How to Run a Health Check on Your Budget

Owning a home is a major milestone — and homeownership is likely your biggest monthly expense. But financial well-being is about much more than making timely mortgage payments. Just as you probably go in for a yearly physical, it’s smart to run a quick “homeownership budget check-up” to make sure the rest of your financial health is in good shape, too.

Guidelines from the U.S. Department of Housing and Urban Development (HUD) suggest that households spend no more than 30% of their gross income on housing costs. These include taxes, insurance, and utilities, but not other home-related expenses like regular maintenance, lawn care, or the technology that keeps your home running.

That leaves you with roughly 70% of your budget for everything else — from groceries and transportation to retirement savings and unexpected expenses. If your calculator results place you around or below that 30% mark, you may be in a solid spot. But how is the rest of your money working for you?

Here are five areas worth checking in on:

1. Emergency Savings: Your First Line of Defense

Financial experts often recommend keeping three to six months of essential expenses set aside in a liquid account such as a savings or money market account. Why? Because homeownership can come with surprises: a leaky roof, broken furnace, or even an unexpected job loss. These issues can cost anywhere between 15-40% of the median annual income. An emergency fund calculator (or even some quick napkin math) can help you convert this into a percentage.

The good news is that you don’t need to pull it all together immediately. Even setting aside a small amount each month can make a big difference in the long run. Automating contributions makes it easier to build this safety net without having to think about it.

2. Retirement Contributions: Planning Beyond Your Mortgage

A healthy budget doesn’t just cover your immediate expenses — it also invests in your future self. Many experts suggest aiming to save 10–15% of your income for retirement if you’re able.

If your employer offers a retirement plan, such as a 401(k), with a match, that’s essentially free money with every paycheck. And remember: it’s less about reaching your goal right away, and more about creating consistency. With compound interest, small contributions over many years can grow significantly.

3. Everyday Flexibility: Prioritizing Breathing Room

Once the essentials, emergency fund, and retirement contributions are covered, the next thing to check is whether your budget leaves room for any discretionary spending. Having flexibility matters — not only for things like vacations or hobbies, but also for peace of mind.

Red flags that your budget may be too tight include:

- Relying on credit cards for everyday purchases (especially if they aren’t paid off monthly)

- Skipping contributions to savings accounts

- Stressing over small, routine expenses

One simple step? Track your spending categories for a month to get a better sense of where your money is going. Many people are surprised to find small leaks — like unused subscriptions or frequent takeout orders — that can be redirected toward bigger goals.

4. Home Maintenance Costs: The Ongoing Investment

That's right, the house gets two categories, since the housing costs bucket doesn’t account for another very important ongoing expense: maintenance. A common rule of thumb is to budget 1–4% of your home’s value annually for maintenance and repairs — quite a wide range. For a $400,000 home, that’s anywhere from $4,000 to $16,000 a year. You can get a more specific figure by taking your home’s age, location, and condition into consideration. Newer homes can stay closer to the 1% range, while older homes or properties in harsher climates should aim for the 4% side of the scale. If you keep a documented budget, you can also look back at what you’ve spent in past years and use that as a guide.

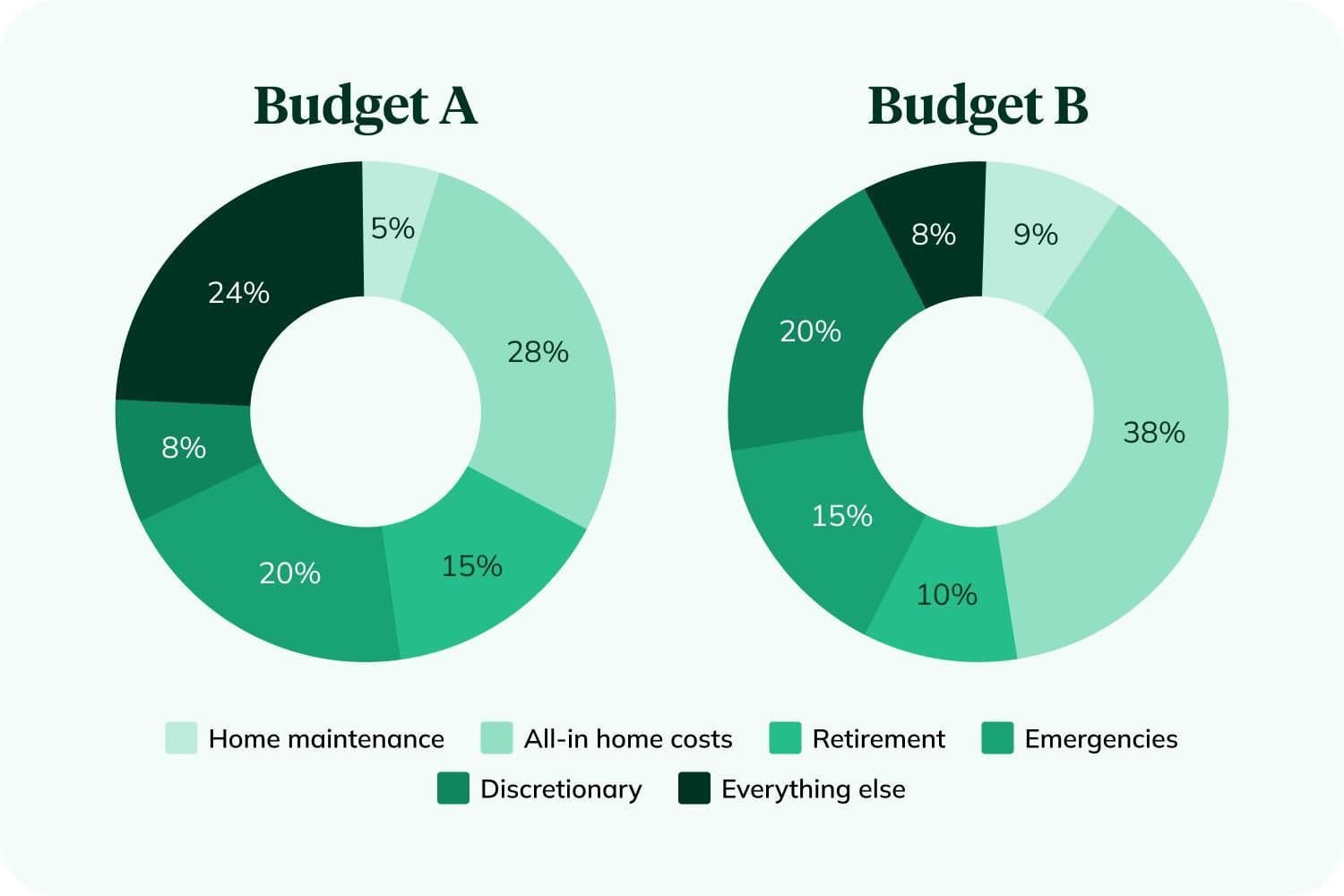

Notice that general ranges are provided for all of the guidance above. Every homeowner’s budget is different, as the right balance will depend on your priorities and personal circumstances. If you’re set on retiring early, maybe your retirement contributions exceed the standard range to make sure you stay on the fast track. If you live in an older home that you’re renovating room by room, you probably have a larger home repair budget than your neighbor in the new build. Here’s an example of just how drastically two budgets can differ while staying in the same suggested ranges:

5. Run Your Health Check

Now that you have your general guidelines in place, the next step is really up to you. You can use a calculator and a piece of paper, create a spreadsheet, or make a small investment in a budgeting app like Monarch or YNAB and start bucketing your costs into these categories to determine if and where you need to make some adjustments to reach your financial goals.

If you’re spending less than 30% of your income on housing, you’re off to a strong start, but the rest of your budget matters just as much. Checking in on your savings, retirement contributions, and spending flexibility can give you a more complete view of your financial health as a homeowner. But there’s one more important component to cover…

6. The Final Piece: Your Home’s Value & Equity

Your home isn’t just an expense — it’s also an asset. Tracking your estimated home value and equity, today and down the road, helps you see the bigger picture of your financial standing and security. As your mortgage balance goes down and your property value (hopefully) increases, your equity grows, too.

Equity can serve as a valuable future resource — whether for emergencies, renovations, or other long-term goals. It’s not money you should rely on for everyday expenses, but it’s an important piece of your financial puzzle.

Ready to see the full picture? Track your home value and equity anytime with your free Home Equity Dashboard.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.