How to Calculate Home Equity and How to Use It

Last updated March 24, 2024

You’ve heard the term, but what is home equity, exactly, and how is it calculated? Home equity is the value of a homeowner’s interest in their home, and it’s important to keep track of because home equity plays a crucial role in home financial planning. Determining your home equity involves subtracting the outstanding principal on your mortgage from your current market home value. This number changes over time due to factors like market trends and mortgage payments;; the more you’ve put toward your home, the greater your home equity. Here we’ll cover how to calculate home equity, and how to use it.

Why Is Home Equity Important?

Building equity in your home is important for a few reasons. First, it counts toward your net worth because unlike nearly every other asset you buy with a loan, your home can still grow in value after you pay it off. Additionally, having equity in your home allows you to leverage it for purchases such as home renovations, financing a second home, or funding education expenses — more on this later. Finally, when it comes time to sell your home, the more equity you’ve built up, the more profit you could make on the home.

How Long Does It Take to Gain Equity in a Home?

Building equity in a home is a gradual process that typically takes several years. The amount of equity you can build up will depend on factors such as the initial down payment, the mortgage interest rate, and any fluctuations in the housing market. Since it takes time to build, it should be part of a long-term wealth strategy rather than a short-term plan to get cash.

Those who are looking to increase the equity in their home during this process may look into making extra payments towards their mortgage principal. This allows you to pay off your loan faster and reduce the amount of interest paid over time. Another way to build equity is by making improvements to your home that increases its value, such as renovating the kitchen (link to 2024 kitchen trends blog) or adding a new bathroom.

Knowing how to find the equity in your home can help you make informed decisions about if and when to sell your home or options for tapping into your equity such as taking out a home equity line of credit (HELOC).

Homeowners that don’t know how much equity they have are also less likely to know how much debt they have. See more insights like this in our free Homeowner Report.

What is the Formula for Home Equity?

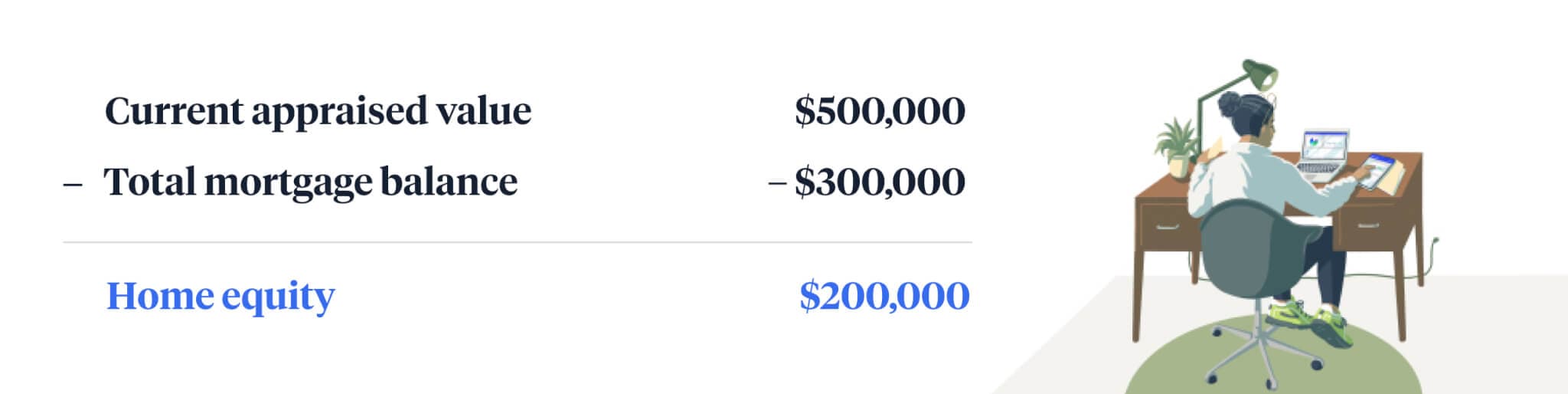

Luckily, when it comes to answering the question, How much equity do I have in my house? you have a few different options for finding it. The first is a pretty simple math equation you can do yourself. Simply subtract your total mortgage balance from the current appraised value of your home.

How to calculate home equity:

If you’ve been in your home for a while and aren’t quite sure of the current appraised value, there are a few different ways to go about determining it, short of scheduling a formal appraisal. You can start by looking at nearby “comps,” or comparable homes in your area that have similar square footage, number of bedrooms and bathrooms, and floor plans. By comparing recent sales data for these comps, you can gauge the approximate current market home value of your property.

You can also look at the cost-per-square foot of your home and find an average. This is also pretty easy to do: simply divide the selling price of your home by the total square footage.

Once you have a general idea of your home’s current appraised value, you can subtract your mortgage balance to find your home equity. This figure represents the portion of your property that you own, free from mortgage debt.

A second way to determine the equity in your home is by using a home equity calculator like this one in our Home Equity Dashboard. You can track your home value, your estimated current home equity, and even see forecasted values for up to ten years.

How Can I Access My Home Equity?

Now that you know how to determine your home equity, it’s just as important to know to access it. There are several paths to tapping into your home equity, and each comes with pros and cons. Here are some of the most common ones:

Home equity loan

A home equity loan is a second mortgage that typically uses a home appraisal to evaluate your home value to determine how much home equity you can access. It usually offers a predictable monthly payment, and a fixed interest rate, and provides you with a lump sum of cash. Qualification criteria for a home equity loan will vary by lender, but typically require a credit score of 620 or higher and a debt-to-income ratio of 43 percent or lower.

Home equity line of credit (HELOC)

A HELOC is a revolving line of credit that gives you access to cash through a portion of the equity you’ve built in your home. You only pay interest on the amount you borrow, making it a flexible option for homeowners who may not need a large lump sum of money all at once. HELOCs typically come with a variable interest rate which means that it can fluctuate with macroeconomic conditions, and has a draw and repayment period.

Cash-out refinance

This type of mortgage replaces your existing one and exceeds your loan balance, providing the difference in cash. By opting for a cash-out refinance, you have the opportunity to access funds for needs such as home improvements or debt consolidation. Ideally, you're pursuing a cash-out refinance only if it means you’re also locking in a lower interest rate but you're also possibly extending your original mortgage timeline. In periods of higher rates, a cash-out refinance is a less attractive option because you’re likely giving up a lower rate.

Reverse mortgage

A loan for homeowners 62+, a reverse mortgage allows the lender to pay the borrower in exchange for the home’s equity. This solution is often appealing to retirees on a fixed income, offering a steady stream of funds without the need to sell their home. This financial solution has some unique qualification criteria and characteristics that homeowners should be aware of. We dive into more detail about how reverse mortgages work here.

How Can I get Equity Out of My Home without Refinancing?

In cases where homeowners don’t want to give up a strong interest rate, a refinance doesn’t feel like the right fit. Home equity loans and lines of credit add another debt and another monthly payment to your balance sheet. But there is one more financial product that doesn’t involve loans or refinancing your home, and that’s a home equity investment.

Home equity investments

A home equity investment (HEI) is a loan alternative that gives homeowners a lump sum of cash in exchange for a share of their home’s future value. Similar to a loan, the home is the collateral, but unlike a loan, there is no monthly payment or interest for the duration of the investment (typically up to ten years). There is typically no debt-to-income (DTI) criteria and fair credit scores are accepted.

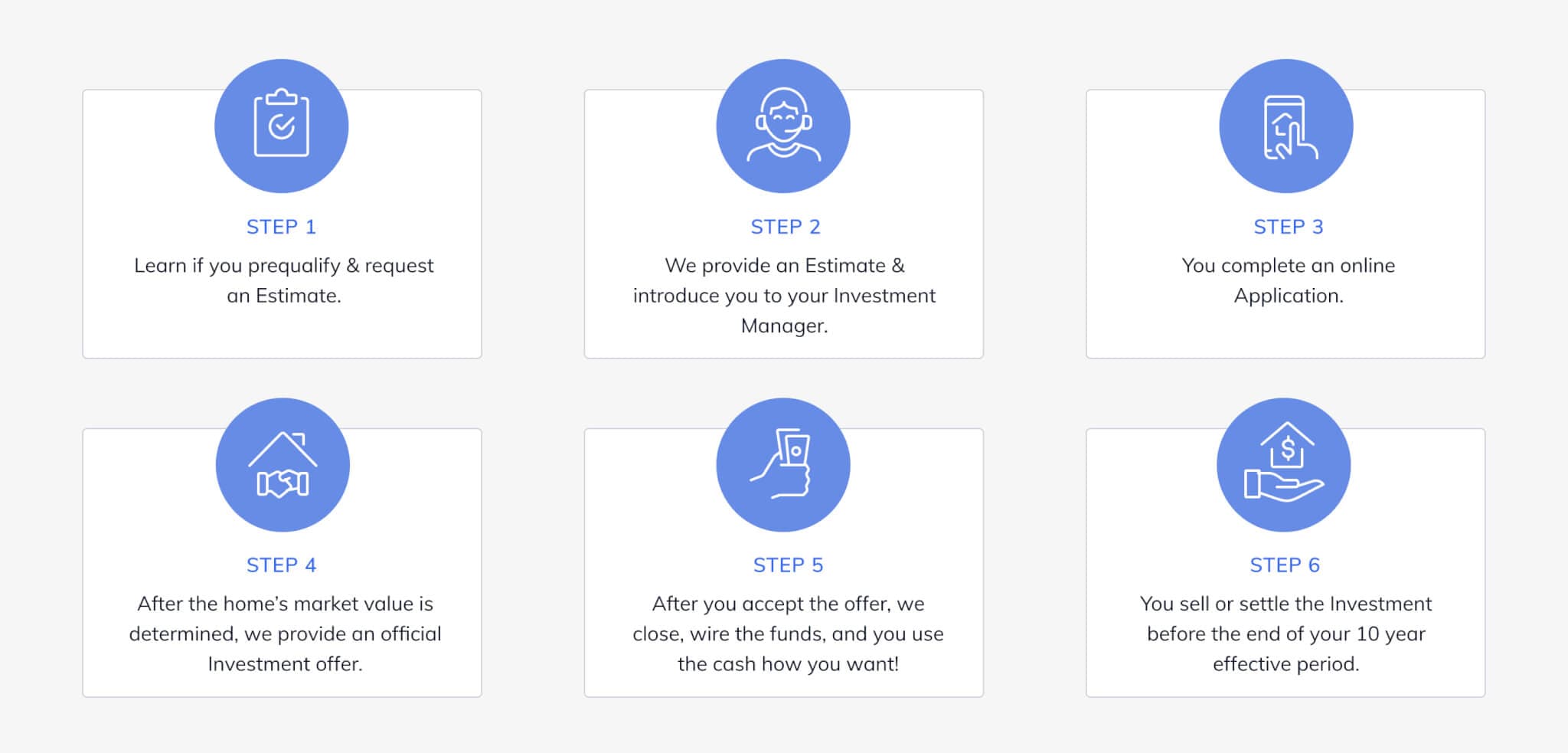

The process for receiving an investment will vary by provider. Below are the steps for receiving a Home Equity Investment from Hometap:

How Much Equity Can I Borrow From My Home?

This answer will vary slightly depending on which financial product you choose to access it, but generally you’ll need to maintain at least 15-25% of your home equity. For example, if you have 50% equity in your home now, you’ll likely find that you’re able to receive 25-35% of it.

How Can My Equity Work for Me?

While there are many ways to use your home equity — and a home equity investment lets you use it for anything you’d like — it can pay off in the long run to be thoughtful and strategic about where you decide to put the funds you receive. For example, using the money to make home improvements that will potentially add more value to your home is probably a wiser decision than spending all of it on a lavish vacation or a shopping spree. Let’s talk through some of the ways that using your home equity may make financial sense.

Paying down debt, including credit cards and student loans, is one of the biggest reasons why homeowners access their equity. Chipping way at high-interest debt can feel like an uphill battle, so eliminating a large chunk at once or consolidating debt can speed up your progress.

Another common use for home equity is home improvement and renovation projects. The benefits of this are a few fold: first, you’ll have the satisfaction and enjoyment of newly renovated spaces. It’s also possible that the renovation will allow you to receive more money for your home if you decide to sell down the road.

Have you always dreamed about a vacation home? How about an investment property that brings in additional income? You can put your equity toward a down payment on a second property. Besides having a go-to getaway spot, you’ll be diversifying your portfolio with real estate as well.

Many homeowners use their home equity to start or grow their small business without the hassles of a loan (and the hurdles that come along with getting approved for one). One of the characteristics that makes a home equity investment especially attractive to small business owners is that the lack of monthly payments means there’s no impact to cash flow. Income requirements and W2s aren’t required either, which can be ideal for self-employed entrepreneurs.

If you’re looking for a way to fund current — or future — expenses that your retirement savings can’t cover, like health care, your home equity can save the day and give you peace of mind, along with some extra cash. This is especially attractive if you plan to sell the home within the next 10 years. Though it isn’t required to sell, it may be beneficial to use the proceeds from the sale of the home to settle the Investment.

With college tuition increasing every year, tapping into your home equity can be a strategic approach to fund your child’s education or address your own student loan debt. Many families find themselves seeking alternative financial solutions to manage these expenses.

By accessing your home equity, you can secure funds to cover tuition fees, textbooks, housing expenses, and other educational necessities. Moreover, if you’re burdened by existing student loan debt, leveraging home equity can facilitate debt consolidation or repayment.

Many homeowners use home equity investments to balance out their portfolio. A well-rounded portfolio includes a variety of investments that span across at least a few different sectors, including stocks, bonds, mutual funds, and real estate. By distributing your assets, you decrease the risk of a major loss in any one particular area.

Whether it’s your first or fourth child, it’s no secret that the costs of expanding your family can add up quickly. Your home equity can cover the costs of childbirth, IVF, adoption, surrogacy, or raising a child.

Life is full of unexpected events. Whether you need cash fast to pay for medical bills, or deal with other surprise costs that pop up, your home equity can get you access to a lump sum of money in as little as a few weeks.

These are just some of the ways you can use your equity to live a less stressful life. Now that you know how to calculate your home equity, what it is, and why it’s important, it’s time to decide how you’ll use it!

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Home Financing 101”

How Much Is Your House Worth? Picking a Home Value Estimator

5 Characteristics to Consider to Choose the Right Neighborhood