Income Security a Top Concern for Cash-strapped Orlando Homeowners

Florida makes the top ten list for highest income-to-mortgage ratios at 15.53% with an average monthly mortgage payment of $936. Likewise, Orlando property values are below the national average, with a median home price of $156,117. Yet, with equity built up in their homes, Orlando homeowners still have little to no cash on hand for more immediate expenses. Nearly three-quarters (73 percent) of Orlando-area homeowners feel house rich and cash poor, and 24 percent of those respondents feel this way most or all of the time.

Why Is This Happening?

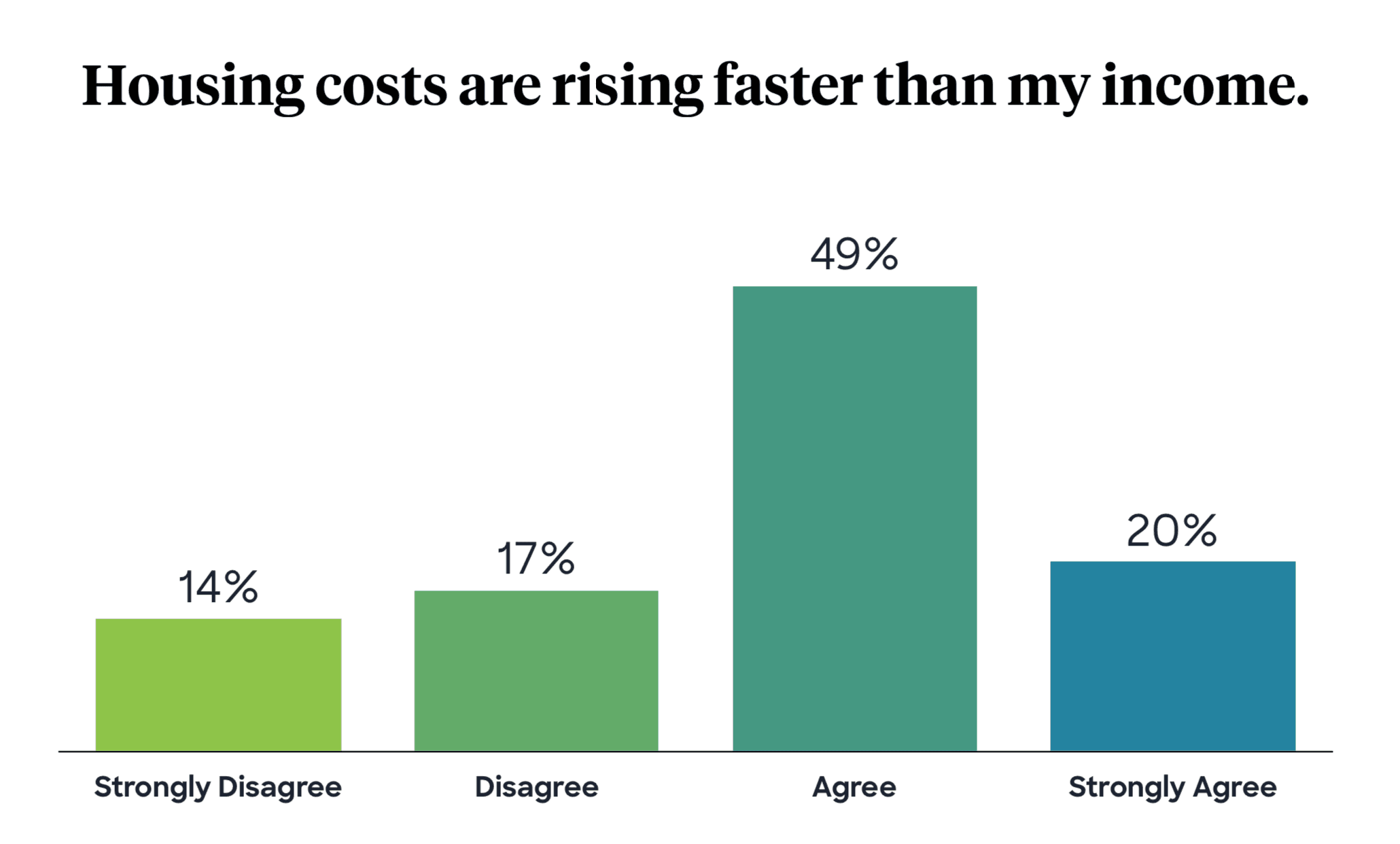

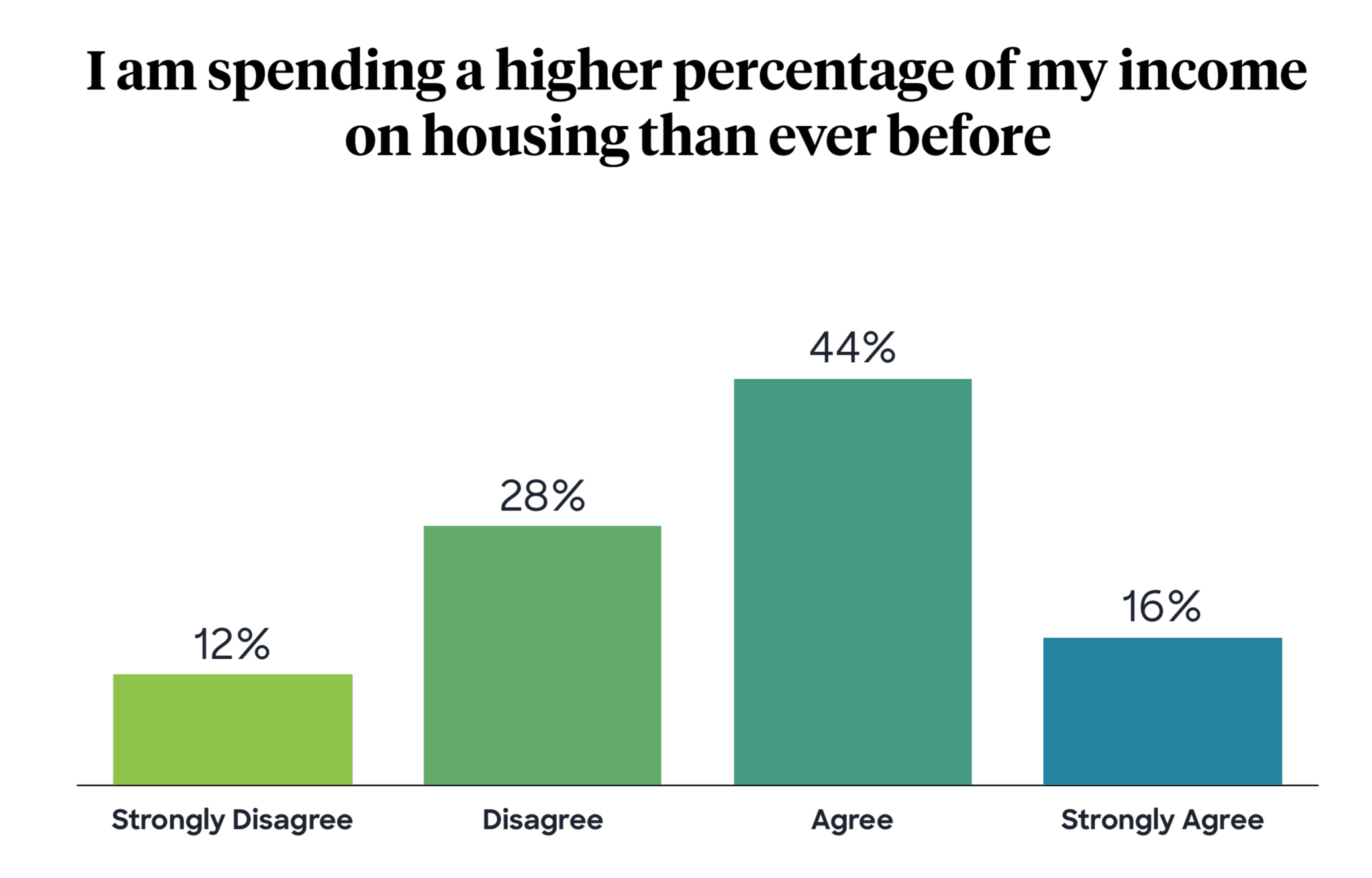

Since its infancy, Hometap has been studying the house-rich, cash-poor phenomenon that has been building since the Great Recession. The widening gap between wages and housing costs as well as the lack of attractive options to access home equity is largely to blame for this crisis. In fact, according to a recent Hometap study, 69 percent of Orlando-area homeowners report their housing costs are rising faster than their income while 60 percent say they’re spending a higher percentage of their income on housing than ever before.

Why Does It Matter?

Our study of nearly 700 homeowners aimed to track the impact the house-rich, cash-poor crisis is having on homeowners across the country. What we found when we took a closer look at Orlando is that the uncertainty around future income and anticipated costs of home maintenance were the two biggest concerns when it came to financial security.

Home maintenance is a significant source of stress across all age groups and geographies, and that remains true for Orlando. Eighty-one percent of Orlando homeowners answered that they’re moderately to extremely stressed about these anticipated costs.

The best way to prepare for costly emergency repairs is to set aside money each year—and keep it there even if you don’t end up using it. HGTV recommends saving 1–3 percent of your home’s value every year for home maintenance and repairs.

One thing Floridians need to take into consideration more so than others is their risk of natural disasters, which can take a long-lasting toll on its victims. Homeowners prone to hurricanes, fires and floods may want to consider doubling their emergency funds.

See the national results of Hometap’s Homeowner Study

Orlando is ranked the third best city for jobs in a study comparing 180 U.S. cities based on job market value and socio-economic factors, and ranked number one for job security. Despite this, security of future income ranked as a top concern with 80 percent of respondents saying they were moderately to extremely stressed.

A great upside to Orlando is its potential for vacation rentals. If you’re looking to invest in a second property, there are several hot spots where it pays to be a homeowner, including Orlando. No state income tax and the area’s low property taxes and housing prices make it an attractive place to buy right now.

Access Your Equity, Eliminate Homeowner Stress

If you’re like most homeowners, you have other financial goals you want to meet besides homeownership. But 59 percent of Orlando-area homeowners say high housing costs make it difficult to achieve other financial goals, whether that’s paying off debt, starting a business, or any number of goals.

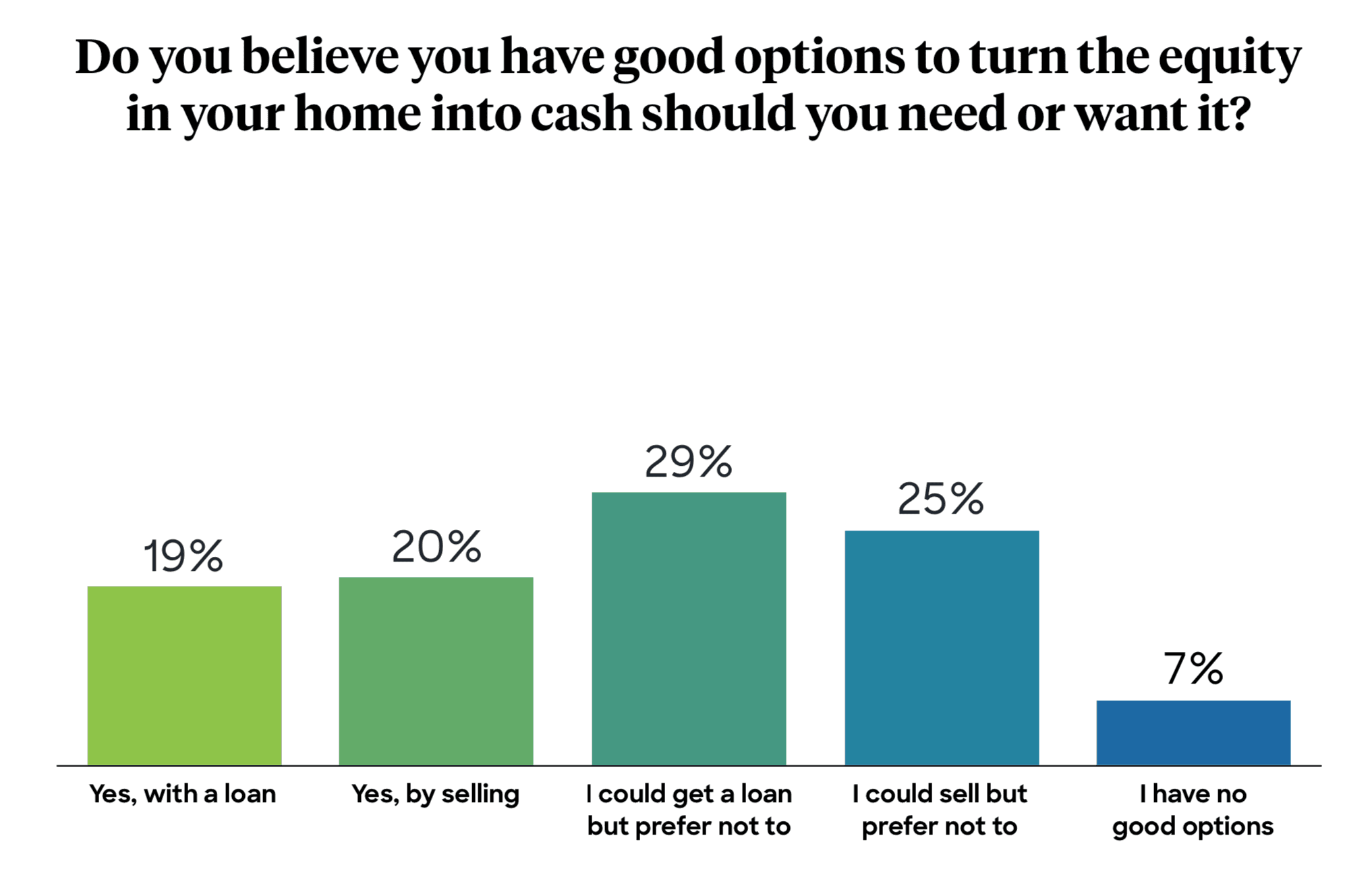

Homeowners may have difficulty achieving financial goals because they can’t access their home equity. In fact, 61 percent of Orlando homeowners in our study don’t feel like they have good options for turning the equity in their home into cash. A whopping 29 percent don’t want to take on a loan and the debt, interest, and monthly payments that come with it. Another 25 percent say they could sell their home to access equity but would prefer not to.

As a homeowner, you do have options. You can access home equity via a home equity loan, home equity line of credit (HELOC), cash-out refinance, or home equity investment—and not all of these options involve taking on additional debt.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.