5 Ways to Pay Off Your Home Mortgage Early and Save

Paying off your mortgage early can be beneficial in a number of ways. Most importantly, it allows you to save money in interest, and also lets you shift your focus to saving for retirement, building an emergency fund, or simply just enjoying life a little more.

However, it’s important to note that you shouldn’t stretch your budget if you have more pressing financial needs. For example, if the money you plan on using to pay off your mortgage would be better used to invest, build a retirement fund, or save for emergencies, that might be a better decision. In addition, by paying off your mortgage early, you’ll lose the benefits of claiming mortgage interest as a tax deduction.

That being said, if you already have some cash set aside for emergencies, a retirement fund that’s aligned with your goals, and don’t have much outstanding debt, paying off your mortgage early can still be a smart priority. And if your mortgage was taken out after January 10, 2014, you likely don’t need to worry about any prepayment penalties.

If you’re curious about how long it will take you to pay off your mortgage at your current rate, you can use this early mortgage payoff calculator. Simply select “other” when prompted for the type of debt and input your current interest rate and the amount you’re paying each month to receive an estimated total cost and timeline for being mortgage-free.

Then, get started by exploring some of the best methods for paying off your mortgage faster.

1. Get rid of PMI

One of the biggest obstacles to paying off a mortgage quickly is private mortgage insurance, or PMI. PMI is usually tacked onto mortgages when the borrower is unable to afford the minimum down payment on a home — usually 20% — as a step to protect the lender in case the borrower stops paying the loan.

If you have PMI, you could end up paying hundreds of dollars a month in addition to your regular payment — so getting rid of it as fast as possible is often key to reducing your payoff timeline. There are more than a few ways to do this, including getting a new home appraisal, increasing your home’s value, and requesting early cancellation.

2. Pay more each month toward your principal

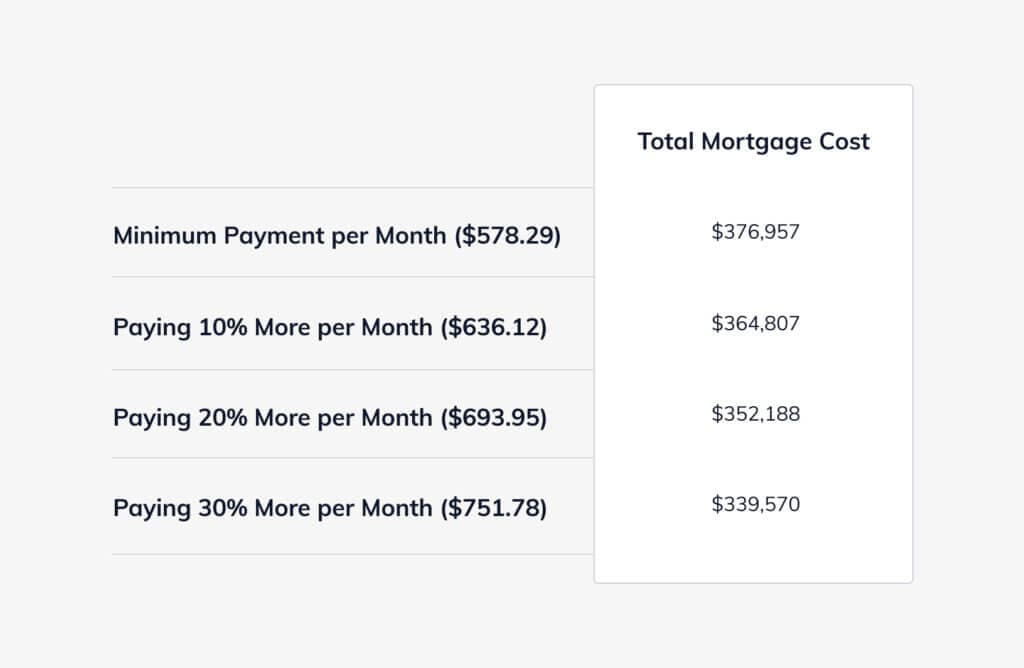

If you’re able, pay extra toward your principal, which in turn reduces the total interest you’ll pay.

The chart below shows the total mortgage cost when making the minimum payment versus 10%, 20%, or 30% extra per month on the average balance of $208,185 over a 30-year period.

3. Make one more payment each year

Some homeowners opt to make just one extra monthly payment per year to shorten their timeline. If you choose to do this, you don’t necessarily need to make the payment all at once; in fact, it’s more common to use this approach by making bi-weekly payments of half your monthly amount on an ongoing basis. This way, by the end of the year, you’ll have added another installment without having to locate a lump sum of cash to pay in full. If you go this route, you’ll want to make sure you check with your mortgage provider first, as it may require some advance planning.

4. Refinance your home

While a cash-out refinance might be the first solution that comes to mind when thinking about refinancing your home, a home equity line of credit (HELOC) is often a better choice since it might offer a lower interest rate than your current mortgage without dealing with the closing costs you’d be saddled with if you went with a traditional refinance. One downside that you need to be aware of is that while you can initially make interest-only payments on a HELOC, at the end of your “draw” period, you’ll have to pay back the interest and principal together each month — which might be more than your previous monthly payment.

5. Consider a home equity investment

A home equity investment gives you access to cash in exchange for a share of your home’s future value, but unlike a HELOC, doesn’t accrue interest or require monthly payments. While this option isn’t common as a primary reason to receive an investment, some homeowners find it to be an advantageous secondary use of funds. For example, if you decide to use an investment to pay off debt or renovate your home and have cash left over, you can put it toward paying off PMI or your principal. Take it from California homeowner Elizabeth, who used a Hometap Investment to handle the debt she incurred from a Home Energy Renovation Opportunity (HERO) loan and used the rest toward her mortgage balance.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.