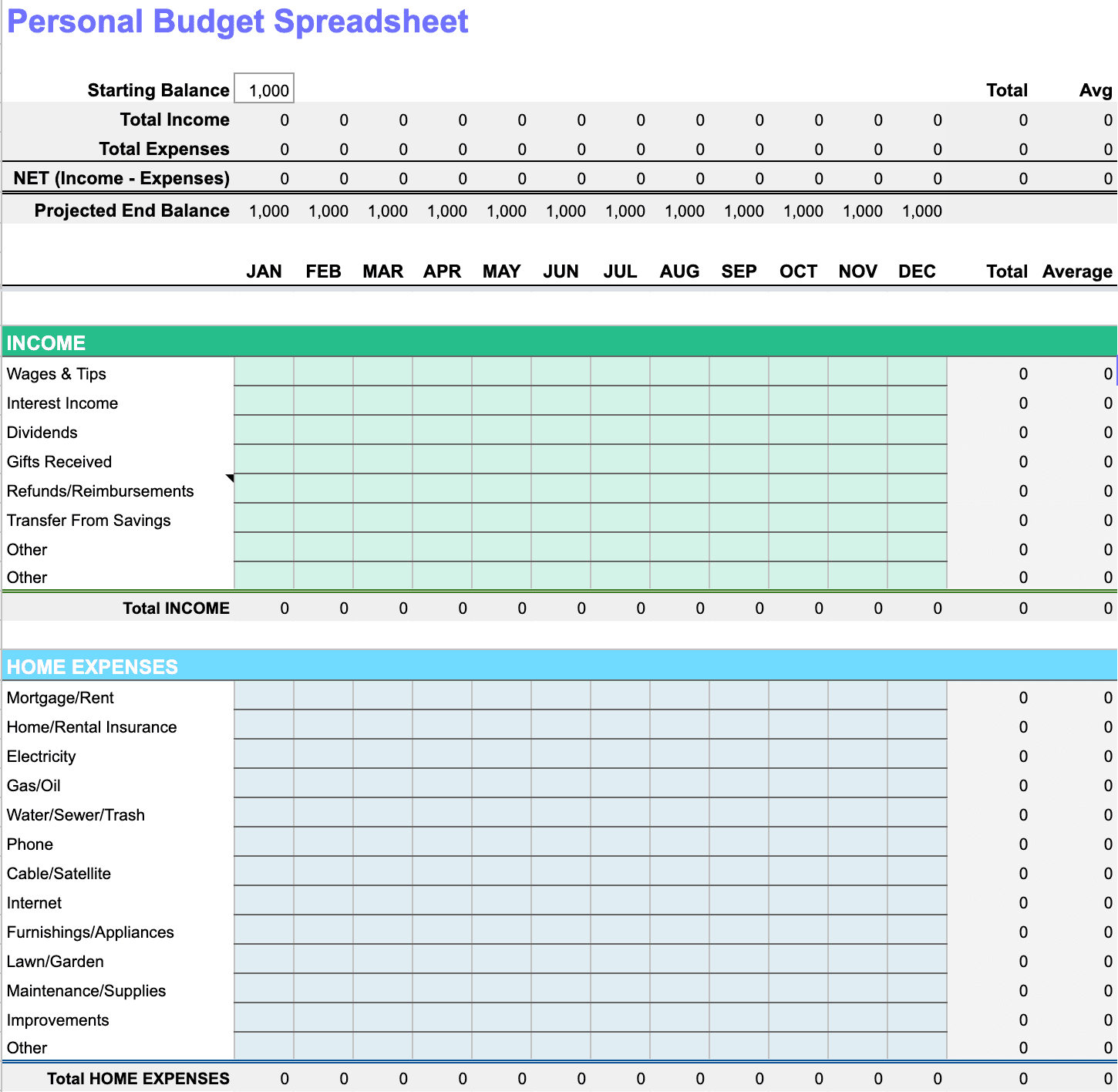

To get started with a budget for your financial plan, you’ll need to know what you’re working with each month. You can use a simple spreadsheet, online tools like Monarch or YouNeedaBudget (YNAB), or even just plain paper and pencil.

Regardless of how you budget, in every case you’ll be figuring out how much money you have coming in and how much you’re spending, looking specifically at all your monthly credits and debits.

Your monthly credits will tally up your monthly income, including anything you’re earning from a full-time or part-time job, a side hustle, or contract work. If your income varies, consider using a typical average for a given month, or even be a little conservative and put in the lower-end of what you could earn to give you some wiggle room. For debits, list out your typical bills and expenses each month. You can DIY your budget doc, using templates in Google Sheets or Excel, or you can find some free templates that work for you and modify them to meet your needs, like this one from Vertex42.com.

Compare the totals, looking at your monthly income against your monthly expenses. How much do you have left over to work with each month? With your budget, will you have enough to save or invest to achieve your goal, when you want to achieve it?

If the amount isn’t satisfactory to you, take a look at your discretionary spending first, such as cable, dining out, and other means of entertainment. Can you eliminate some of your expenses or embrace less-expensive options to free up more money?

It’s also worth shopping around some of your utility expenses every so often to get better rates on everything from rubbish disposal to cable and internet. (You may even negotiate better rates sticking with your current providers!)

If earning more sounds like a better option, could you negotiate for a raise with your employer or take on a side hustle? You may find that a combo of cutting back on expenses, while aiming to earn more at the same time, could make sense for you, your situation, and your goals.

Getting organized and being intentional can also go a long way. For example, you could designate specific credit cards for specific expenses, like one card just for utilities, one card just for entertainment, one just for emergencies. You could try a cash-only approach, to become more mindful of your spending habits. If you need extra motivation, you could recruit a finance 101 buddy, much like a gym buddy, to practice better financial habits along with you and keep you accountable.

Remember, you can always adjust your timeline, too. If you’ve crunched the numbers and discovered that it may be too much of a stretch to buy a house in the next two years, see if it’s more feasible in three to five. Being flexible and creative is all part of building your financial plan.

Financial Plan Step 3: Check In Regularly

Once you’re up and running with your budget, don’t just set it and forget it: It pays (literally) to check in regularly. A good rule of thumb is to check in once a month to make sure you’re on track and making progress toward your goals. Checking in monthly allows you to see if you’re hitting your milestones and make smart adjustments so you stay on track.Seeing little wins along the way, like becoming debt-free or seeing the extra income your side hustle brought in, can motivate you for the long haul.

Speaking of the long haul, financial plans are designed to be adaptable as people grow and change, so it’s also smart to plan a yearly “big picture” overview to see if your plan still makes sense for your situation. For example, over the past year, you may have gotten a raise, paid off a student loan, or bought a house. So, your financial plan may need a few tweaks to address your new circumstances and to address any new goals you’ve set for yourself.

Financial Plan Step 4: Tap Into Your Largest Asset

Of course, life is unpredictable, and with any long-term financial plan, there may be unexpected situations along the way. Medical bills, car trouble, home repairs, and the like can all derail even the most carefully crafted financial plan.

As a homeowner, don’t overlook one of your biggest advantages: home equity. Partnering with home equity investors like Hometap can give you a percentage of your home’s equity now in exchange for a share of the future value of your home. If you find your goals are just out of reach due to high-interest debt, or something unexpected throws off your financial plan, you can use a Hometap Investment to bulk up your savings and get your plan back on track.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.